Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Buy The Graph (GRT) in UK With GBP | CoinJar

The Graph

GRT

Overview

What is The Graph?

How to Buy Graph (GRT): Why do investors buy Graph? This is a complex one to explain, so stay with us.

Firstly, The Graph is an indexing protocol. Here’s what that means. Imagine The Graph as a bridge connecting developers to data.

Instead of developers having to set up their own data servers or sift through a huge pile of data, does the heavy lifting for them. It’s like having a librarian organise all the books in a library so that anyone can find the right information quickly.

What are Subgraphs?

Think of subgraphs as specialised search engines for blockchain data. Developers create these subgraphs to focus on specific topics, like smart contracts, tokens, or other entities on a blockchain.

For example, let’s say we have a DeFi (Decentralised Finance) subgraph. It would index data from various lending protocols, token swaps, and liquidity pools.

The Graph helps developers find the information they need without getting lost in the data jungle.

Subgraphs are like targeted search engines that organise and serve up relevant data slices. The Graph is all about making blockchain data more accessible and user-friendly.

Where is The Graph used?

The Graph originally focused on the Ethereum blockchain, but it has since expanded to support multiple blockchains, enhancing its interoperability within the blockchain ecosystem. This broadens the use cases for The Graph, allowing a wider range of decentralised applications (dApps) to benefit from its data indexing and querying capabilities.

How Does The Graph Work?

Creating subgraphs

Developers create subgraphs using The Graph’s tools. They define which data they want to index (e.g., events emitted by specific smart contracts).

Once a subgraph is created, it starts indexing data from the blockchain.

Indexing data

Indexers (participants in The Graph Network) process and index blockchain data according to the subgraph’s rules.

Indexers store this indexed data in a decentralised manner, ensuring availability and resilience.

Querying data

Developers and applications query subgraphs using GraphQL. GraphQL allows precise and efficient data retrieval.

For example, a DeFi app might ask a subgraph to fetch the latest token prices, liquidity pool details, or historical transaction data.

Why Would Someone Want to Buy GRT?

Speculation

Some people buy The Graph for speculative reasons. As of time of writing (30 May 2024) the price was US$2.84, in February of 2021. The all-time low price was US$0.05 in November 2022. At the time of writing (30 May), the price was US$0.28.

Data Access:

Developers building decentralised applications (dApps) need reliable and efficient access to blockchain data.

By holding GRT tokens, users can participate in the network and support the indexing of valuable subgraphs.

Staking and earning rewards

GRT holders can stake their tokens to become Delegators or Curators.

Delegators support Indexers by staking GRT, and in return, they earn a share of the rewards earned by the Indexers.

Curators identify useful subgraphs and signal their importance by staking GRT. Successful subgraphs attract more queries and generate rewards.

Network growth and governance

The Graph community actively participates in governance decisions. Holding GRT allows users to vote on proposals, shaping the protocol’s future.

Conclusion: Why investors buy The Graph

In summary, The Graph provides a crucial infrastructure layer for Web3 applications. This makes blockchain data accessible. Whether you’re a developer or simply a crypto enthusiast, The Graph could help in connecting to blockchain data.

Cash, credit or crypto?

Buy The Graph using Visa or Mastercard. Get cash in your account with Faster Payments Service (FPS). Convert crypto-to-crypto with a single click.How to buy The Graph with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Featured In

