Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy Lido DAO (LDO) in UK With GBP | CoinJar

Lido DAO

LDO

Overview

What is Lido DAO?

UK Buy Lido DAO (LDO): As a liquid staking provider on the network, Lido plays a crucial role in expanding access to staking – a process that helps keep Ethereum protected and operational.

Let’s dig into what is, how it works, and why investors buy it.

What Is Lido DAO?

Lido DAO is a decentralised autonomous organisation (DAO) that facilitates Ethereum staking. But what exactly does that mean? Let’s break it down.

Ethereum staking

Staking involves locking up a certain amount of cryptocurrency (in this case, 32 ETH) to earn rewards.

Lido’s role

Lido aims to remove the complexities involved in staking by allowing users to deposit any amount of ETH into its protocol. Lido then uses these funds to reach the 32 ETH threshold required for staking. Third-party partners handle the technical aspects, making it convenient for end-users.

Liquid staking

Lido issues a derivative token called “staked ether” (stETH) to users who stake via the protocol. This stETH represents their staked funds and can be traded like regular ETH, providing liquidity.

Why investors should pay attention

Accessibility

Lido democratises staking by removing barriers. Investors no longer need to hold a large amount of ETH or deal with technical complexities. Anyone can participate, regardless of their holdings.

Liquidity

Traditional staking locks up funds for an extended period. With Lido, stakers receive stETH tokens that can be freely traded. This liquidity feature is attractive to investors who want flexibility.

Risk diversification

By staking through Lido, investors contribute to a larger pool, reducing individual risk. Lido’s decentralised approach ensures that no single entity controls the network.

Earn passive income

Staking generates rewards in the form of additional ETH. Lido’s simplified process allows investors to earn interest without the hassle of running their own validator node.

Positive market sentiment

(TVL) has surged, indicating growing interest from investors. As more users participate, Lido’s influence in the Ethereum ecosystem strengthens.

Conclusion: Lido DAO

Lido DAO seems to be the staking landscape, making Ethereum staking accessible. This could be one to keep an eyeball on.

Cash, credit or crypto?

Buy Lido DAO using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy Lido DAO with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

