Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy Amp (AMP) in UK With GBP | CoinJar

Amp

AMP

Overview

What is Amp?

Buy Amp (AMP): Amp is a token that enables instant and competitive cost [crypto] (https://www.coinjar.com/uk/learn/what-is-crypto) payments. It powers the [Flexa Network] (https://flexa.network/), a payment provider designed to enable instant and low-cost cryptocurrency transactions and also facilitates traditional payments.

The Flexa Network allows businesses to accept [payment] (https://flexa.network/currencies) in a variety of ways including in cryptocurrencies. It’s like a bridge between traditional payment methods and digital assets.

Utility token

AMP is a type of cryptocurrency that serves a specific purpose within the Flexa ecosystem.

Flexa Network

The Flexa Network acts as a bridge between traditional payment methods (like credit cards) and digital assets (cryptocurrencies).

It allows businesses and consumers to make payments using cryptocurrencies like Bitcoin or Ethereum.

How does AMP work?

Imagine you’re buying a product online using AMP (Flexa’s native token). When you pay with AMP, an equivalent value of AMP tokens is temporarily locked up as collateral. The transaction is confirmed on the blockchain, and the AMP collateral is released.

Why do investors buy AMP?

Here are a few reasons why people buy AMP.

Instant settlements

AMP facilitates immediate settlement of payments. When you make a purchase using AMP, the transaction is confirmed quickly, allowing merchants to receive funds without delays.

Collateralisation

AMP acts as collateral for transactions. When you pay with AMP, it’s locked up as collateral until the transaction is confirmed.

Competitive transaction fees

The Flexa Network aims to minimise transaction fees. By using AMP, users can avoid uncompetitive fees associated with traditional payment methods.

How Does AMP Work?

Imagine you’re buying a cup of coffee using AMP.

The user initiates payment: They scan a QR code at the coffee shop to pay with AMP.

Collateralisation: The equivalent value of AMP tokens is locked up as collateral in a smart contract.

Transaction confirmation: The transaction is broadcast to the network. Validators confirm it, and the coffee shop receives the payment.

Unlocking collateral: Once confirmed, the AMP collateral is released, completing the transaction.

Cash, credit or crypto?

Buy Amp using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy Amp with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

