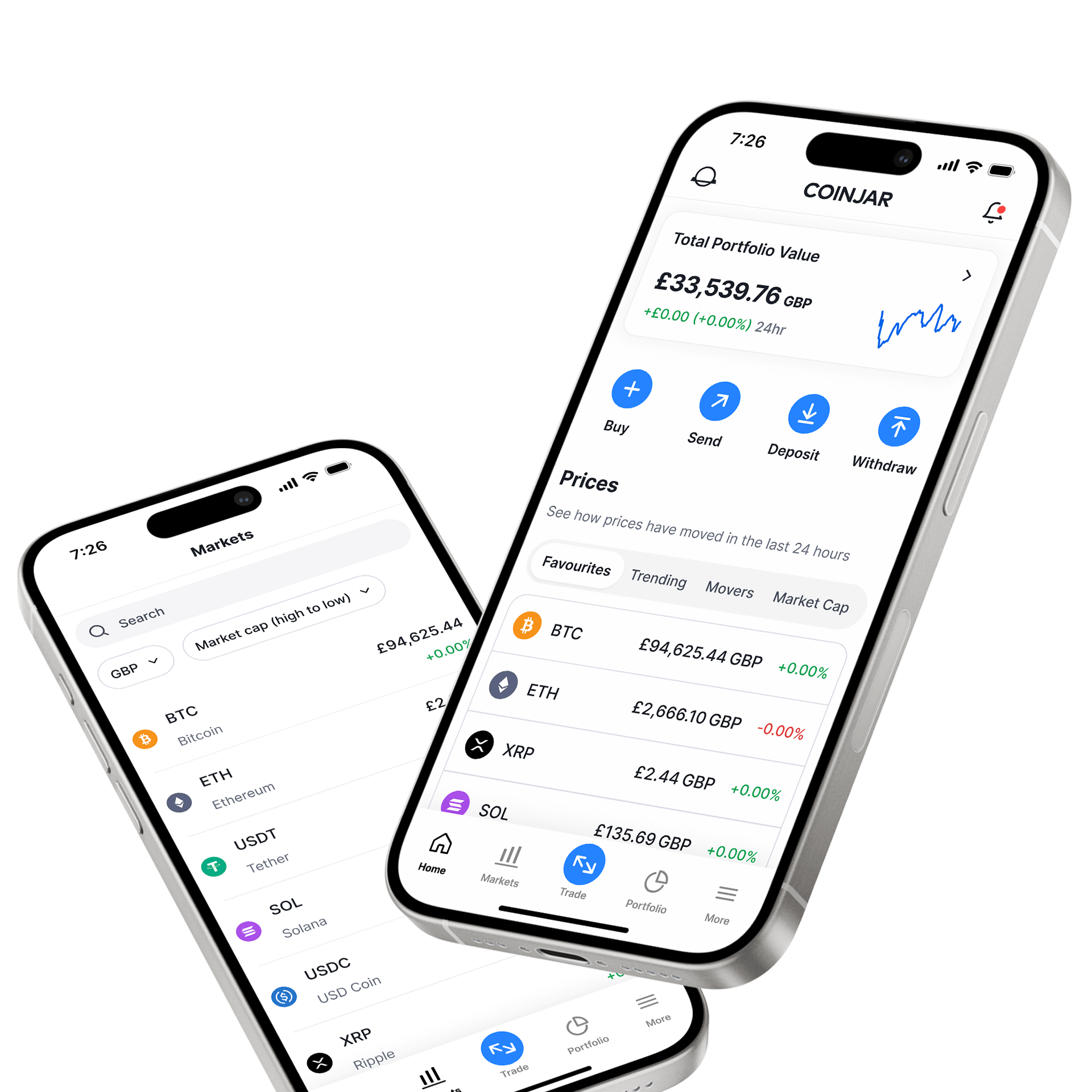

DCA with Recurring Buy on CoinJar

Begin Dollar Cost Averaging (DCA) with CoinJar. Recurring Buy allows you to set up weekly, fortnightly, or monthly purchases at your chosen rate. Use your UK-issued Visa or Mastercard to set up automated crypto purchases with a 1% fee.

