Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy Injective (INJ) in UK With GBP | CoinJar

Injective

INJ

Overview

What is Injective?

Buy Injective Token (INJ): Injective Protocol is a decentralised layer-2 exchange protocol built on . It aims to provide efficient, protected, and permissionless trading for various assets, including cryptocurrencies, synthetic assets, and more. The Injective Token (INJ) is the native utility token of the Injective Protocol ecosystem.

There are some very on Injective. Most are financial like DeFi or crypto exchanges, but some games and other things are starting to appear. For example, is a SocialFi game that plays out on X (formerly Twitter).

Cool stuff on Injective

[xNinja.Tech](### xNinja.Tech) is where players become a crypto ninja.

xNinja.Tech is the first SocialFi 2.0 dApp built on the Injective Protocol. SocialFi combines social media (like Twitter) with crypto. It’s tweeting and earning rewards at the same time.

When players interact with tweets on their Twitter feed (like, retweet, or reply), they unlock treasure chests on xNinja.Tech. Inside these chests, they find crypto tokens, ninja food, and other valuable items.

xNinja.Tech has created a community of crypto enthusiasts as they follow the journey of the elemental ninjas (Earth, Fire, Water, Air, and Lightning).

Talis Art

is an NFT (non-fungible token) marketplace that empowers artists and bridges the gap between physical and digital art within the Injective ecosystem.

Talis serves as a virtual hub for exchanges. Artists can create, sell, and buy NFTs on this platform. Things people seem to like about it are:

Launchpad Sales: Where new NFT collections are introduced.

Peer-to-Peer Trades: Direct exchanges between users.

Secondary Market Acquisitions: Purchasing NFTs from other users.

Floor Sweeping: Acquiring NFTs at the most competitive price.

ENJ and developers

Injective is a special type of blockchain designed specifically for the financial industry. It’s a digital platform where developers can build cool stuff related to money, trading, and other financial activities. Here’s why developers like it:

Speed: For financial apps, speed matters a lot, and Injective delivers.

Web3 Modules: These are like building blocks for creating different types of financial apps. You can use them to build apps for trading, lending, saving, and more. It’s like having a toolbox with all the tools you need to build your idea.

Interoperability: Injective can talk to other blockchains, like Ethereum, Cosmos, and Solana. This makes it convenient for developers to connect their apps to other cool stuff on the internet.

Why do investors buy INJ?

Utility token

INJ serves multiple purposes within the Injective ecosystem. Holders can use it for governance, staking, and participating in network upgrades.

Staking rewards

Users who stake their INJ tokens can earn rewards by participating in network validation and governance. Staking helps protect the network and ensures its smooth operation.

Trading fee discounts

INJ holders receive discounts on trading fees when using the Injective exchange. This encourages adoption and liquidity on the platform.

Decentralised governance

INJ holders can propose and vote on protocol changes, making it a truly community-driven project.

Why Buy INJ?

Investment opportunity

Some people buy INJ as an investment, hoping that its value will appreciate over time. As the Injective ecosystem grows, demand for the token may increase.

Staking rewards

Staking INJ allows users to earn additional tokens as rewards. This passive income attracts investors looking for yield.

Participation in governance

Those interested in shaping the future of Injective Protocol buy INJ to participate in governance decisions. Their votes influence protocol upgrades and changes.

Access to platform features

INJ holders benefit from reduced trading fees, giving them an advantage when using the Injective exchange.

Conclusion: Why Investors buy Injective Token

Injective Token (INJ) plays a crucial role in the Injective Protocol ecosystem. Whether you’re an investor, trader, or DeFi enthusiast, you may find the token a noteworthy proposition.

Cash, credit or crypto?

Buy Injective using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy Injective with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

