Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy 0x Token (ZRX) in UK With GBP | CoinJar

0x Token

ZRX

Overview

What is 0x Token?

Why investors buy 0x Token: An interesting project in the space is the . But what exactly is it, and how does it work? Let’s break it down into user-friendly terms.

What Is 0x Token?

0x is a decentralised protocol built on the Ethereum blockchain. The 0x platform provides the building blocks for making exchanges. It gives developers the tools to create their own trading platforms.

0x gathers liquidity (digital assets to trade) from lots of different places. This helps people get better prices when they trade.

All of this enables users to do peer-to-peer (P2P) trading of digital assets, including tokens and cryptocurrencies. Think of it as a bridge that connects buyers and sellers directly.

ZRX tokens play a crucial role in providing liquidity for decentralised exchanges (DEXs).

Liquidity providers use ZRX to facilitate trading by adding funds to the order books.

This ensures that buyers and sellers can easily find each other and execute trades.

How Does 0x Work?

In user-friendly terms, 0x helps people trade digital assets without relying on big exchanges.

Liquidity aggregation

0x aggregates liquidity from over 100 other exchanges, including and .

This aggregation ensures that users can swap assets at the most competitive price, minimising slippage (price impact) during trades.

ZRX uses

The ZRX token serves two main purposes within the 0x protocol. First, there's governance. ZRX holders participate in protocol upgrades and decisions. And then there's rewards. Participants (such as relayers) earn ZRX tokens for their contributions.

Decentralisation

Unlike traditional exchanges, 0x operates without a central authority. It allows users to trade directly from their wallets, maintaining control over their funds.

Smart contracts

0x uses smart contracts to automate trades. These contracts execute predefined rules when specific conditions are met. For example, if Joanne wants to sell her ZRX tokens at a certain price, the smart contract ensures a seamless transaction with Mike, who wants to buy ZRX.

Off-chain order books

Instead of storing all trade orders on the blockchain (which can be slow and expensive), 0x uses off-chain order books. These order books keep track of buy and sell orders, making trading more efficient.

Relayers

Relayers are platforms that host order books and match buyers with sellers. They earn fees for facilitating trades. Users can choose from various relayers based on their preferences.

Why Use 0x?

Competitive fees

By eliminating intermediaries, 0x reduces transaction fees. Traders only pay gas fees for executing smart contracts.

Increased liquidity

0x aggregates liquidity from various sources, making it easier to find others for trades.

Security

Since 0x operates on Ethereum, it benefits from the protective measures and transparency of the blockchain.

Conclusion: 0x Token

0x token is a decentralised protocol that enables efficient and protected P2P trading of digital assets. Whether you’re a crypto enthusiast or just crypto curious, understanding 0x opens doors to the fascinating world of decentralised finance (DeFi).

Cash, credit or crypto?

Buy 0x Token using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy 0x Token with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