Dollar cost averaging

How it works

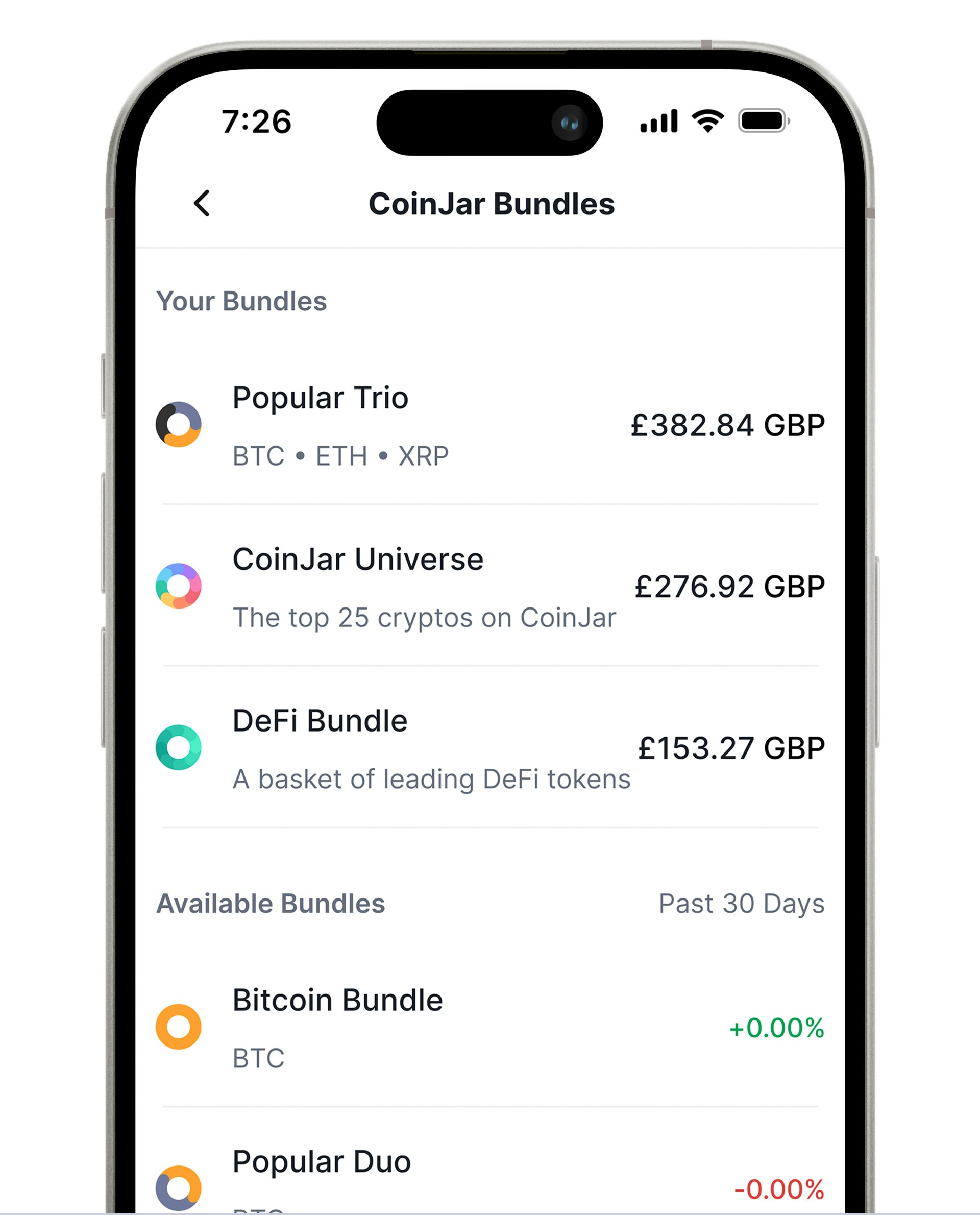

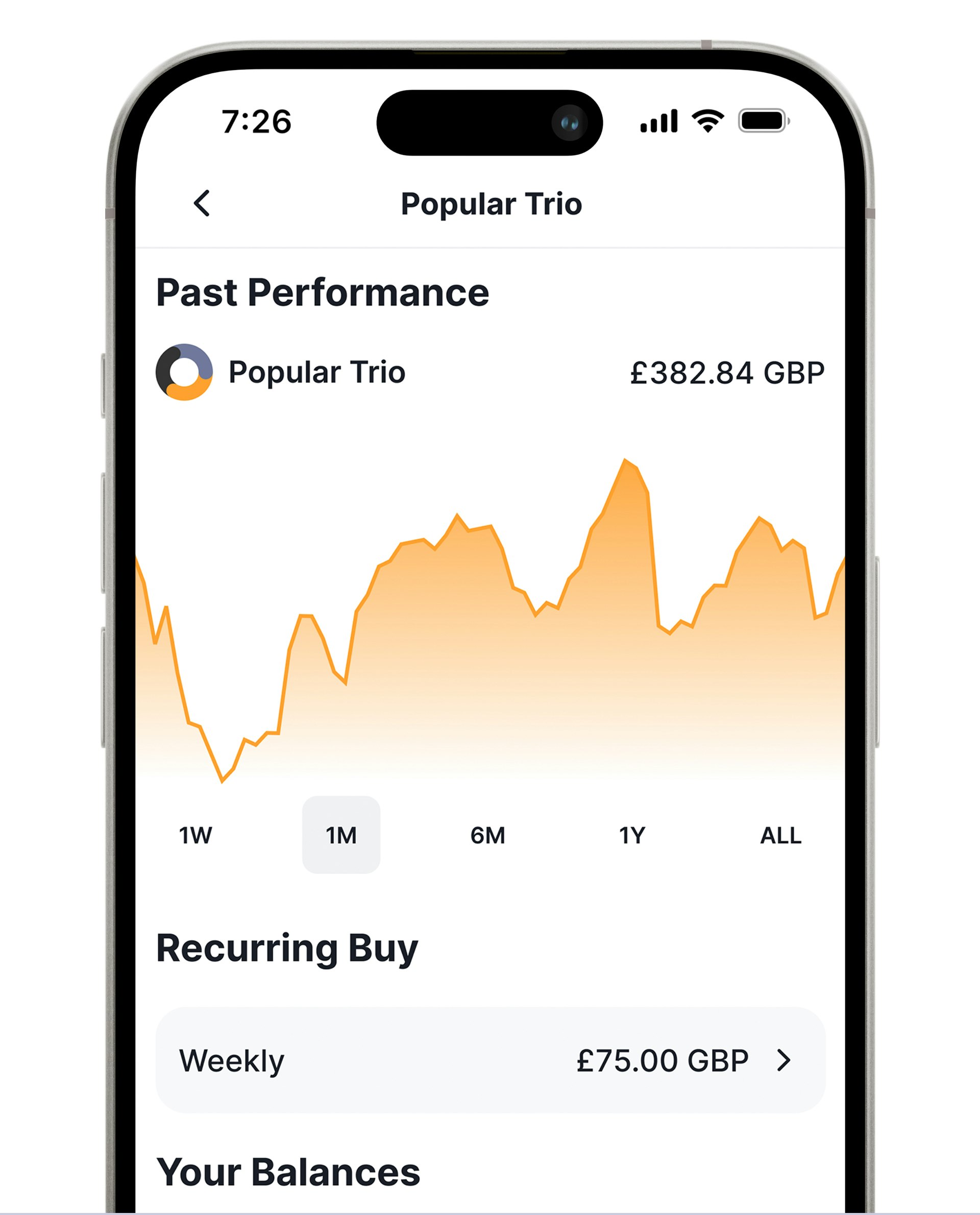

Pick a Crypto or a Bundle

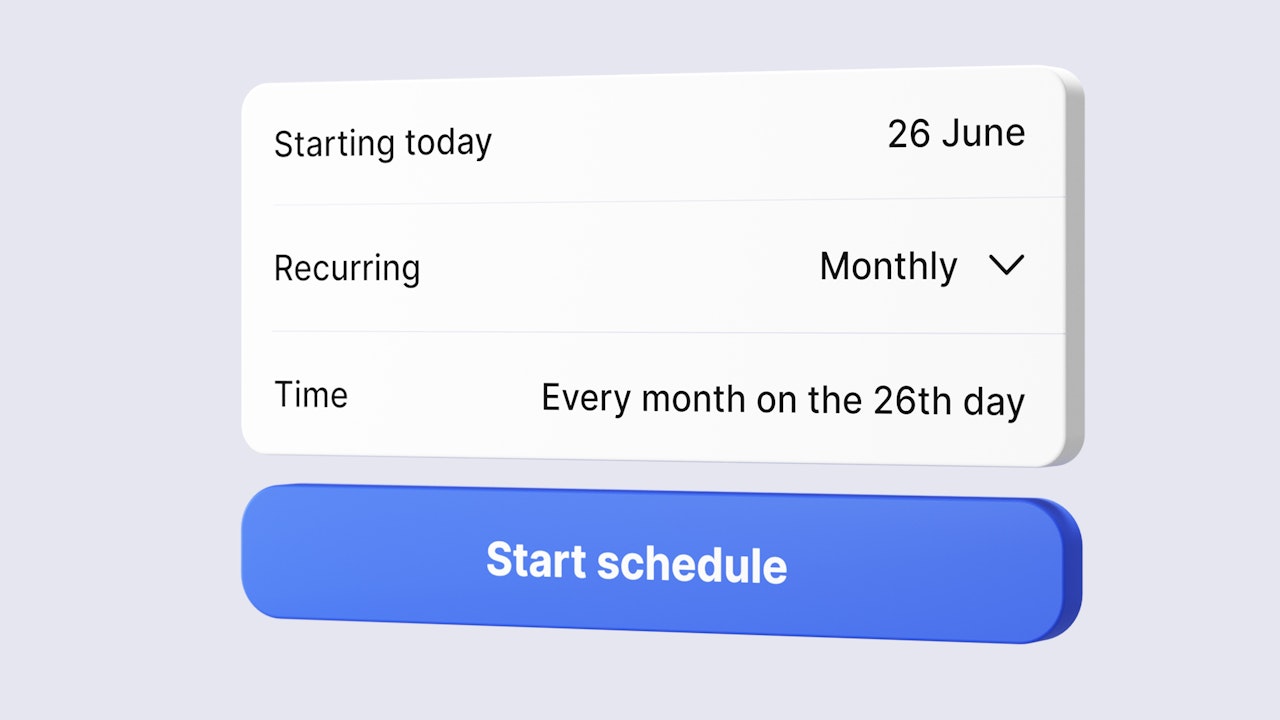

