Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy Cartesi (CTSI) in UK With GBP | CoinJar

Cartesi

CTSI

Overview

What is Cartesi?

Buy Cartesi (CTSI): Cartesi is a blockchain project that aims to bridge the gap between decentralised applications (DApps) and real-world computation. It provides a decentralised layer 2 infrastructure that allows developers to build complex applications while benefiting from the protection and transparency of .

Why do people buy Cartesi (CTSI) tokens?

Scalability and efficiency

helps to address the scalability limitations of existing blockchains by offloading heavy computations to a sidechain. This means that DApps can perform complex computations without clogging the main blockchain.

Familiar programming languages

Unlike some other blockchains, Cartesi allows developers to write DApps using familiar programming languages like C++, Python, and Rust. This lowers the entry barrier for developers and encourages broader adoption.

Layer 2 solutions

Cartesi’s sidechain infrastructure enables efficient computation and data storage. Users can interact with DApps seamlessly, knowing that their transactions are protected and cost-effective.

Staking and incentives

The native utility token of Cartesi is called CTSI. Holders can stake CTSI tokens to participate in network consensus and earn rewards. Staking incentivises honest participation and contributes to the network’s protection.

Transaction fees

CTSI tokens are used to pay transaction fees within the Cartesi ecosystem. Whether you’re executing a smart contract or storing data on the sidechain, CTSI serves as the medium of exchange.

CTSI token

Users pay transaction fees in CTSI when interacting with DApps. Stakers validate transactions and earn rewards in CTSI. The token’s utility extends to various aspects of the Cartesi ecosystem.

Cartesi is all about helping to make blockchain practical for real-world applications.

Cash, credit or crypto?

Buy Cartesi using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy Cartesi with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