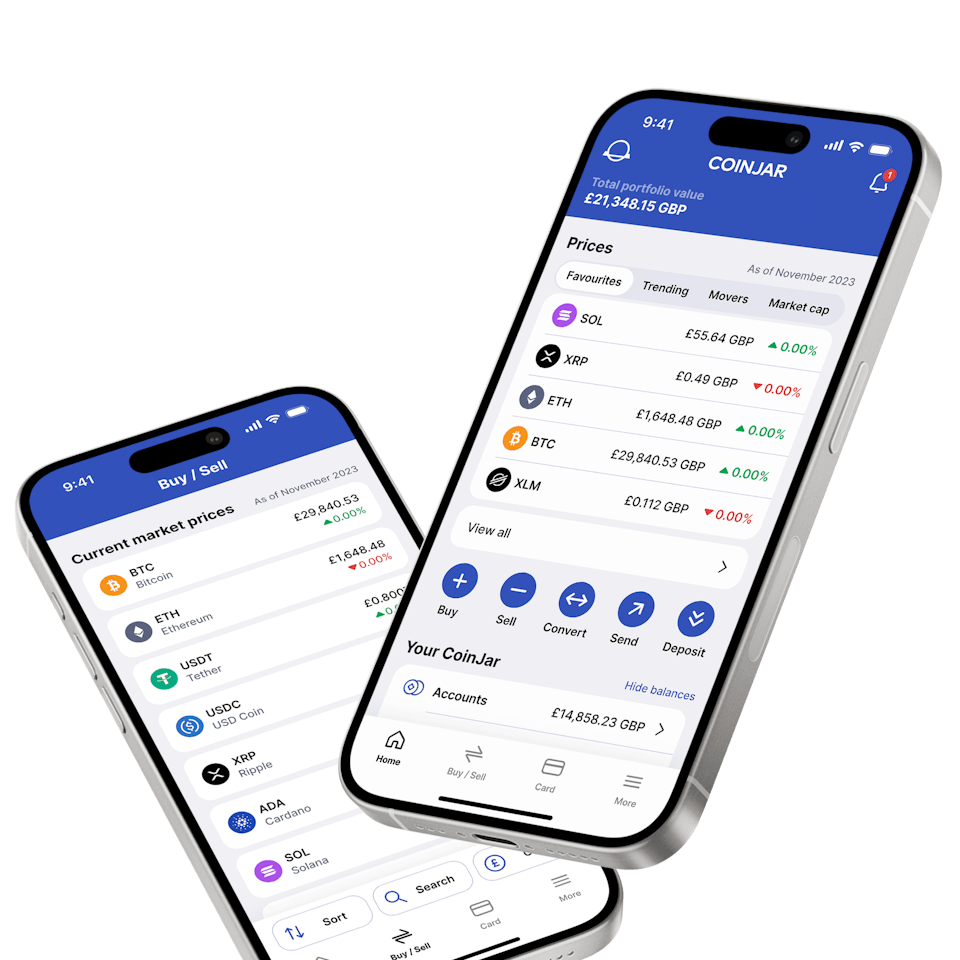

CoinJar App

All-in-one crypto wallet

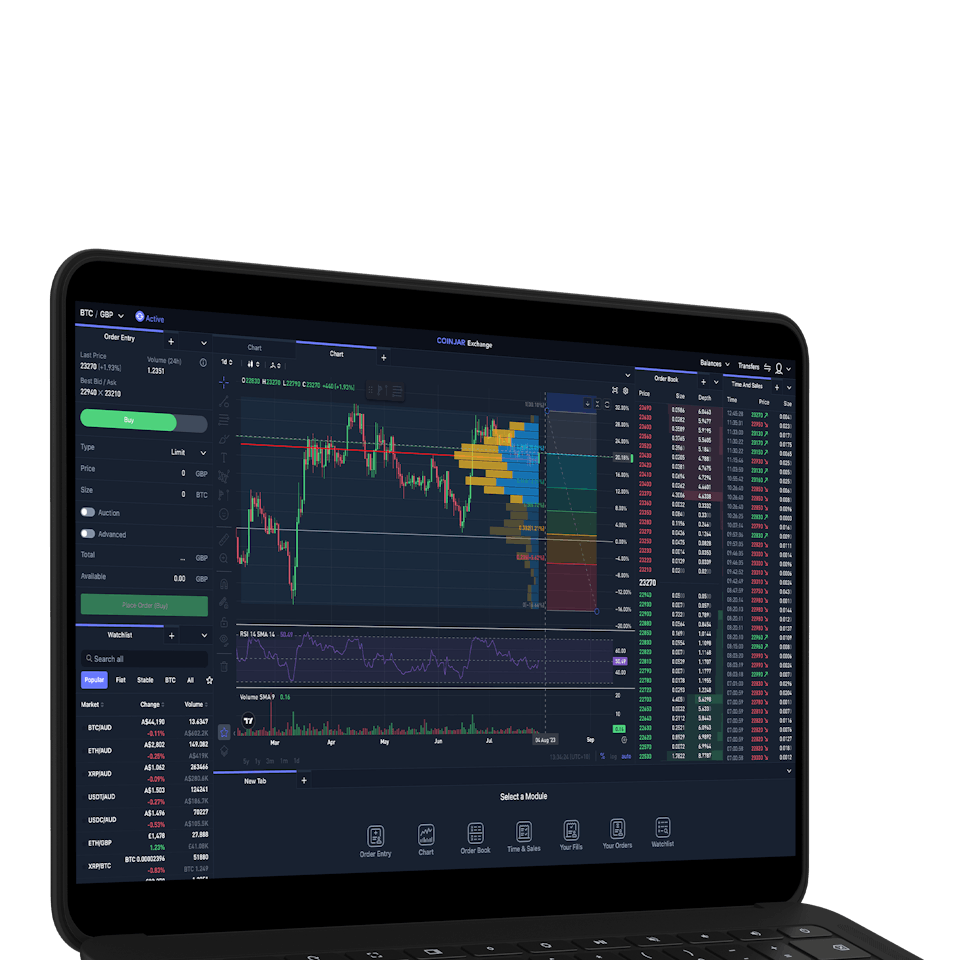

CoinJar Exchange

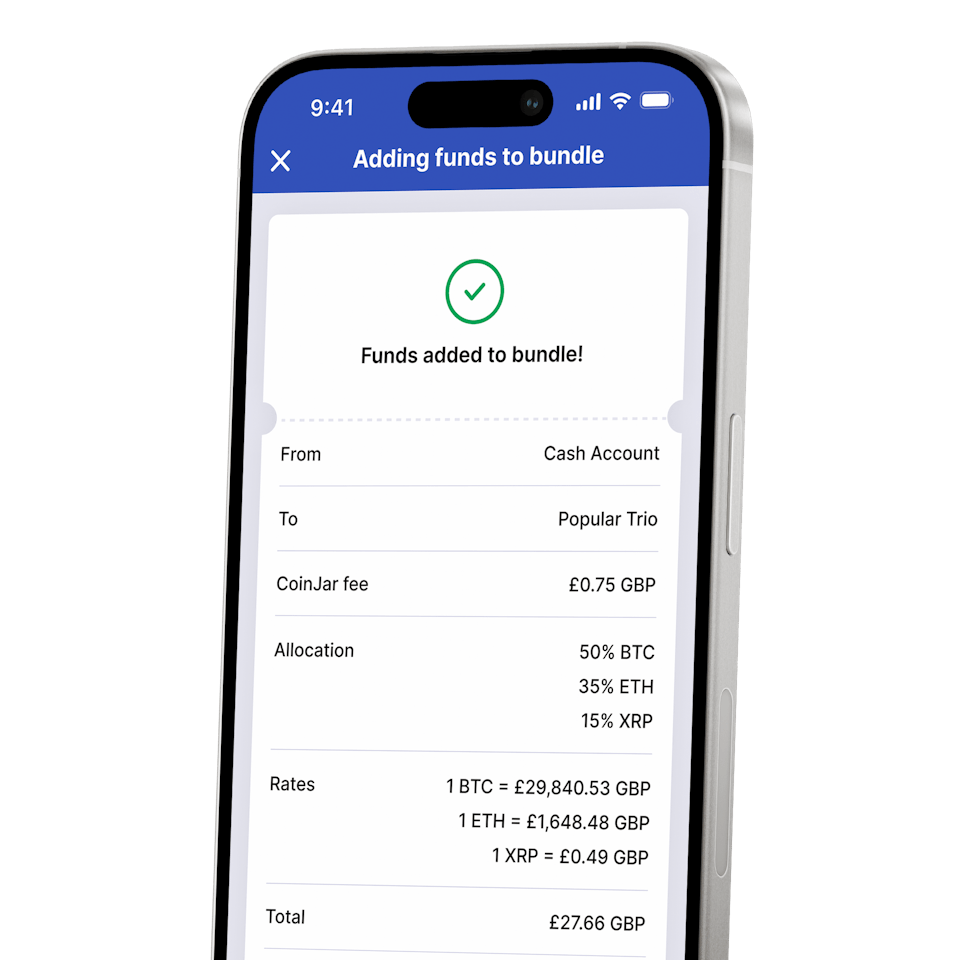

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is INJ Token?

INJ is the native utility token of the Injective Protocol. It serves various purposes within the ecosystem, including governance, staking, and participation in network upgrades.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.