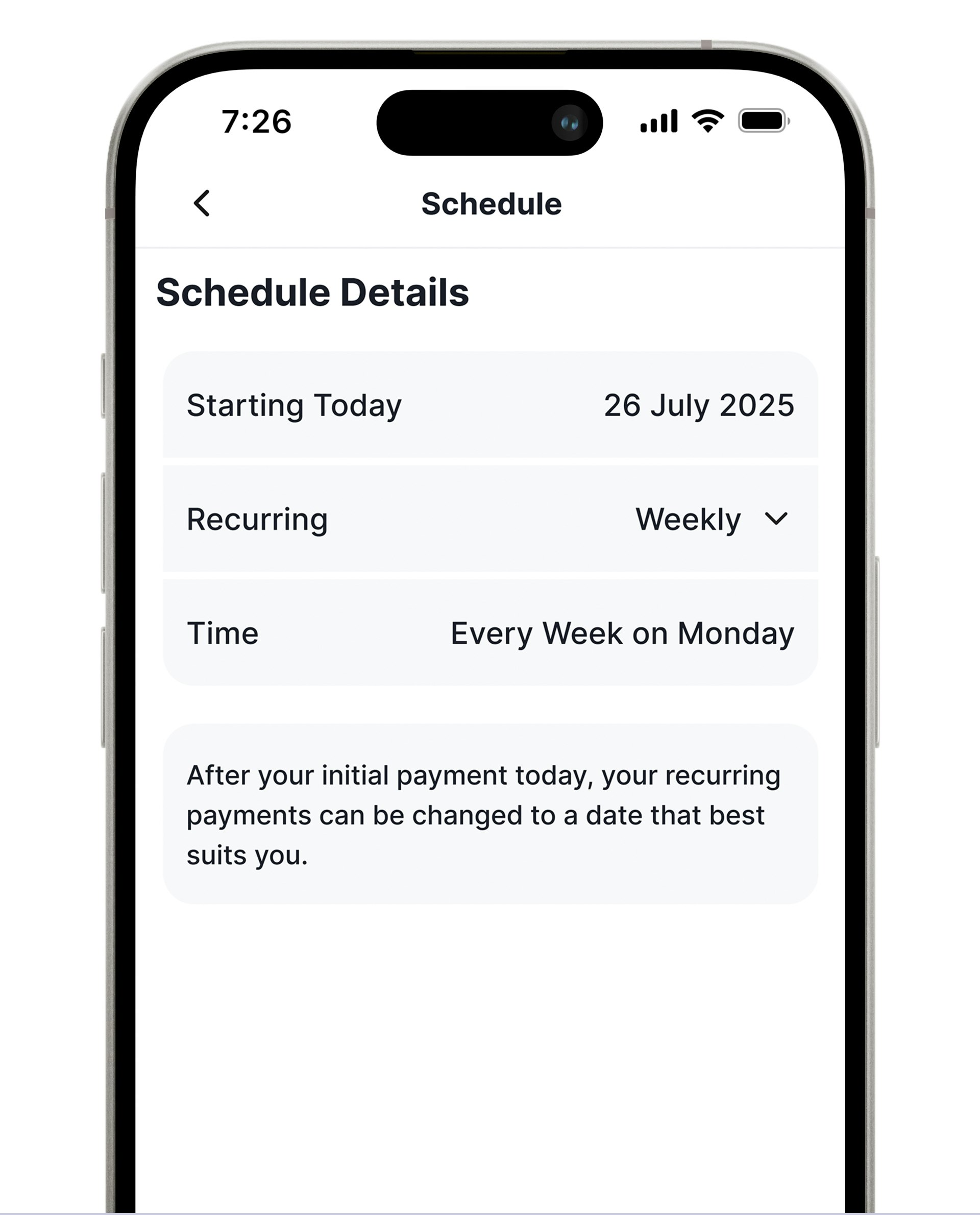

Select a crypto or tap the ‘Bundles’ icon to browse the full range.Set up a schedule

Enter the amount you'd like and select weekly, fortnightly, or monthly payments.Pause and resume

Pause or resume your schedule at any point.

Set up Recurring Buy now with a debit card

You can use your UK-issued Visa or Mastercard to set up your recurring buys with CoinJar.