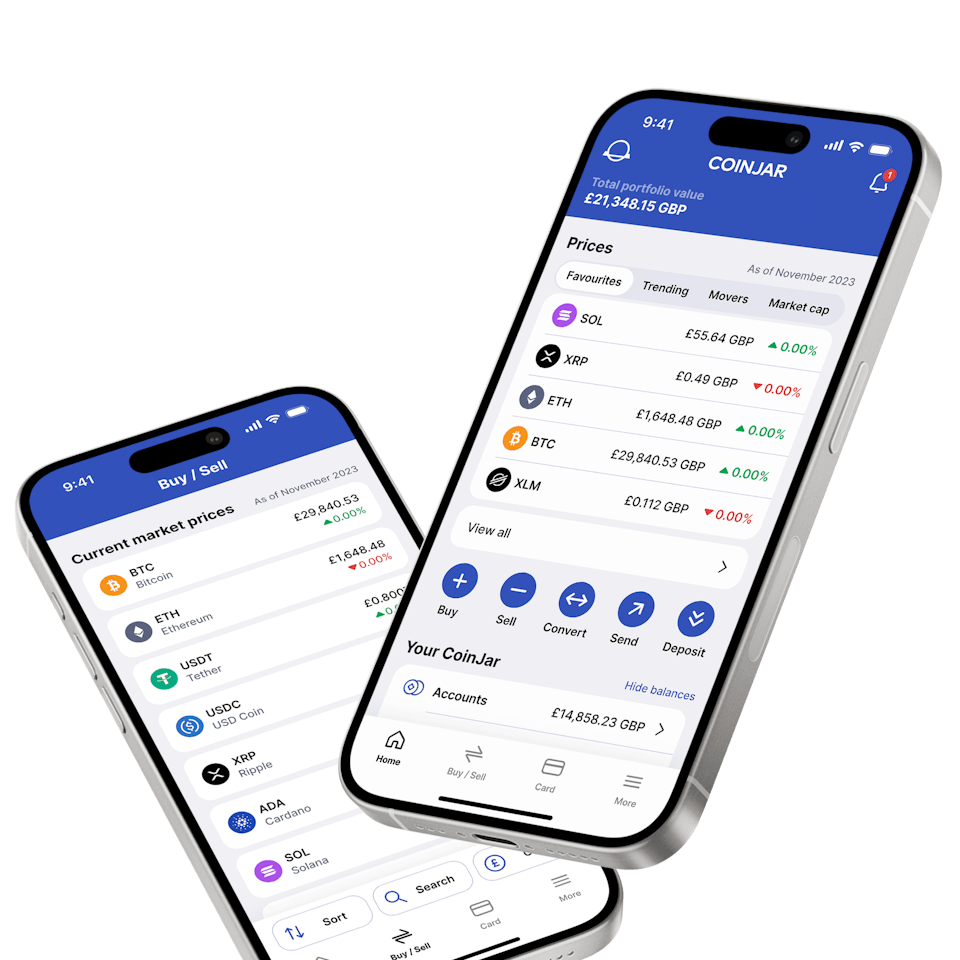

CoinJar App

All-in-one crypto wallet

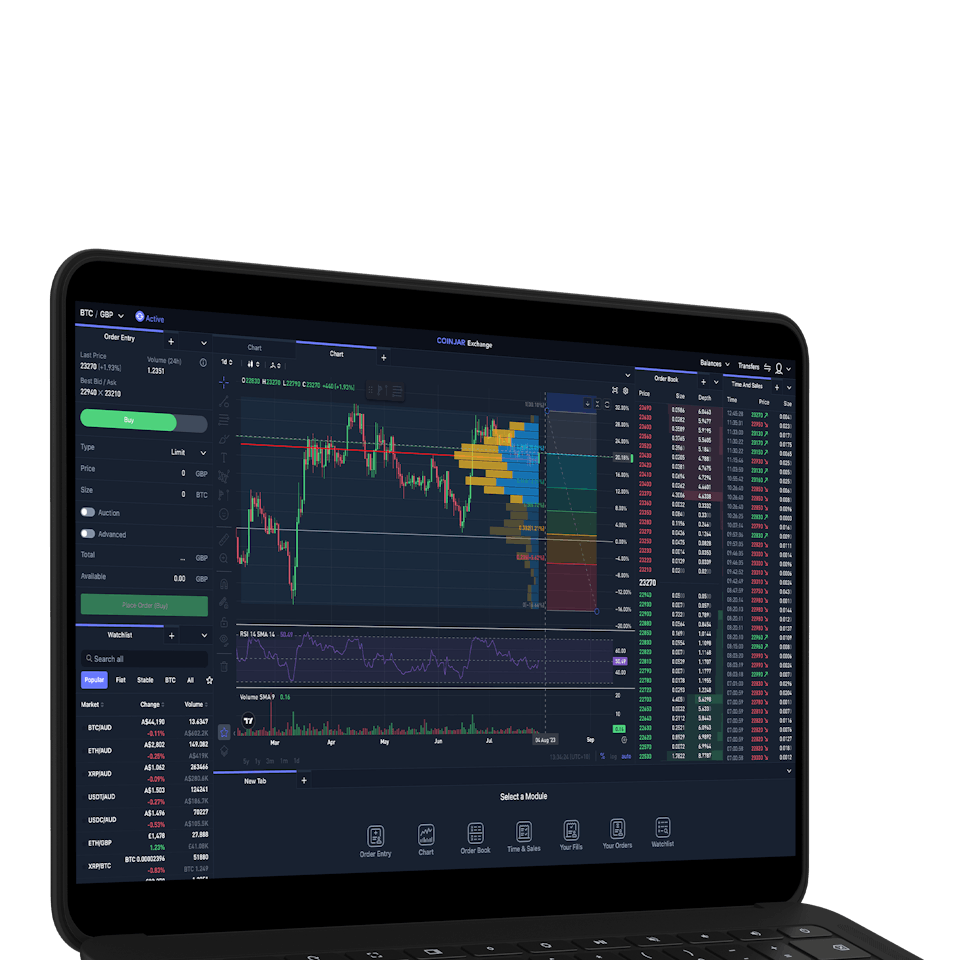

CoinJar Exchange

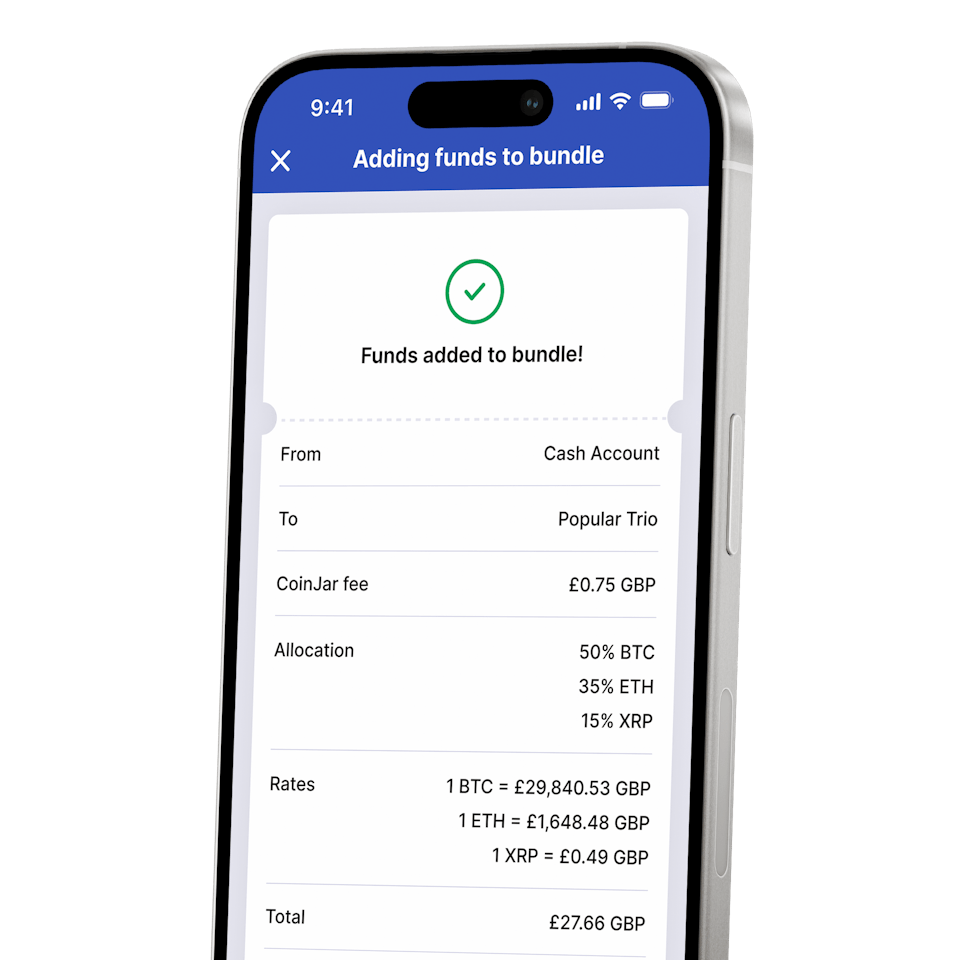

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Cartesi?

Cartesi is an app-specific rollup protocol with a virtual machine that runs Linux distributions. It creates a richer and broader design space for DApp developers, offering a modular scaling solution deployable as L2, L3, or sovereign rollups while maintaining strong base layer protection guarantees.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.