Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Cryptocurrency Prices

| Cryptocurrency | Index price | |

|---|---|---|

BitcoinBTC | ||

EthereumETH | ||

TetherUSDT | ||

SolanaSOL | ||

USDCUSDC | ||

XRPXRP | ||

DogecoinDOGE | ||

TronTRX | ||

CardanoADA | ||

AvalancheAVAX | ||

Shiba InuSHIB | ||

ChainlinkLINK | ||

Trump MemeTRUMP | ||

PolkadotDOT | ||

Maker DaiDAI | ||

UniswapUNI | ||

LitecoinLTC | ||

PepePEPE | ||

StellarXLM | ||

Ethereum ClassicETC | ||

SuiSUI | ||

PolygonMATIC | ||

Immutable XIMX | ||

AaveAAVE | ||

RenderRENDER | ||

OptimismOP | ||

ArbitrumARB | ||

InjectiveINJ | ||

dogwifhatWIF | ||

MakerMKR | ||

Fetch.aiFET | ||

The GraphGRT | ||

BonkBONK | ||

QuantQNT | ||

AlgorandALGO | ||

Lido DAOLDO | ||

EOSEOS | ||

GALAGALA | ||

Axie InfinityAXS | ||

TezosXTZ | ||

The SandboxSAND | ||

Ethereum Name ServiceENS | ||

ApeCoinAPE | ||

DecentralandMANA | ||

PAX GoldPAXG | ||

ChilizCHZ | ||

SynthetixSNX | ||

CompoundCOMP | ||

Curve DAOCRV | ||

1inch1INCH | ||

AmpAMP | ||

Basic Attention TokenBAT | ||

0x TokenZRX | ||

Rocket PoolRPL | ||

BiconomyBICO | ||

Universal Market AccessUMA | ||

yearn.financeYFI | ||

AudiusAUDIO | ||

Band ProtocolBAND | ||

LoopringLRC | ||

SushiSwapSUSHI | ||

Pax DollarUSDP | ||

CartesiCTSI | ||

BalancerBAL | ||

BancorBNT | ||

Kyber NetworkKNC | ||

Badger DAOBADGER | ||

Origin ProtocolOGN | ||

OrchidOXT |

Learn more about CoinJar’s trading fees

How to buy Bitcoin with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

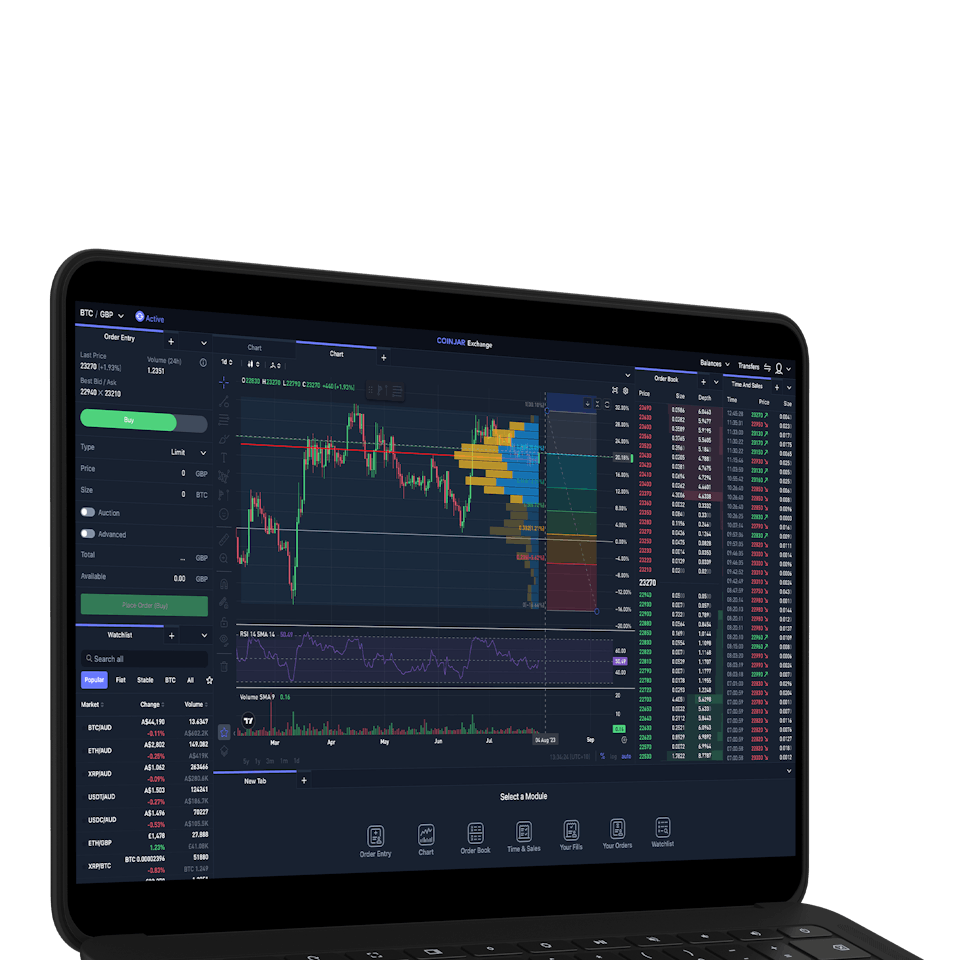

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSFor each of the FAQ’s below, please consider the specific crypto risks involved in investing, which are outlined in the standard risk warning at the bottom of the article.

Frequently asked questions

What is the most established website for live cryptocurrency prices?

For real-time cryptocurrency prices, CoinJar provides a reliable platform. You can track live prices for various crypto assets directly on the CoinJar website or mobile app.

How does Bitcoin’s price compare to other cryptocurrencies?

Bitcoin (BTC) remains the most well-known and widely adopted cryptocurrency. Its price often sets the tone for the entire market. While other cryptocurrencies may have unique features, BTC’s influence remains significant.