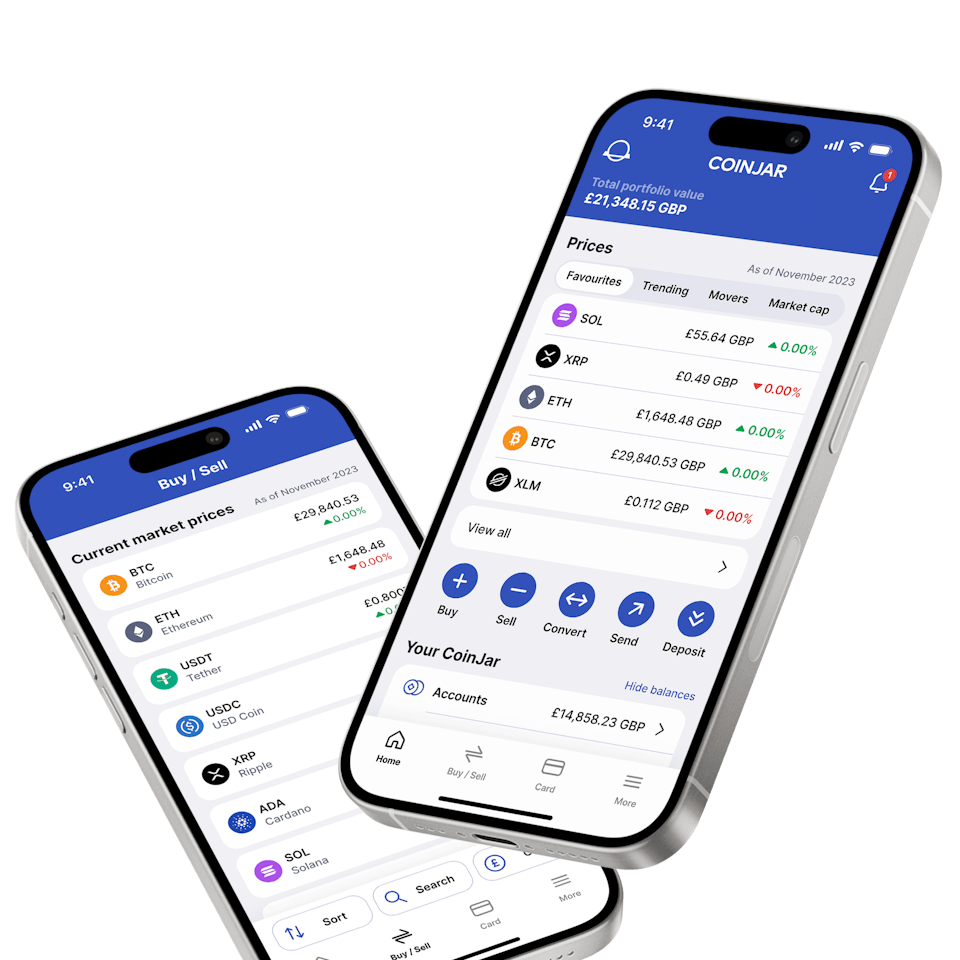

CoinJar App

All-in-one crypto wallet

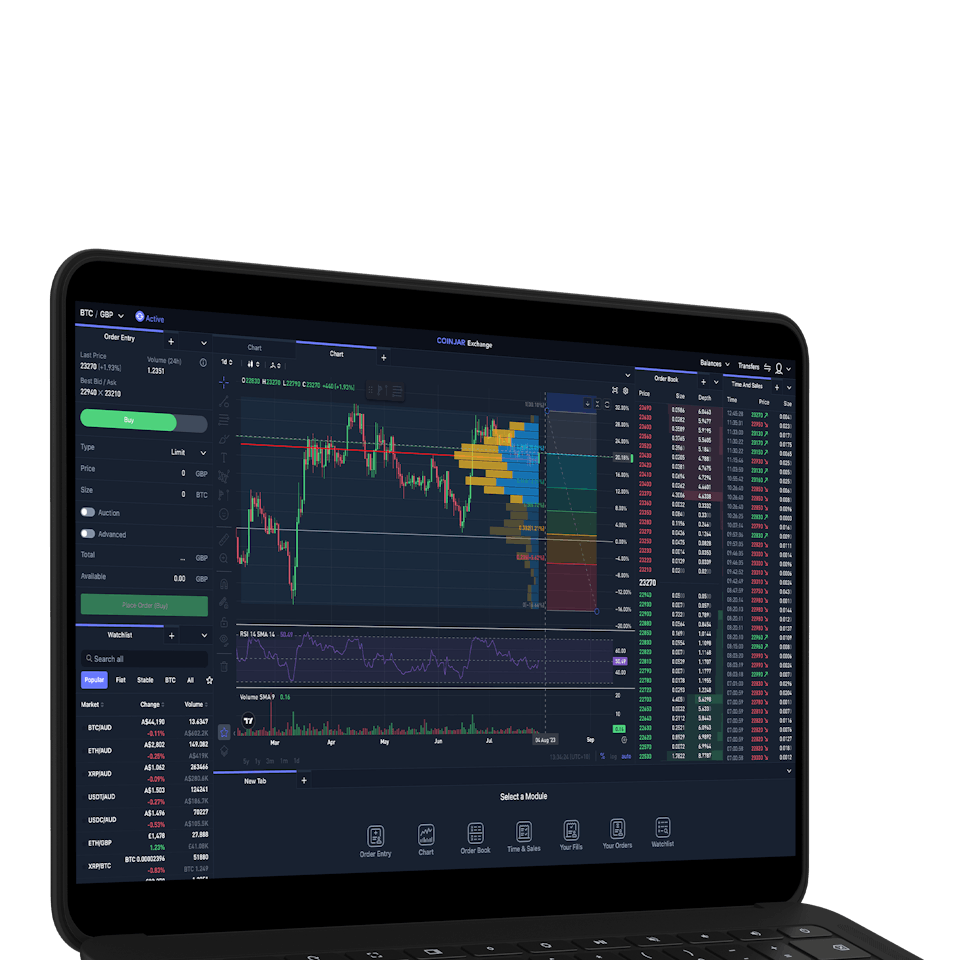

CoinJar Exchange

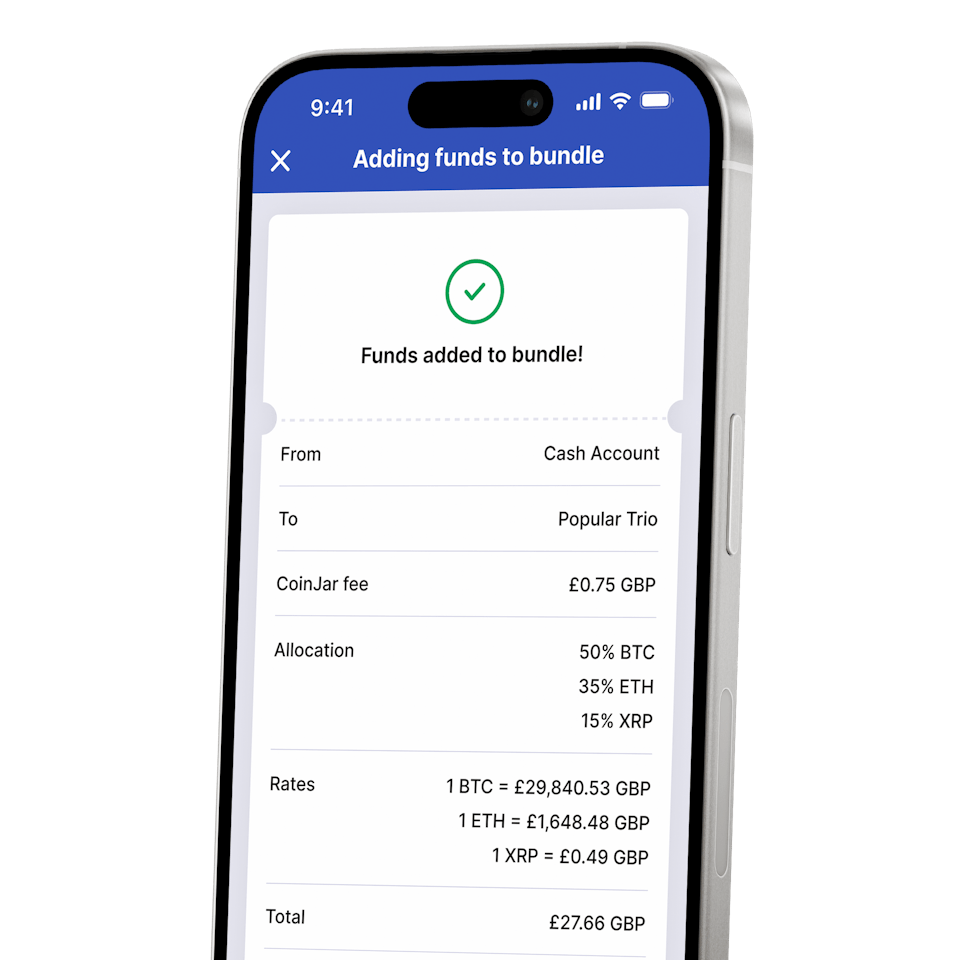

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is AMP Token?

AMP is an open-source digital collateral token built on the Ethereum blockchain. It serves as a utility token for collateralising asset transfers, offering instant and verifiable assurances for various value transfer activities.

How does AMP work?

AMP allows users to collateralise any type of asset by staking their tokens. These tokens act as verifiable collateral, securing transactions (in a financial manner) within the Flexa Network.

The system of collateral partitions ensures that tokens can be staked without moving wallet addresses, enhancing protection and efficiency.

Who created AMP?

AMP was developed by the Flexa Network, with close support from blockchain software company Consensys. The project was led by Tyler Spalding.

What are the key features of AMP?

24/7 Availability: AMP operates around the clock, enabling transactions at any time. Irreversibly protected transactions: Once confirmed, AMP transactions cannot be reversed.

Smart contracts: AMP leverages smart contracts as collateral managers.

Proof of stake (PoS) consensus: AMP uses PoS for network protection.

ERC-20 token: AMP adheres to the widely adopted ERC-20 standard.

Open source: The AMP codebase is open for scrutiny and contributions.

What is the circulating supply of AMP?

At the time of writing (May 2024) there are [42 billion] (https://coinmarketcap.com/currencies/amp/) AMP tokens (approximately 42% of the total supply) in circulation.

The maximum supply of AMP is 99,444,125,026 coins. AMP’s supply is fixed and non-inflationary, which helps reduce volatility and risk for users and merchants.

What asset-related use cases does AMP support?

AMP facilitates transactions for a wide variety of asset-related use cases, including digital and physical assets.

It provides value transfer assurances for instant payments, making it ideal for retail, remittances, and more.

How does AMP offer instant verifiable assurances?

When you use AMP, the collateral is instantly verified, ensuring a level of protection and efficient transactions.

The Flexa Network benefits from AMP’s collateralisation model.

What is the live price of AMP in the past 24 hours?

Please check the top of this page for live prices.

How does AMP support value transfer activities?

AMP supports a wide variety of use cases for collateralisation. It can be designated to collateralise any account, application, or transaction, providing a versatile solution for value transfer activities.

How do AMP smart contracts work?

Collateral managers, which are smart contracts, lock, release, and redirect collateral within token partitions as needed to facilitate value transfers. AMP networks can collateralise payment networks, enabling instant, fraud-free payments to merchants across digital payment networks.

How do collateral partitions work?

Collateral partitions can be designated to collateralise any account application, or even transaction, ensuring balances are directly verifiable on the Ethereum blockchain.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.