CoinJar Instant Buy

Buy crypto with your bank account

Link your bank account securely through Plaid and buy cryptocurrencies instantly. Works with over 10,000 U.S. financial institutions.

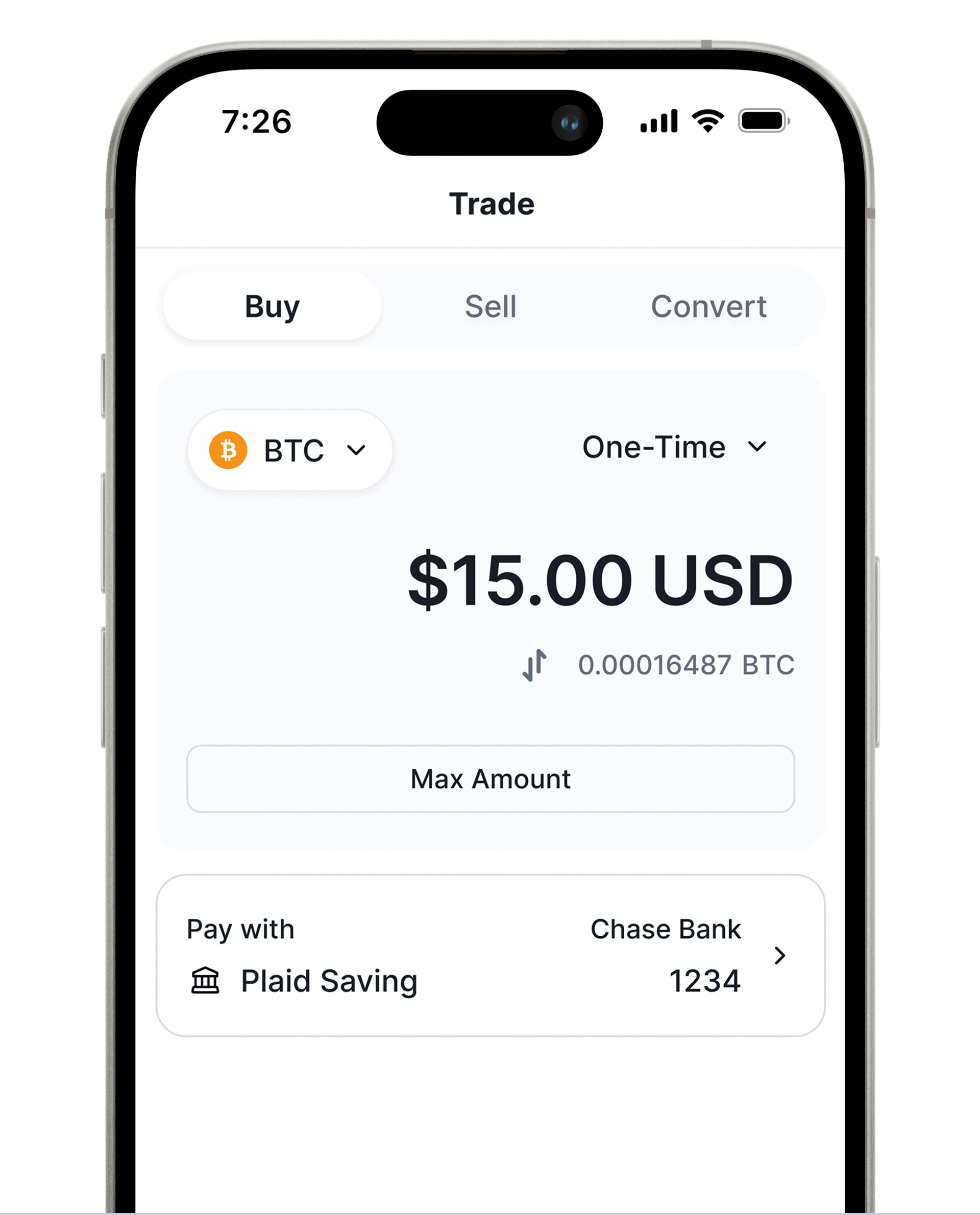

Buy crypto at today’s quoted price with a simple 1% fee — no hidden charges. With wire transfer, assets are available immediately. With ACH, purchases clear in 3–5 business days