How often does Bitcoin’s price change within a single day?

Bitcoin’s price can fluctuate significantly within a day due to market demand, news, and trading activity. It’s common to see multiple price changes, especially during volatile periods.

How to track the current Bitcoin price in real-time?

To track real-time price, see at the top of this page.

What price do you think Bitcoin will reach in the next 2 years?

Predicting future prices is challenging. However, Bitcoin’s long-term potential remains positive, and its value could appreciate over time. Always consider market dynamics and do thorough research.

What is the value of a Bitcoin, and how often does it change?

Bitcoin’s value fluctuates continuously due to market forces. Its price is influenced by factors like adoption, investor sentiment, and macroeconomic conditions. CoinJar provides real-time updates on .

Why do most crypto prices seem to move together?

Cryptocurrencies often move in tandem because they share market sentiment, liquidity, and investor behavior. Additionally, Bitcoin’s dominance affects the overall market direction.

Will cryptocurrency prices ever go back to all-time highs?

Historical trends suggest that cryptocurrencies can experience cycles of highs and lows. While no guarantees exist, many believe that the market will eventually recover and reach new highs.

Why do many cryptocurrencies mirror BTC price moves?

Bitcoin’s influence extends beyond its own market. As the pioneer cryptocurrency, BTC’s price movements often set the tone for other coins.

Will cryptocurrency prices correct from their recent run-up?

Corrections are common after rapid price increases. While short-term volatility occurs, long-term growth remains a possibility. Diversify your portfolio and stay informed.

What is Bitcoin Price History from 2010 to 2020?

Bitcoin’s price history is fascinating. From its humble beginnings in 2010 (when it was worth mere cents) to its meteoric rise in 2021 (when it reached nearly US$70,000), BTC has seen remarkable fluctuations.

At the time of writing (April 2024) BTC price is US$66,306. The market dynamics, adoption, and regulatory changes all played a role in shaping this history.

How frequently does Bitcoin’s value change?