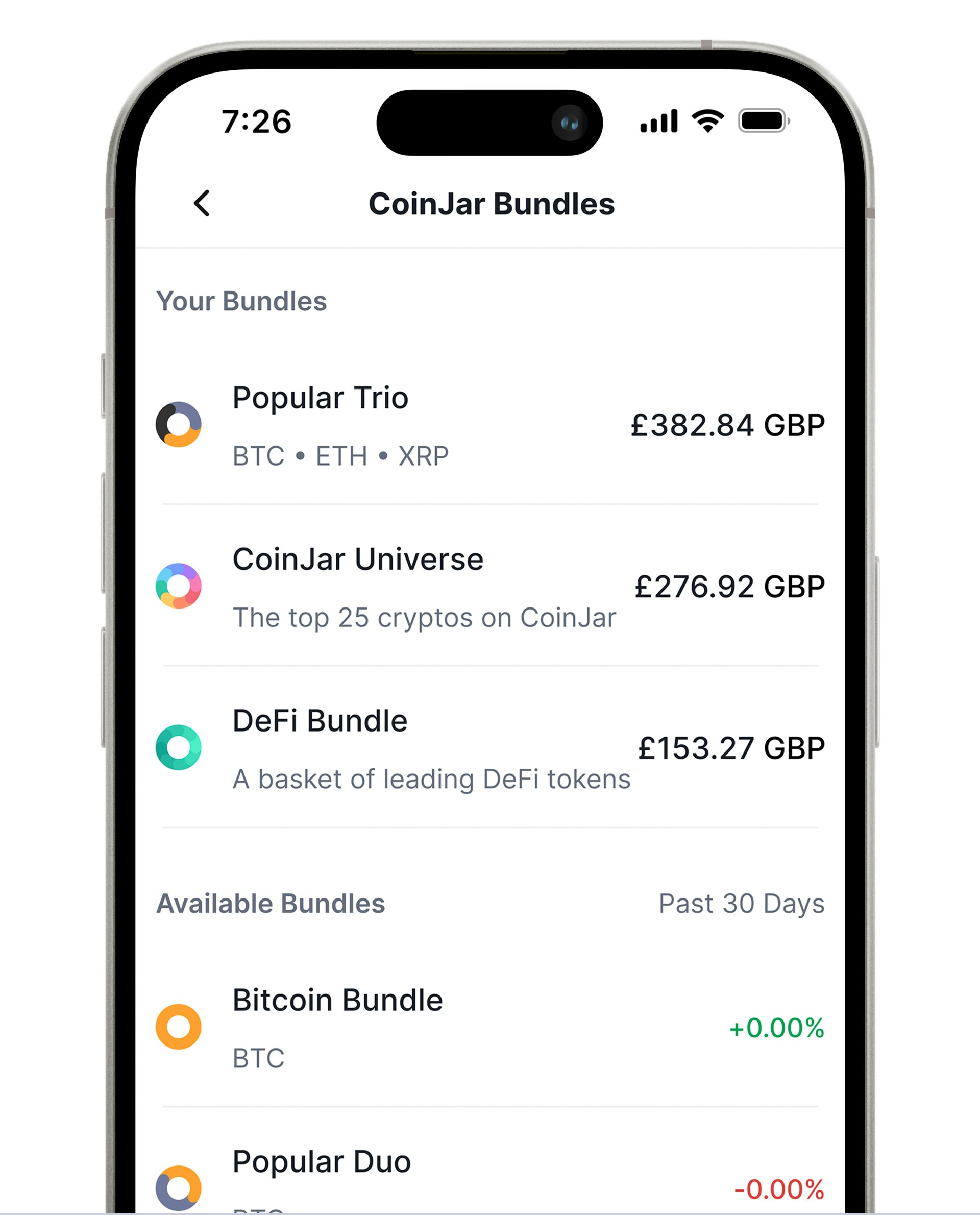

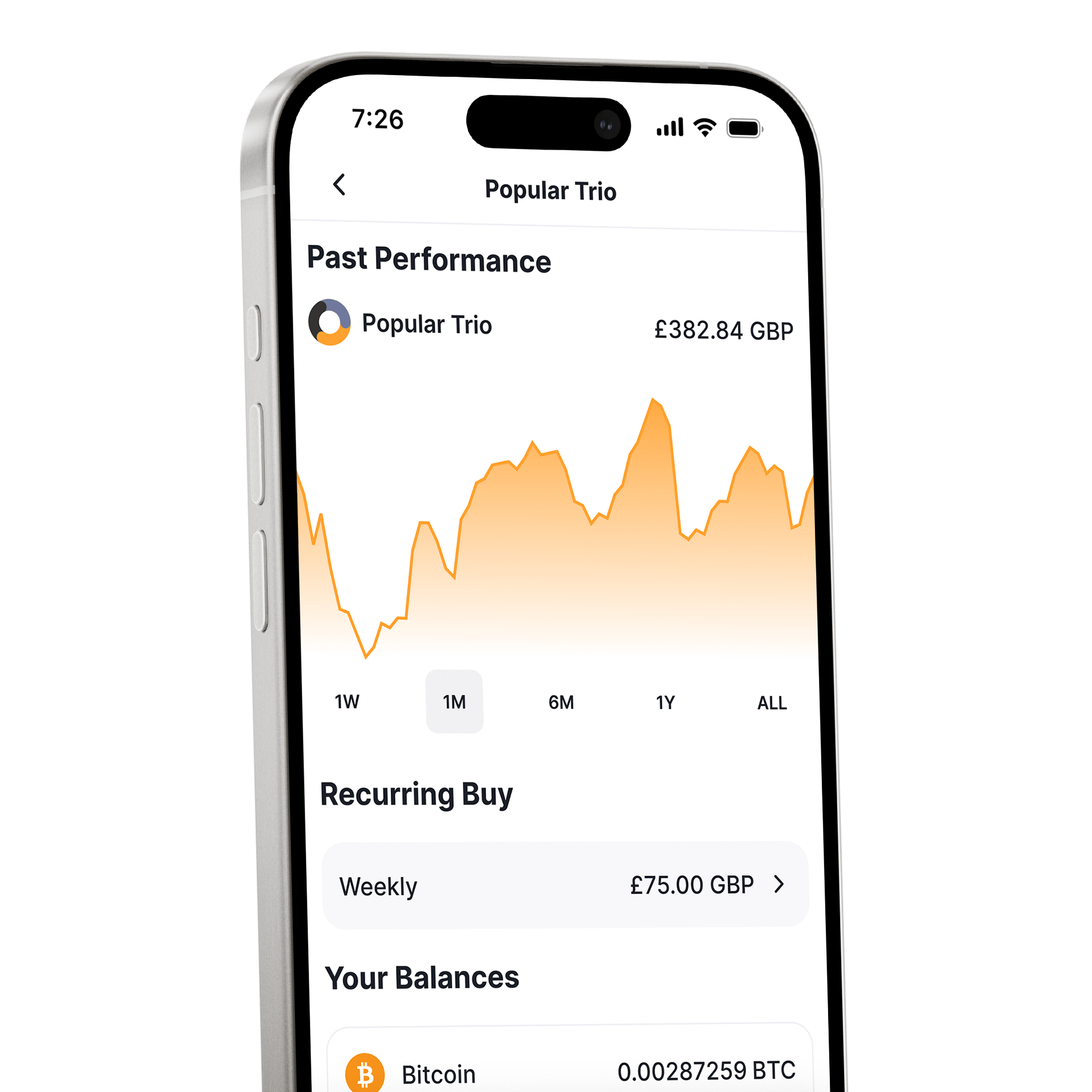

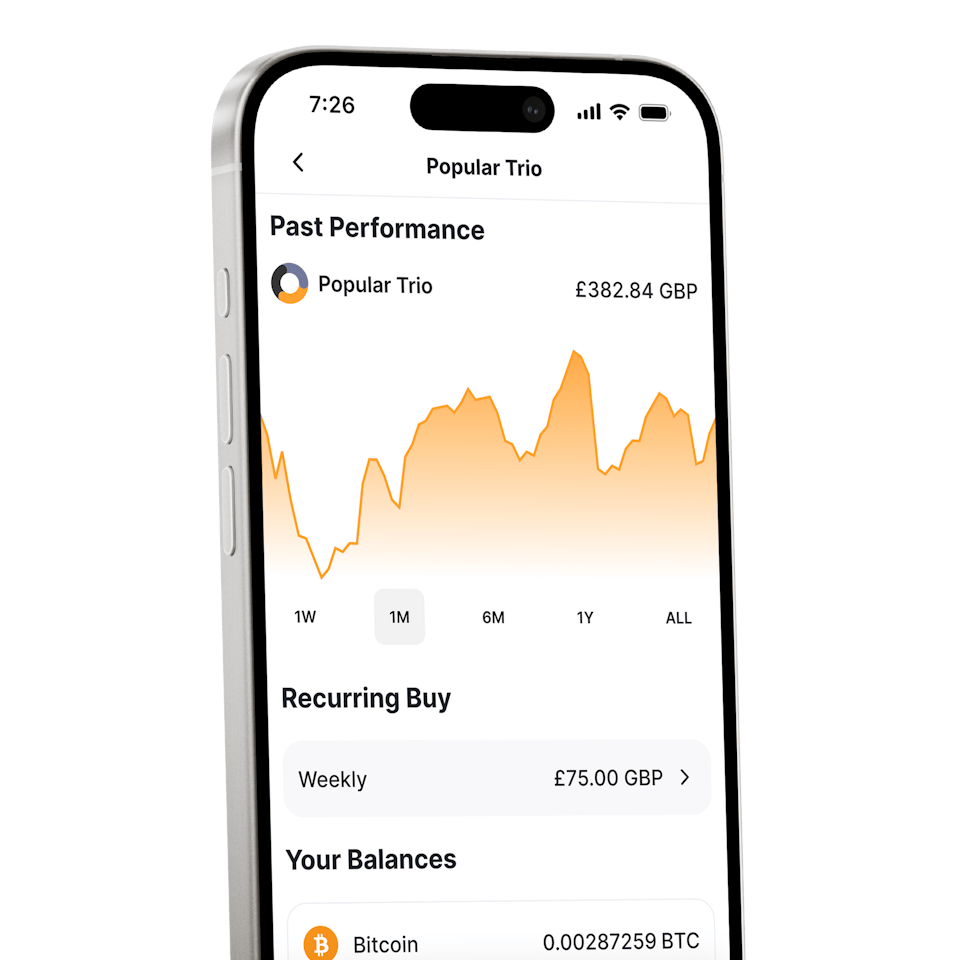

CoinJar Bundles with DCA

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

CoinJar Bundles with DCA

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

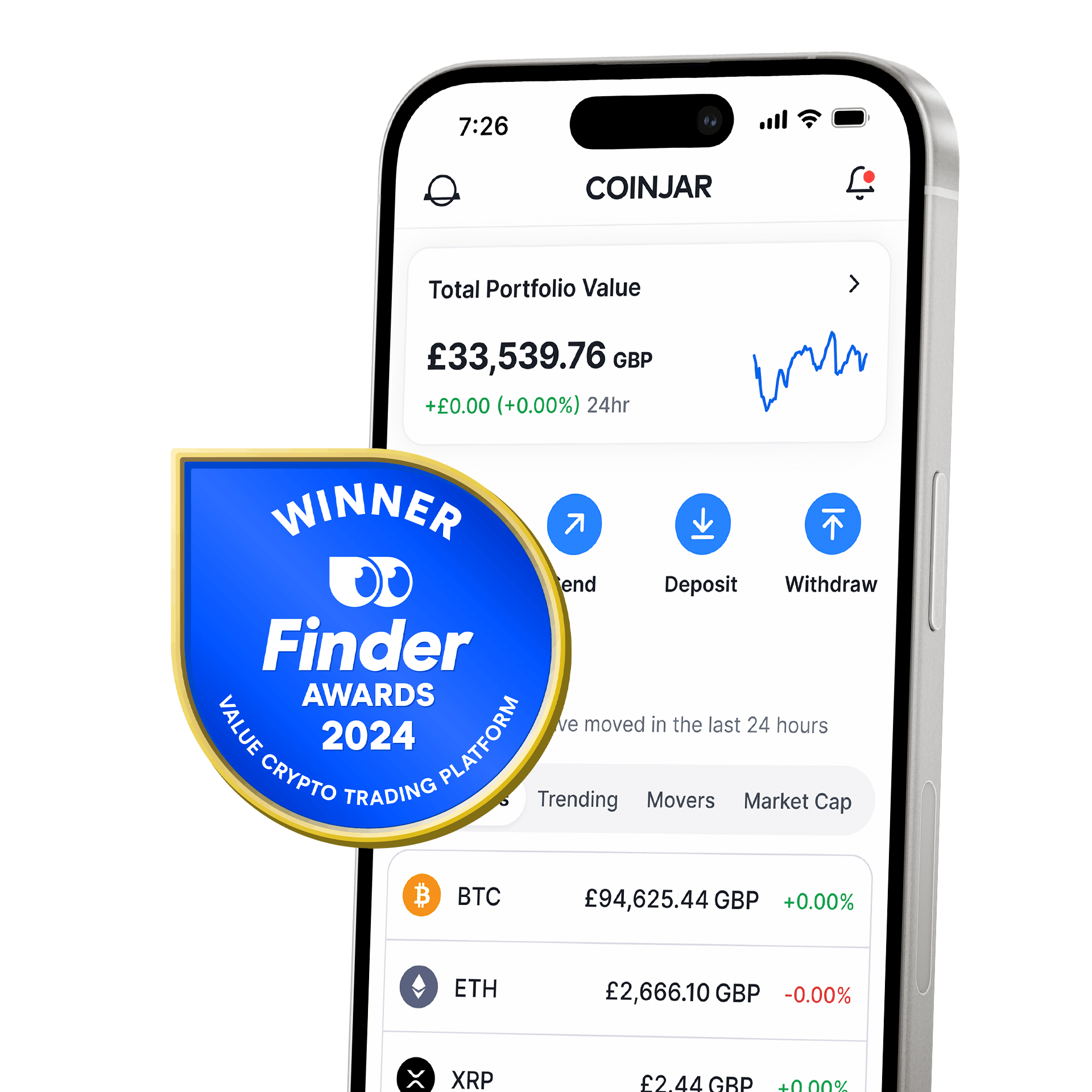

Finder Awards Winner 2024

CRYPTO TRADING - VALUEFinder Awards Winner 2024

CRYPTO TRADING - VALUE

Featured In

Frequently asked questions

What is Dollar Cost Averaging (DCA)?

Dollar-cost averaging in crypto is a strategy where you regularly invest a fixed amount of money into cryptocurrencies, like Bitcoin or Ethereum, regardless of their current price.

