Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy yearn.finance (YFI) in UK With GBP | CoinJar

yearn.finance

YFI

Overview

What is yearn.finance?

Why do investors buy Yearn.finance (YFI)? Yearn.finance, also known as Yearn, is a ‘toolbox’ for people who use cryptocurrencies. It helps them earn interest from their .

What Is Yearn.finance? How does it work?

Yearn operates on the Ethereum blockchain. It also works with other decentralised exchanges like Balancer and Curve. Its main job is to help people make more money from their crypto assets by using DeFi (which stands for Decentralised Finance).

Vaults: Maximising yield

offers a range of vaults where users can deposit their tokens to earn yield. These vaults automatically move assets between different DeFi lending protocols (such as Aave and Compound) to maximise returns. By doing so, users benefit from competitive yields without actively managing their assets.

Governance participation

Yearn.finance’s native token is YFI. Holders of YFI have the opportunity to participate in governance decisions. This means they can vote on proposals related to the protocol’s development, changes, and upgrades. YFI holders play a crucial role in shaping the future of Yearn.finance.

yCRV and yETH Strategies

yCRV: Yearn.finance provides a strategy called yCRV, which aims to achieve maximum CRV (Curve) yields in DeFi. CRV is a stablecoin liquidity pool token, and Yearn optimises its returns for users.

yETH: For those holding Ethereum (ETH), Yearn.finance offers a user-friendly, risk-adjusted liquid staking yield strategy. Users can stake their ETH and earn rewards without locking it up for an extended period.

yPrisma: This is a protocol designed to enhance yield opportunities for digital assets. While the details of are continually evolving, it aims to provide additional ways for users to earn yield within the Yearn ecosystem.

Why Is Yearn.finance worth looking at?

Automated optimisation

Yearn.finance’s vaults automatically manage assets, ensuring users get maximum returns (per your chosen strategy) without active intervention.

Community governance

YFI holders actively participate in shaping the protocol, fostering a decentralised decision-making process.

Diverse strategies

Yearn offers various strategies (like yCRV and yETH) to cater to different risk appetites and asset types.

Innovation

The introduction of yPrisma demonstrates Yearn’s commitment to continuous improvement and innovation.

How to Use Yearn.finance

Connect Wallet: Visit the Yearn.finance website and connect your wallet.

Explore Vaults: Browse the available vaults, choose one that suits your preferences, and deposit your tokens.

Earn Yield: Let Yearn.finance’s automated strategies do the work for you. Monitor your earnings and participate in governance if you hold YFI.

Conclusion: Why Investors buy Yearn.Finance (YFI)

Yearn.finance is a DeFi protocol that optimises yield, is run by its community, and offers innovative strategies for crypto enthusiasts. Whether you’re a yield seeker or a governance enthusiast, Yearn is worth looking into.

Cash, credit or crypto?