Bitcoin’s value changes continuously due to global trading activity. Factors like news, investor sentiment, and macroeconomic events impact its price. CoinJar provides real-time updates to keep you informed.

Why is the price of Bitcoin different in different countries?

Bitcoin’s price varies across countries due to several factors:

Market Demand: Different regions have varying levels of demand for Bitcoin.

Local Regulations: Regulatory environments affect liquidity and accessibility.

Currency Exchange Rates: Bitcoin is often traded against local fiat currencies, leading to price variations.

When will crypto prices go up?

Predicting exact timing is challenging. However, long-term optimism remains. Factors like adoption, technological advancements, and market sentiment can drive prices upward.

Are Bitcoin prices headed for further losses in the short-term?

Short-term volatility is common in crypto markets. While corrections occur, many believe in Bitcoin’s resilience and potential for growth. Always stay informed and diversify your investment strategy.

What makes Bitcoin and Ethereum prices go up and down?

Both Bitcoin and Ethereum are influenced by:

Market Sentiment: Positive news or adoption can boost prices.

Investor Behavior: Large trades impact market dynamics.

Technological Developments: Upgrades and innovations affect confidence.

What are the most competitive places to get live cryptocurrency prices?

For real-time cryptocurrency prices, CoinJar is a reliable choice. The platform provides accurate and up-to-date information on various cryptocurrencies.

What is cryptocurrency? How do I watch crypto prices?

Cryptocurrency is a digital or virtual form of money protected by cryptography. To track crypto prices, use platforms like CoinJar, where you can monitor real-time values and historical trends.

Who controls Bitcoin? How does the price go up every day?

Bitcoin operates on a decentralised network, with no central authority. Its price fluctuates due to market dynamics, investor sentiment, and global adoption. Daily price changes reflect ongoing trading activity.

Who decides the prices of cryptocurrencies?

Cryptocurrency prices are determined by supply and demand in open markets. Traders, investors, and market sentiment collectively influence these prices.

What happens to cryptocurrencies after they go up in value?

When a cryptocurrency’s value increases, it attracts attention and adoption. However, it can also experience corrections. Long-term viability depends on factors like utility, adoption, and technological advancements.

What will happen to cryptocurrency if Bitcoin falls?

Bitcoin’s fall can impact the entire market. However, other cryptocurrencies have unique features and use cases. Some may thrive independently, while others may follow Bitcoin’s trend.

What causes the price of cryptocurrencies to drop?

Price drops can result from:

Market Sentiment Shifts: Negative news or regulatory changes.

Profit-Taking: Traders selling after price increases.

Macro Events: Economic downturns or geopolitical tensions.

When can we see a rise in BTC price?

Predicting exact timing is challenging. However, long-term optimism remains. Factors like institutional adoption, technological advancements, and market sentiment can drive BTC’s price upward.

What gives a cryptocurrency value other than speculation?

Beyond speculation, factors like:

Utility: Use cases and practical applications.

Scarcity: Limited supply.

Adoption: Widespread acceptance.

Protection: Robustness of the underlying technology.

Why do BTC, ETH, and LTC prices rise and fall together?

These cryptocurrencies share market sentiment, investor behavior, and liquidity. Additionally, Bitcoin’s dominance influences the overall market direction. The performance of most cryptoassets can be highly volatile, with their value dropping as quickly as it can rise. You should be prepared to lose all the money you invest in cryptoassets.

What is the best blog site for Bitcoin price prediction?

While there isn’t a single definitive “best” blog site for Bitcoin price predictions, several reputable platforms provide valuable insights. Some popular ones include:

CoinTelegraph, BeInCrypto, CoinDesk, Decrypt and Blockworks.

How is the cryptocurrency market manipulated?

Cryptocurrency market manipulation involves deliberate actions to artificially influence prices or trading volumes. Tactics include:

Pump and Dump: Inflating prices through coordinated buying, then selling to unsuspecting investors.

Spoofing: Placing large fake orders to deceive traders.