Instead of trying to time the market by buying when prices are competitive and selling when the prices increase or are uncompetitive (selling for a positive investment return), you consistently invest the same amount on a regular schedule.

This way, you end up buying more crypto when prices are competitive and less when prices are uncompetitive, which can help reduce the risk of losing a lot of money if prices suddenly drop.

Note that the performance of DCA depends on market conditions over time, and there is no certainty that prices will behave in a way that always benefits the investor.

Over time, this may lower the average cost you paid for your crypto investments.

Is the DCA strategy a good one?

While it can’t be proven that DCA is a better strategy than others, there are some advantages.

Cryptocurrencies are highly volatile, with prices often experiencing significant fluctuations. DCA helps to spread out the investment over time, reducing the risk of making a large purchase at a peak price.

DCA removes the stress of trying to time the market, which can lead to emotional decisions like panic-selling during a downturn or fear of missing out (FOMO) during a price surge. By sticking to a consistent plan, investors can avoid these pitfalls.

Some studies and analyses have shown that in volatile markets, DCA can lead to a lower average purchase price over time.

DCA inherently reduces the risk of investing all your money at a single point in time. This is particularly important in crypto, where price swings can be dramatic.

However…

DCA only works if you stick to the plan. If you stop investing during a downturn, you may miss out on the benefits when prices recover.

And, frequent purchases can lead to uncompetitive transaction fees, especially in crypto, where fees can be significant. Over time, these fees might eat into the potential benefits of DCA.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets.

We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.