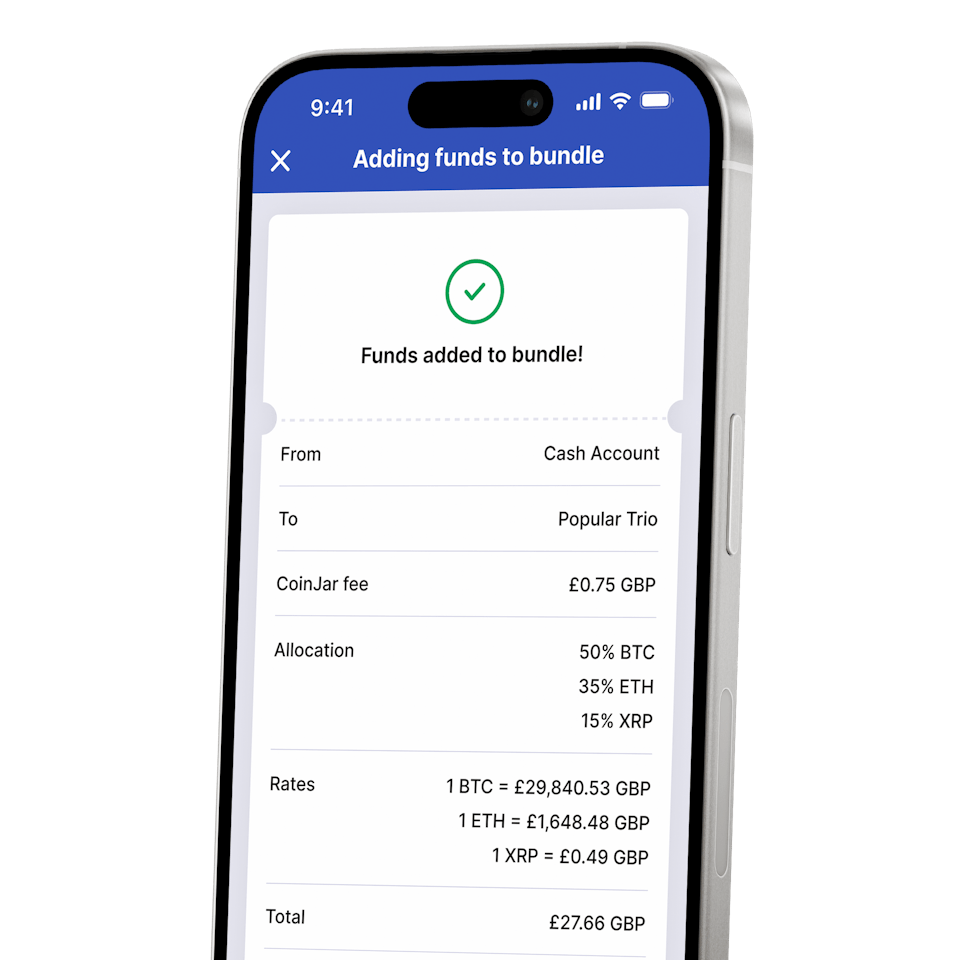

Buy yearn.finance using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy yearn.finance with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