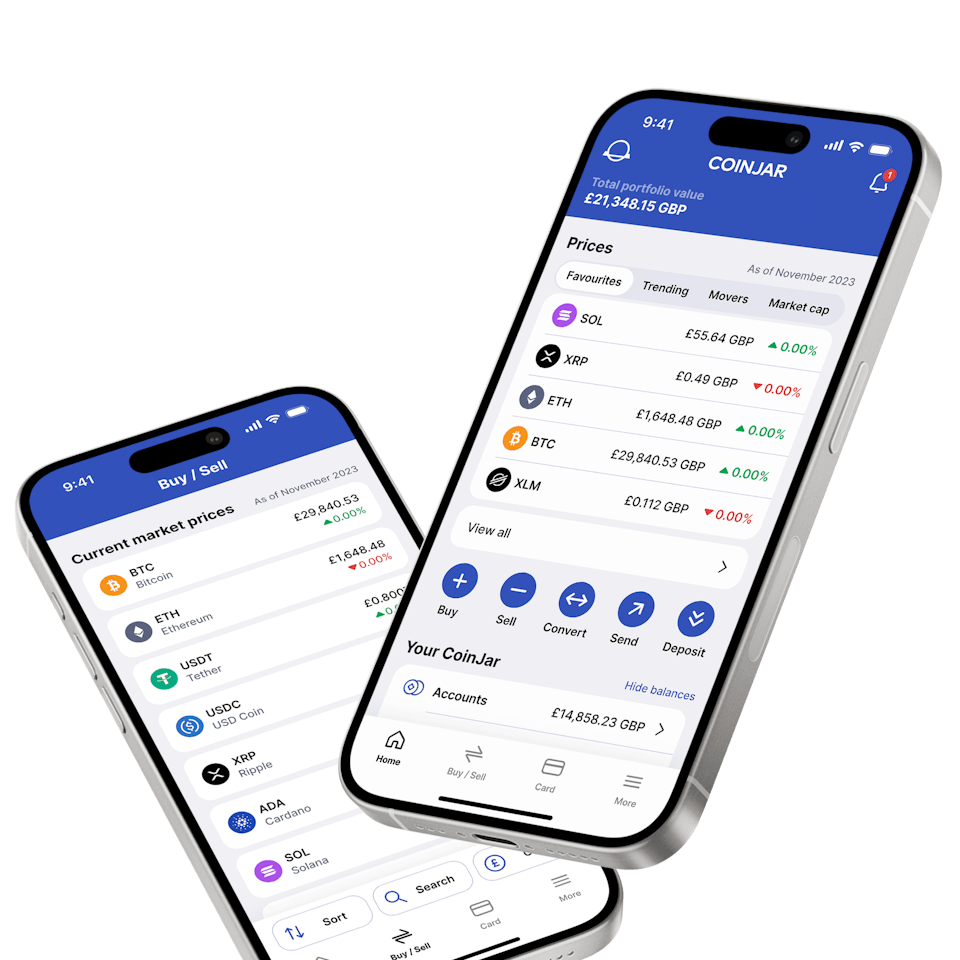

CoinJar App

All-in-one crypto wallet

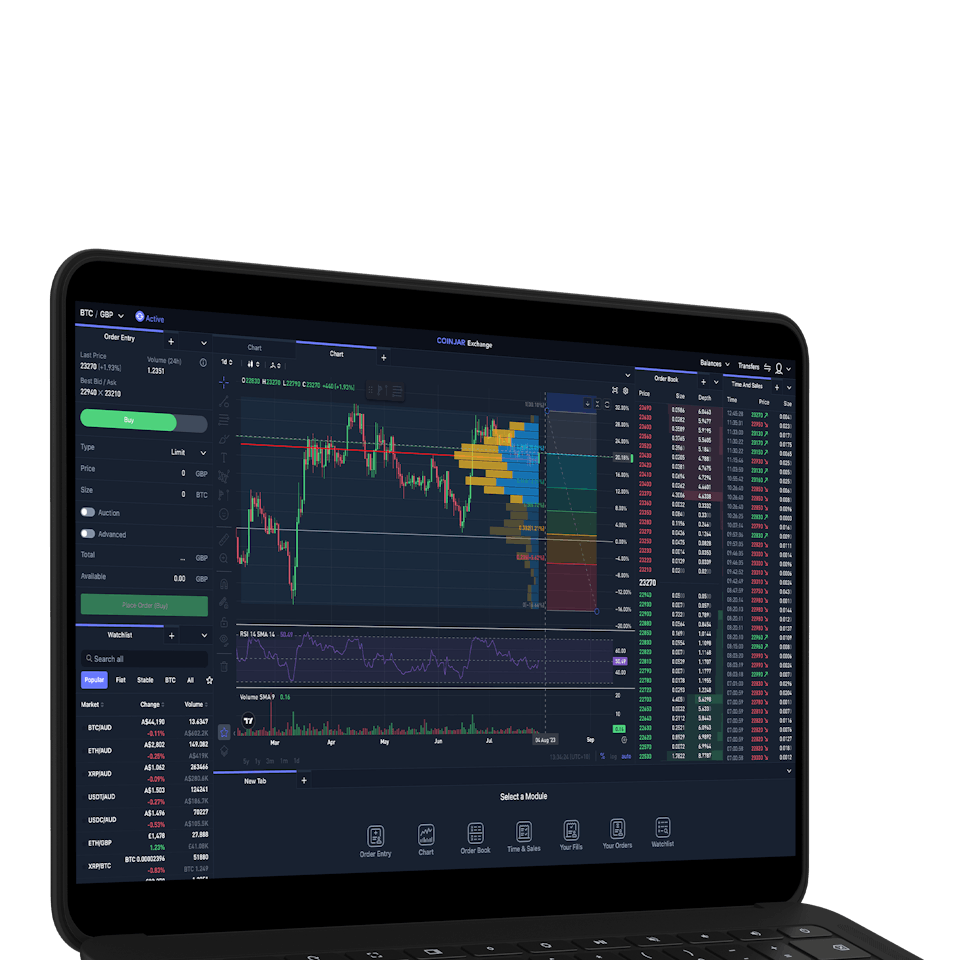

CoinJar Exchange

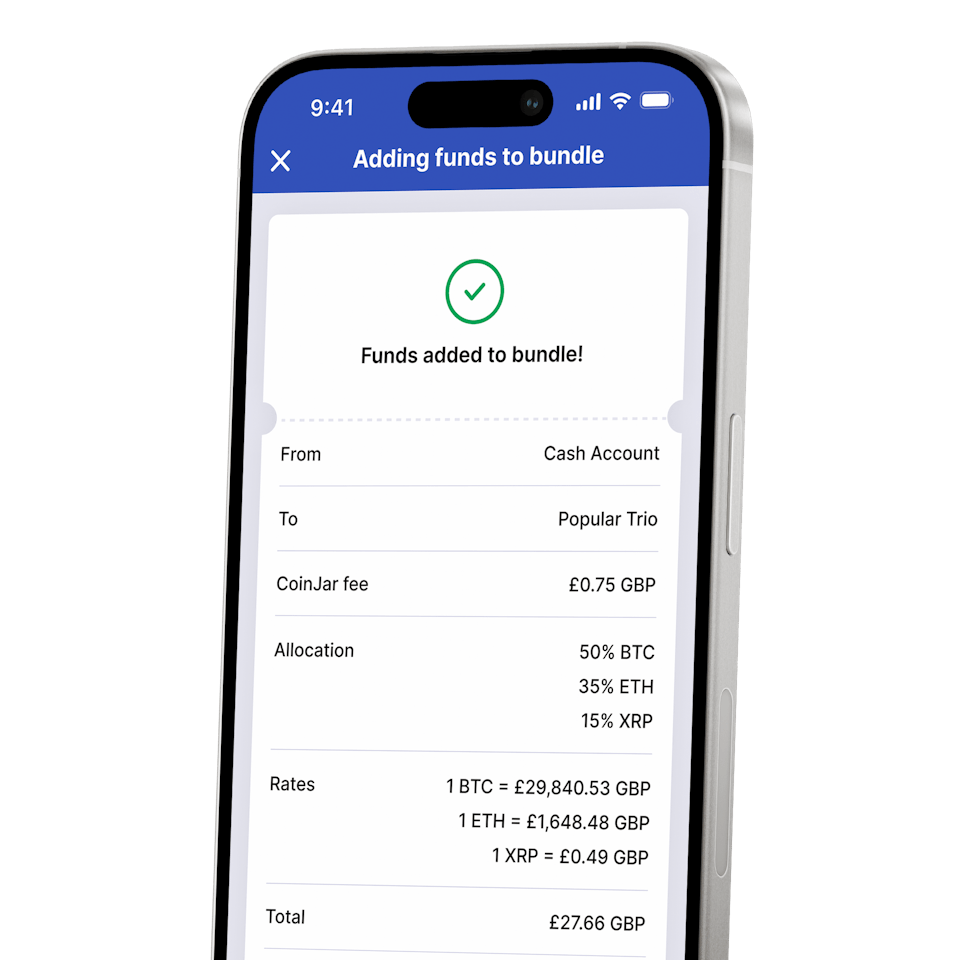

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

How can I trade 0x (ZRX)?

-Sign up to CoinJar: Download the app and verify your ID.

-Deposit funds: Transfer GBP from your bank account.

-Buy 0x: Search for '0x' or 'ZRX' and enter the amount you want to buy.

That's it! You can also sell or convert your 0x within the app.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.