Wash Trading: Simultaneously buying and selling to create false volume.

Insider Trading: Using non-public information for personal gain.

Market Cornering: Controlling a significant portion of supply to manipulate prices.

Is the future price of Bitcoin and Ethereum 0?

It’s highly unlikely that the future price of Bitcoin or Ethereum will reach zero. Both cryptocurrencies have strong communities, use cases, and adoption. However, predicting exact prices is challenging.

What would help the prices of cryptocurrencies to be more consistent?

Several factors could contribute to price consistency:

Increased Adoption: Widespread use and acceptance.

Regulatory Clarity: Clear guidelines foster investor confidence.

Reduced Speculation: Less speculative trading.

Improved Scalability: Efficient networks handle higher transaction volumes.

What will be the future of Bitcoin? Will it ever rise again?

Bitcoin’s future remains uncertain, but historical trends suggest it will continue to evolve. Many believe it will rise again due to scarcity, institutional interest, and growing adoption.

Why does the Bitcoin price fluctuate so much?

Bitcoin’s volatility results from factors like:

Market Sentiment: News, investor emotions, and speculation.

Liquidity: Smaller market cap compared to traditional assets.

Macro Events: Economic conditions, regulations, and global events.

Should investors wait for the rise in the price of Bitcoin or sell it?

Buying during market downturns can be advantageous if you believe in the long-term potential. However, always do thorough research and consider your risk tolerance.

Is all crypto dependent on Bitcoin?

Bitcoin’s dominance influences the broader crypto market. While some altcoins move independently, many still follow Bitcoin’s lead.

What is the formula to calculate the price of a cryptocurrency?

The price is determined largely by supply and demand. It’s influenced by factors like trading volume, market sentiment, and utility. There’s no single formula, but market dynamics play a crucial role.

Should you wait for the rise in the price of Bitcoin or sell it?

Timing the market is challenging. Diversification and a well-defined strategy are essential.

What is the current Bitcoin price?

The live Bitcoin price at the time of writing (April 23, 2024) is approximately $66,022.89 USD. .

What is Bitcoin’s price history?

Bitcoin’s price has experienced significant fluctuations over the years. From its early days when it was worth mere cents to its all-time high of nearly $74,000 in 2024.

Where can I find a Bitcoin price live chart?

You can track Bitcoin’s real-time price using platforms like or CoinGecko, which provide interactive charts and historical data. Or you can use

Which Bitcoin exchange offers BTCUSD trading?

This can be .

What is a digital asset in the cryptocurrency market?

A digital asset refers to any form of value or ownership that exists in electronic or digital form. Cryptocurrencies like Bitcoin are prime examples of digital assets.

Where can I find the latest crypto news, including Bitcoin updates?

Stay informed by following reputable crypto news sources such as CoinDesk, Cointelegraph, or CryptoSlate.

What is Bitcoin’s market cap?

Bitcoin’s is the total value of all circulating Bitcoins. As of now, it stands at approximately $1.38 trillion USD.

How often does the Bitcoin price change in real time?

Bitcoin’s price fluctuates continuously due to global trading activity. Platforms like CoinMarketCap provide real-time updates.

What are the predictions for Bitcoin’s future price?

Predicting exact prices is challenging, but many experts believe in Bitcoin’s long-term potential. Factors like adoption, scarcity, and institutional interest play a role.

Why does Bitcoin’s price fluctuate so much?

Bitcoin’s volatility results from factors like market sentiment, liquidity, macro events, and investor behaviour.

Should you pay attention to Bitcoin news for price prediction?

While news can impact short-term price movements, consider a holistic approach that includes technical analysis, market trends, and fundamental factors.

What is the historical performance of Bitcoin’s price in GBP?

Bitcoin’s historical data against the Pound Sterling (BTC/GBP) shows significant growth and fluctuations over time. You can check the .

Where can I find reliable Bitcoin news?

Explore platforms like CoinDesk, Cointelegraph, or Bitcoin Magazine for up-to-date news and insights.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.