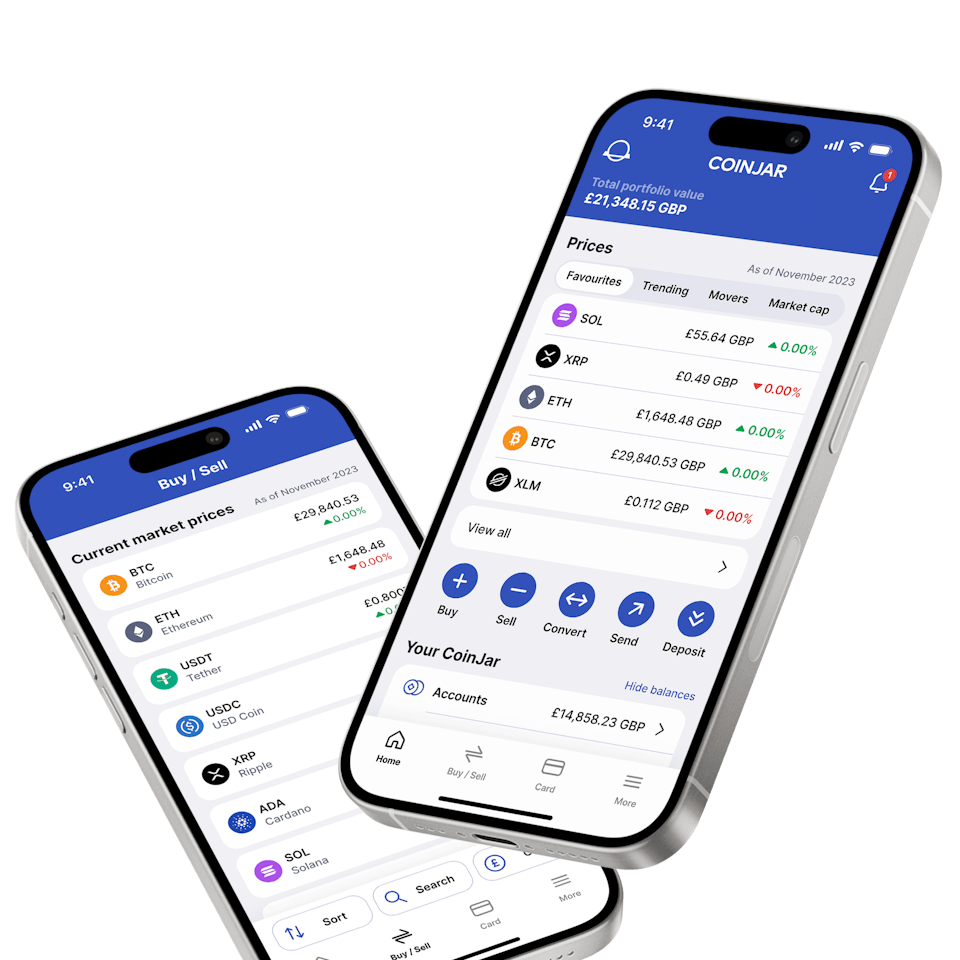

CoinJar App

All-in-one crypto wallet

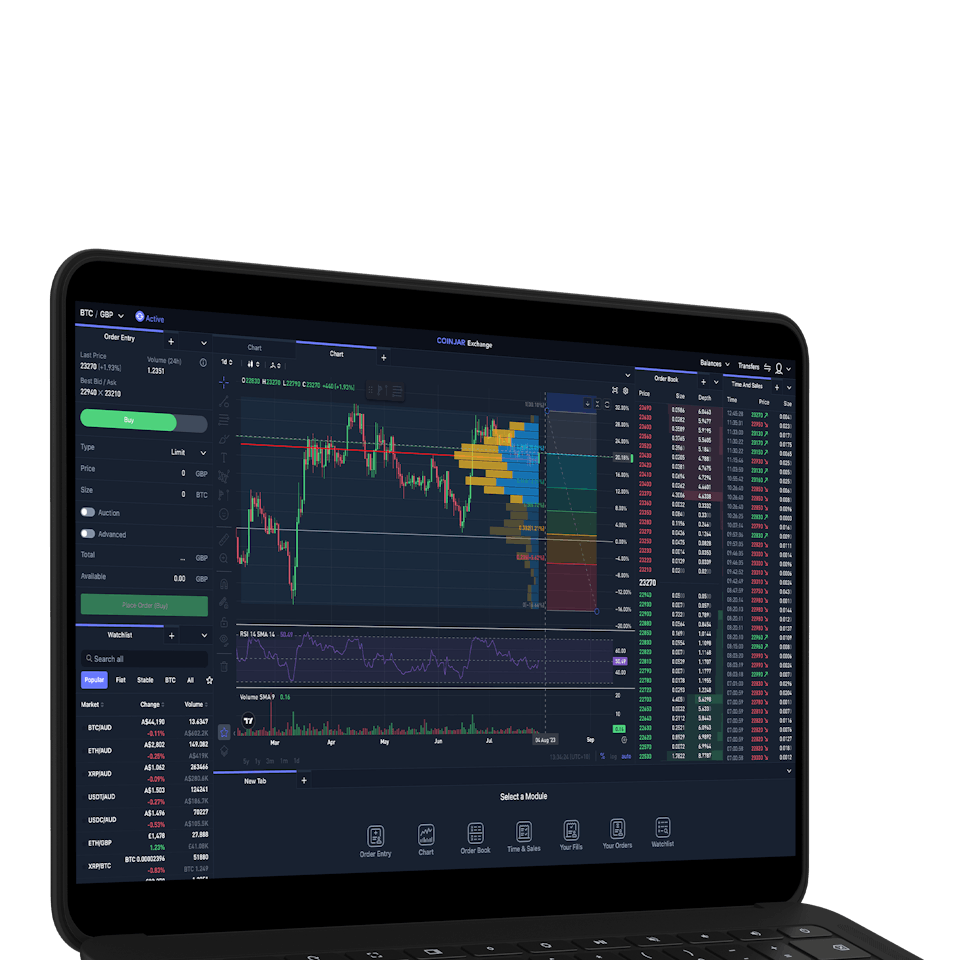

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Yearn.finance?

The Yearn Finance Protocol, commonly referred to as Yearn, is a decentralised finance (DeFi) protocol launched in February 2020. It aims to optimise yield for crypto assets by automating yield farming strategies across various DeFi protocols.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.