How Instant Buy works

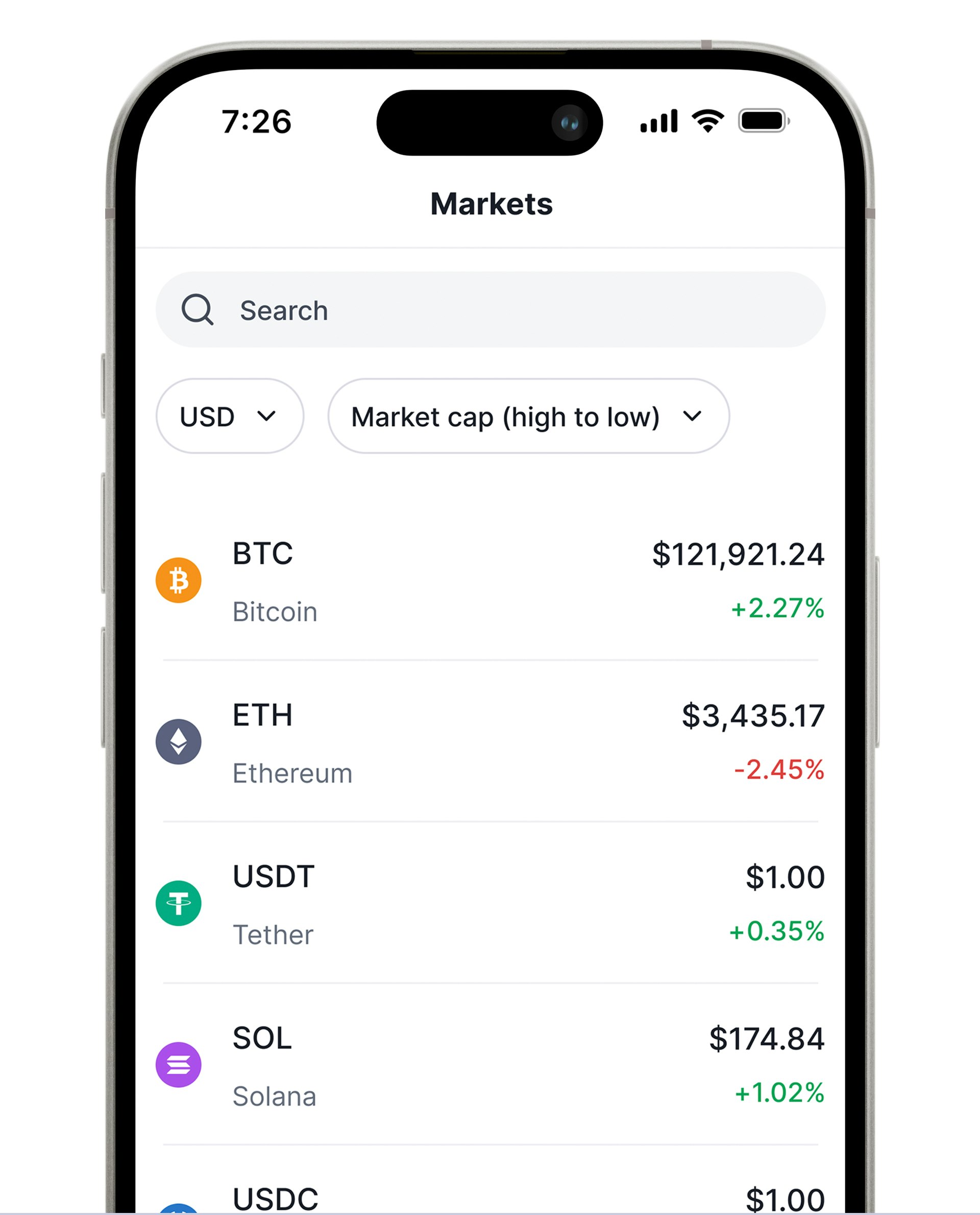

Pick your crypto

Choose from Bitcoin, Ethereum, and 60+ cryptocurrencies.Connect your bank

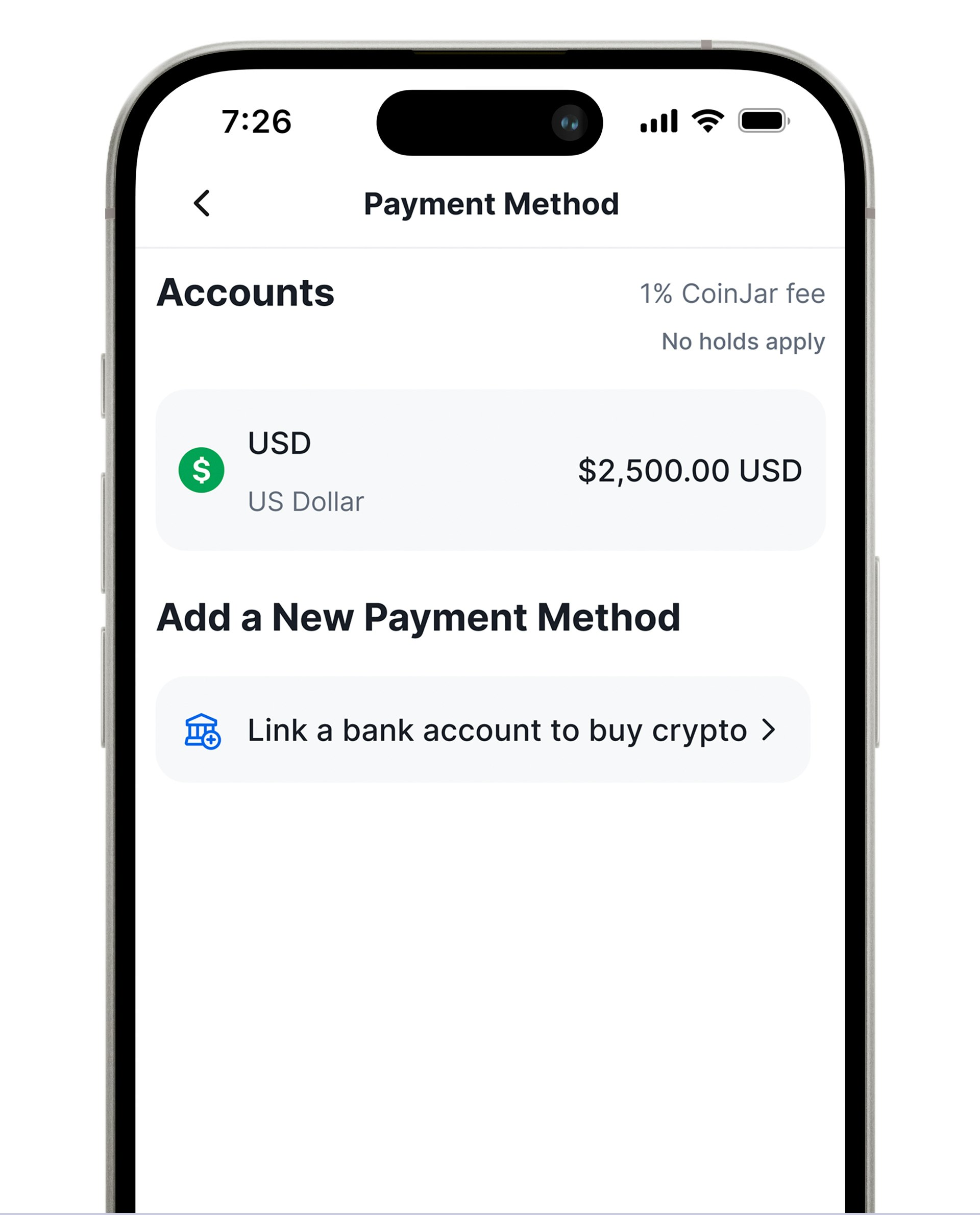

Link your bank account securely through PlaidMake a purchase

Buy crypto with your bank account via ACH or wire transfer.

All purchases made with ACH will be subject to a 7-day reserved balance. For more information, see our dedicated Knowledge Base article.

Frequently asked questions

How do I link my bank account to CoinJar for cryptocurrency purchases?

CoinJar lets you buy crypto either instantly via ACH or using your CoinJar USD balance. To fund your balance, you’ll need to deposit USD and link your bank account. Learn how here

Is CoinJar a financial institution?

No, CoinJar is a cryptocurrency exchange, not a financial institution. It facilitates buying and selling crypto but doesn't offer traditional banking services.

Your information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.