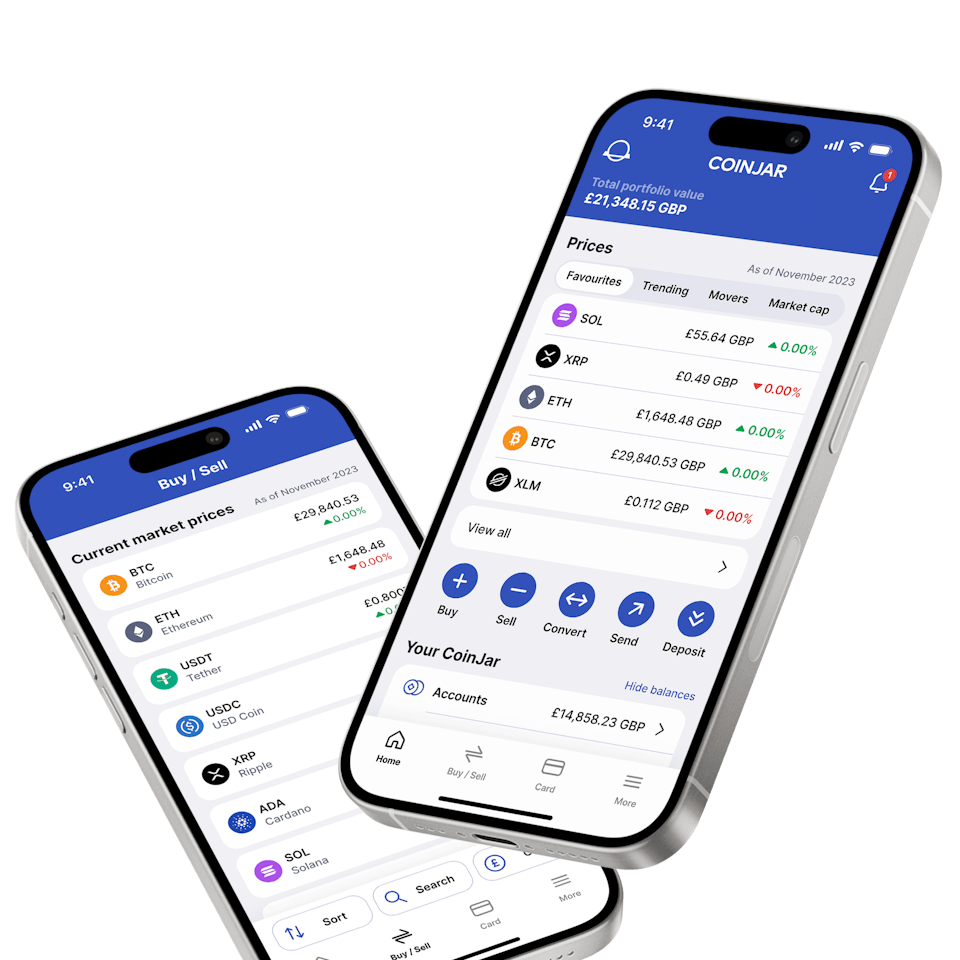

CoinJar App

All-in-one crypto wallet

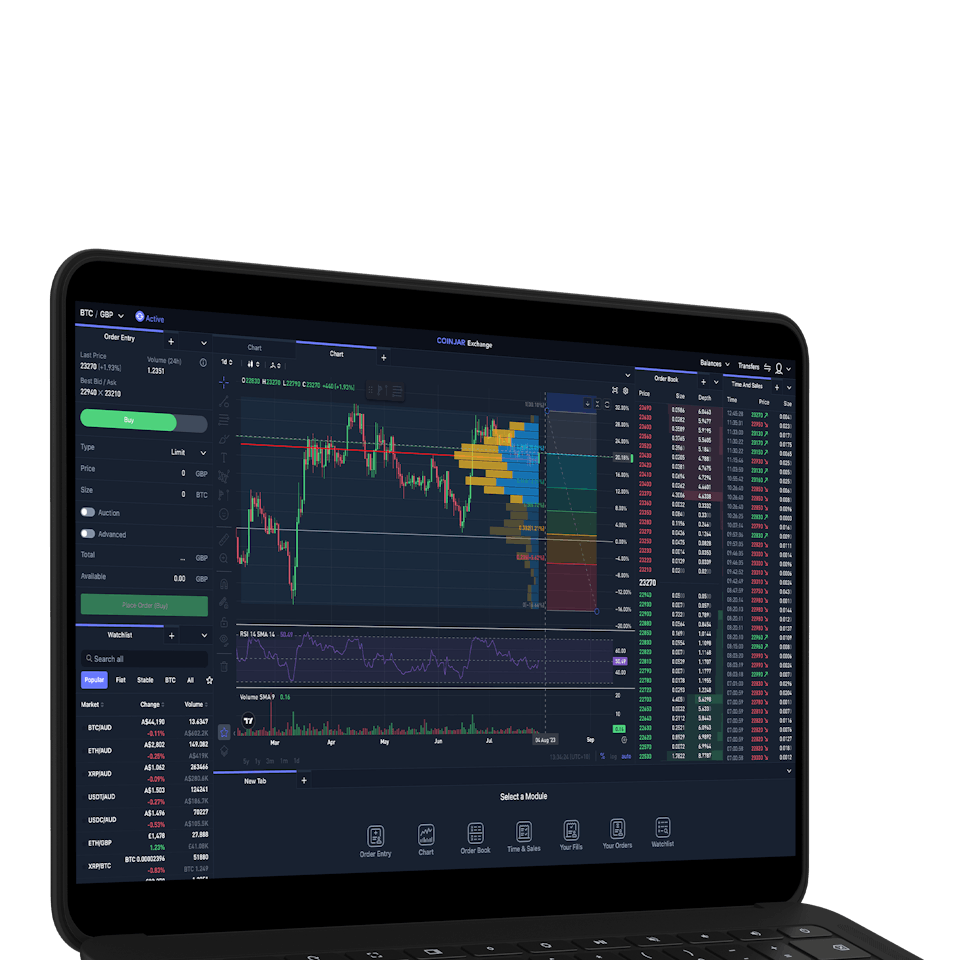

CoinJar Exchange

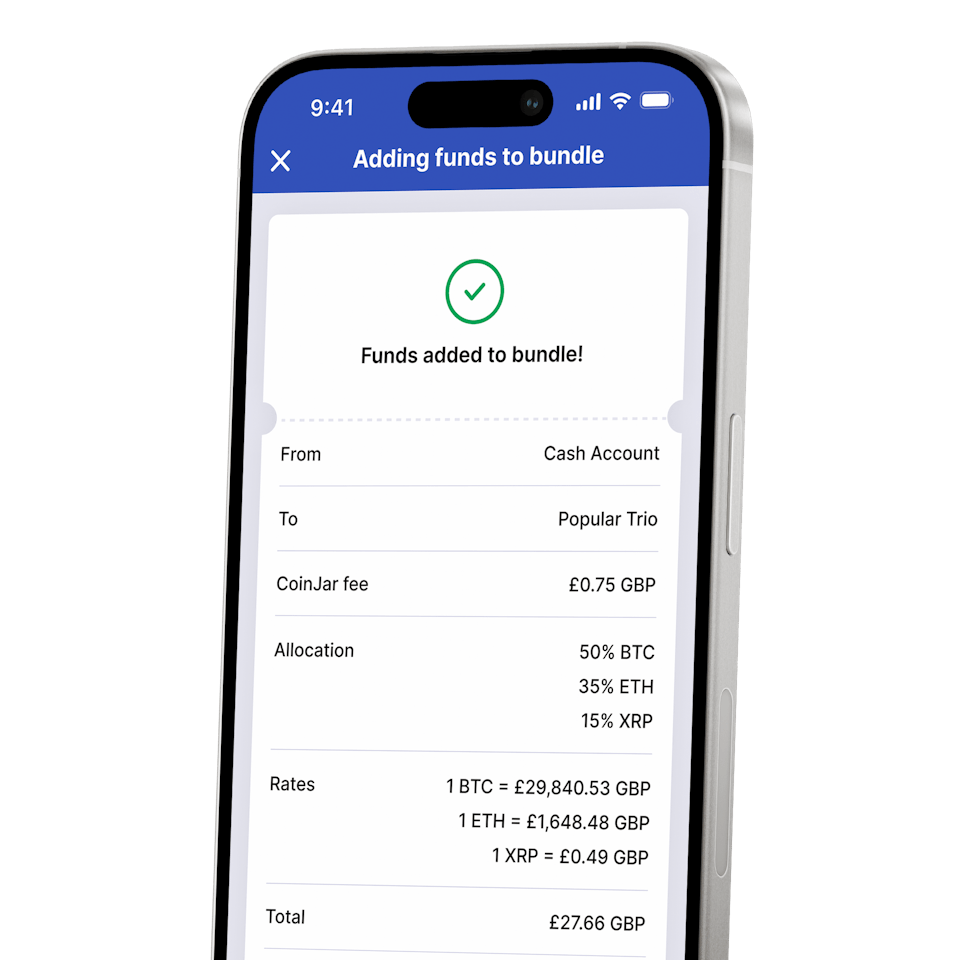

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Lido DAO (LDO)?

Lido DAO is a decentralised autonomous organisation (DAO) that focuses on liquid staking solutions for Ethereum. It allows users to stake their ETH and receive stETH tokens in return.

You can buy LDO on cryptocurrency exchanges like CoinJar.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.