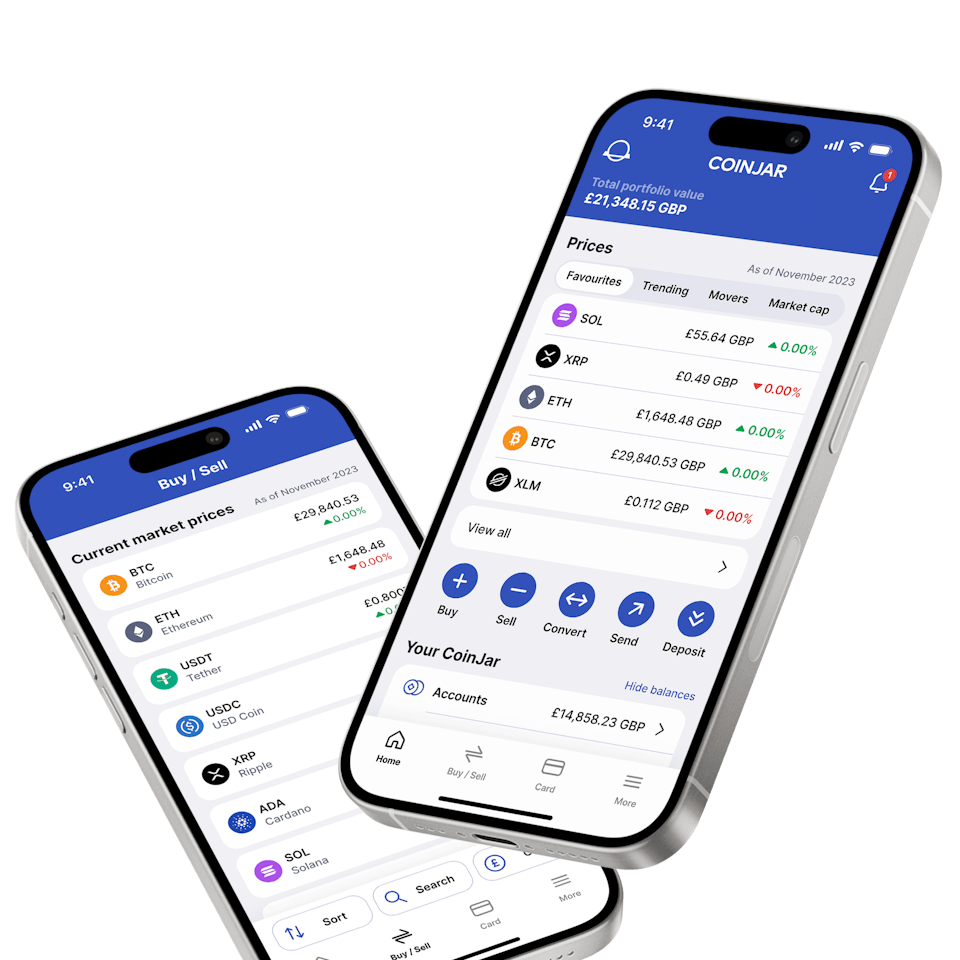

CoinJar App

All-in-one crypto wallet

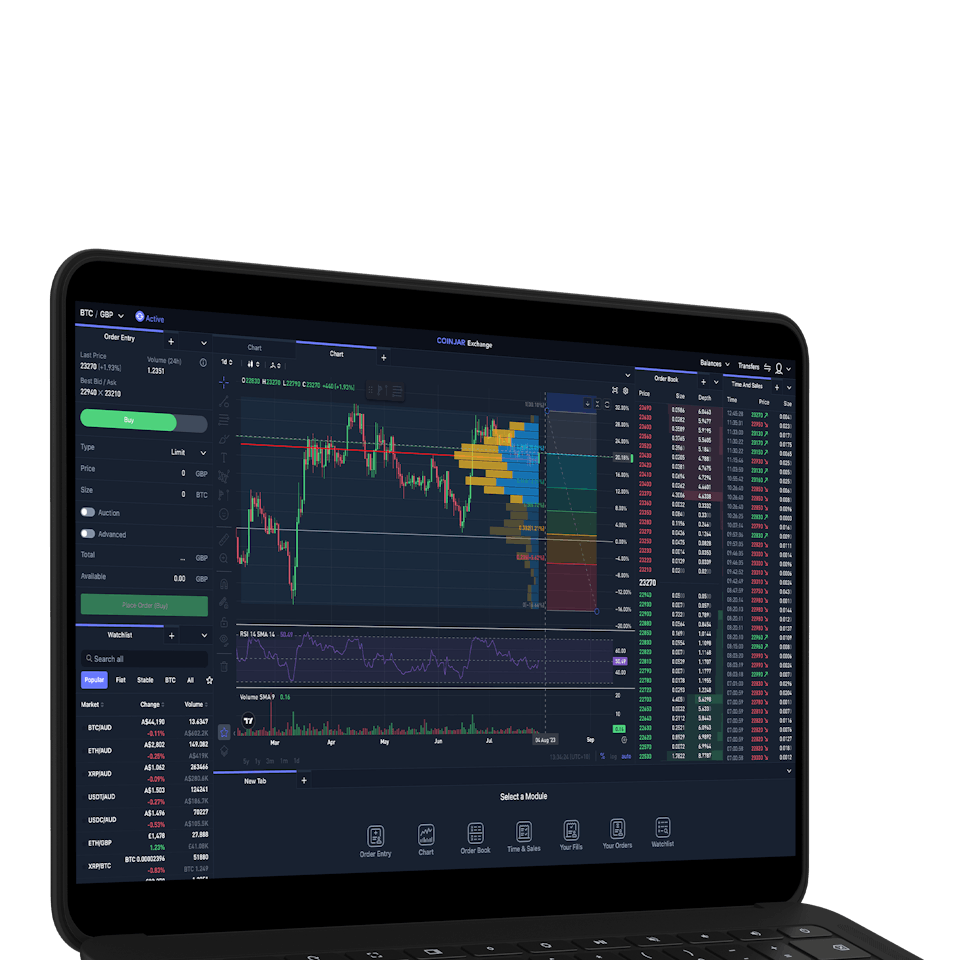

CoinJar Exchange

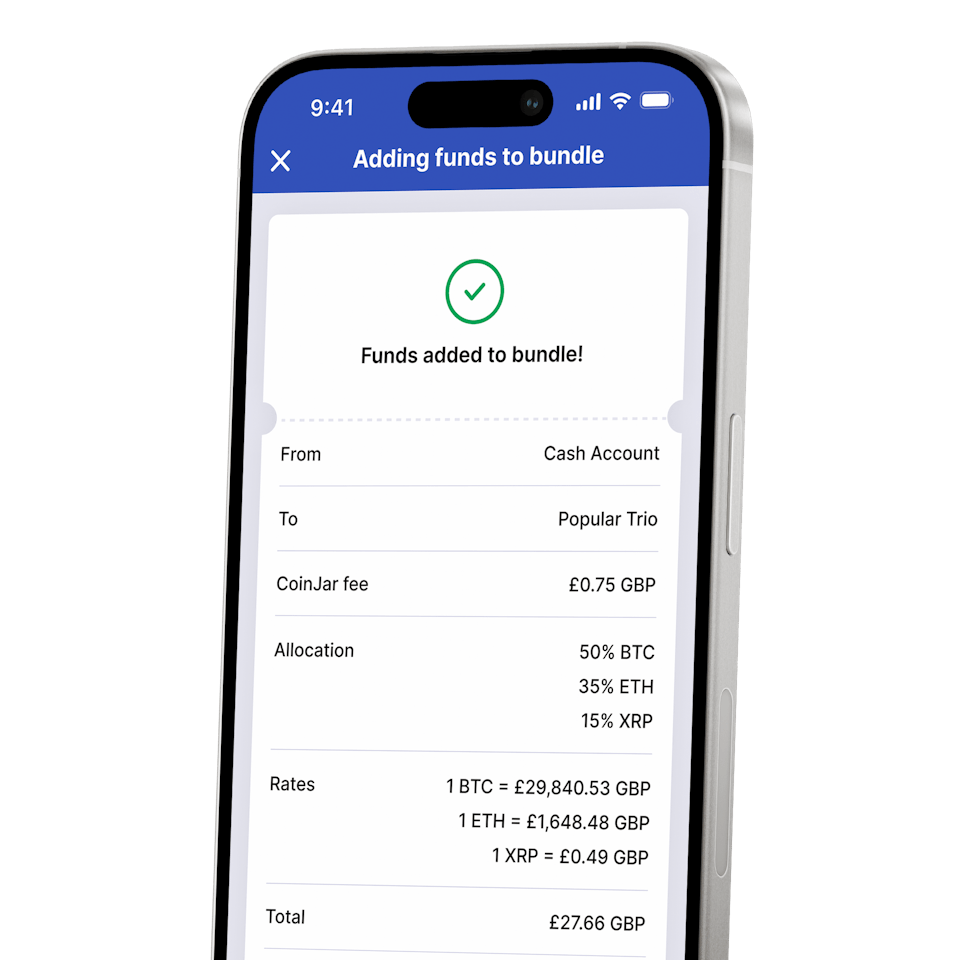

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

How does The Graph work?

Developers create subgraphs, which are specialised search engines for specific data on the blockchain.

Node operators index data from Ethereum, IPFS, and POA networks.

Applications query subgraphs using open APIs called subgraphs (powered by GraphQL).

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.