Buy Chainlink

Chainlink

LINK

Overview

What is Chainlink?

What is Chainlink (LINK)? Buy Chainlink on CoinJar: Chainlink is a that plays a crucial role in the world of decentralized finance (DeFi). In this article, we explain what Chainlink is, how to buy it, and what it is used for.

What is Chainlink?

is a decentralized oracle network that bridges the gap between smart contracts and real-world data.

But what on earth does that mean?

Decentralized oracle networks

Smart contracts on blockchains can’t access external data directly. Chainlink solves this problem by providing a decentralized network of oracles.

These oracles gather real-world data (such as stock prices, weather conditions, or sports scores) and feed it into smart contracts.

Imagine a smart contract that triggers a payment when a specific event occurs (e.g., a flight delay). To execute this, the contract needs accurate external data. Oracles act as trusted intermediaries, ensuring that smart contracts receive reliable information. This makes it a good solution for DeFi applications.

How does Chainlink solve the Oracle Problem?

The oracle problem arises because smart contracts cannot directly access external data. Chainlink addresses this by creating an incentive system for oracles. These oracles provide reliable data, gain a positive reputation, and are rewarded with LINK tokens. As they accumulate reputation, their accuracy and reliability increase.

Is Chainlink a good investment?

LINK has gained growing attention since its introduction in September 2017. Here are some factors to consider.

Real-world adoption

The technology is actively used by various projects, including DeFi platforms, gaming, and supply chain management.

White paper and vision

The outlines its purpose and technical details. It’s essential reading for potential investors.

Team

Co-founded by Sergey Nazarov and Steve Ellis, both are experienced in blockchain technology.

Market demand

As blockchain networks expand, the need for reliable oracles grows. Chainlink decentralises this critical service.

Amount of LINK

Keep an eye on the circulating supply of LINK tokens. Scarcity can impact its value.

Conclusion: Buy Chainlink

Chainlink’s decentralised oracle network addresses a fundamental problem in blockchain-based smart contracts. While no investment is risk-free, LINK’s strong fundamentals make it an interesting choice for those interested in DeFi and real-world data integration.

Cash, credit or crypto?

Buy Chainlink instantly using Visa or Mastercard. Get cash in your account fast with bank transfer, SEPA, Faster Payments, PayID or Osko. Convert crypto-to-crypto with a single click.How to buy Chainlink with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

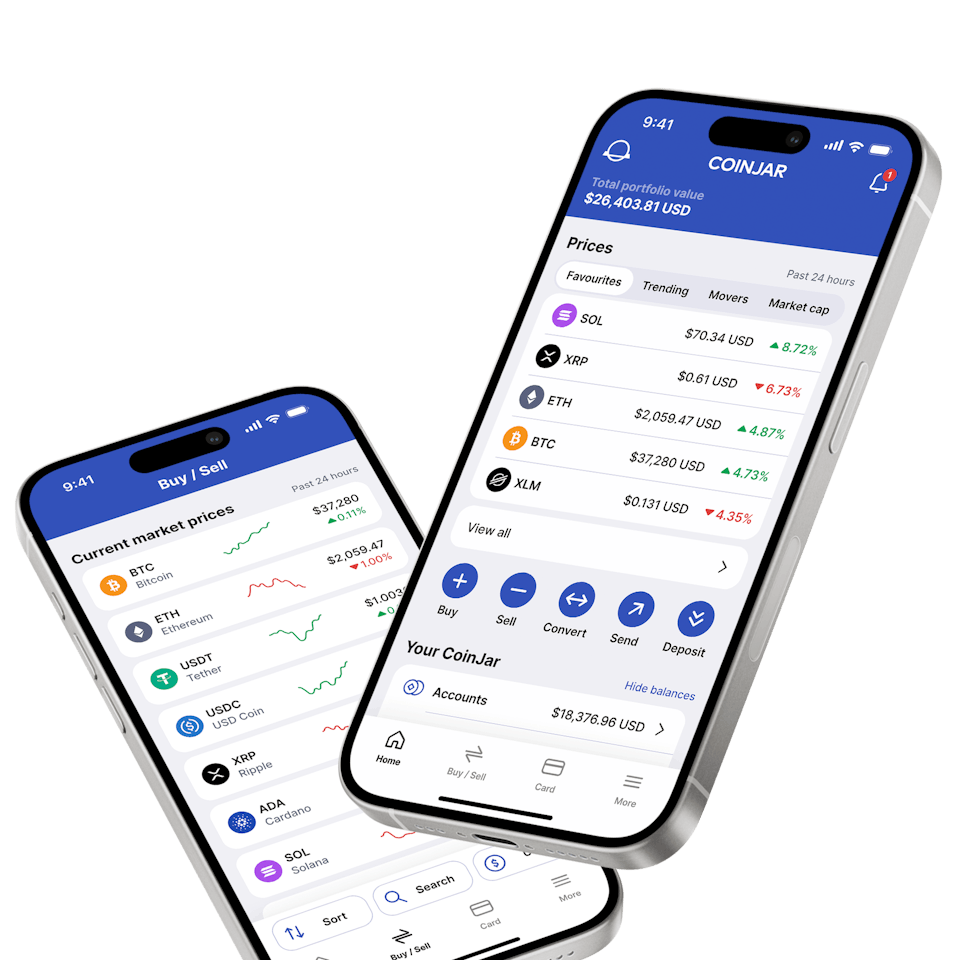

CoinJar App

All-in-one crypto wallet

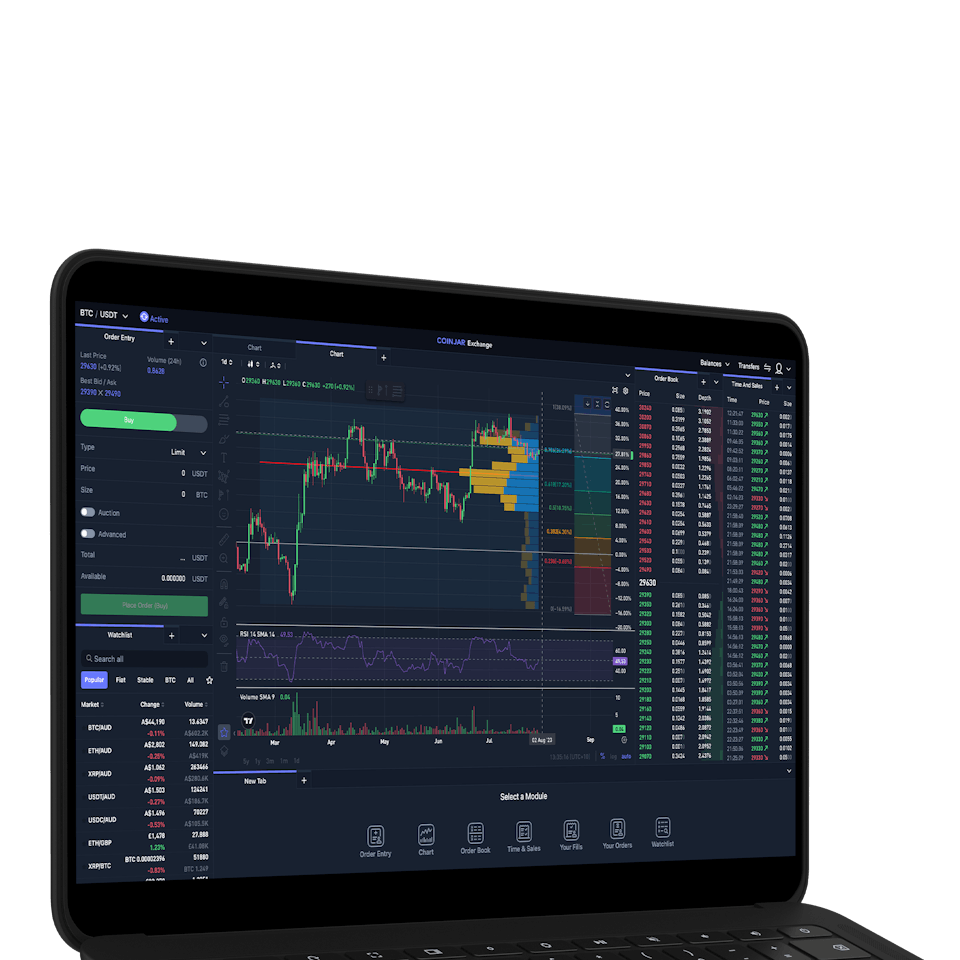

CoinJar Exchange

TRADE FOR AS LOW AS 0%Check out these other popular cryptos

Frequently asked questions

What is Chainlink?

Chainlink is a decentralized oracle network that plays a crucial role in connecting smart contracts on blockchains with external data sources, APIs, and systems. It ensures that smart contracts can securely access real-world data, such as prices, weather conditions, or other relevant information.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the and before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the and apply.