Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

Buy Synthetix (SNX) in the USA With USD | CoinJar

Synthetix

SNX

Overview

What is Synthetix?

Why do investors buy ? If you are interested in and decentralised finance (DeFi), Synthetix Network Token (SNX) is an interesting project worth looking into. But what exactly is SNX, and why should someone consider adding it to their portfolio?

What Is Synthetix Network Token (SNX)?

SNX is the native token of the Synthetix protocol, a decentralised platform that enables the creation and trading of synthetic assets. But what are synthetic assets?

Think of them as digital representations of real-world assets, such as stocks, commodities, or fiat currencies. These synthetic assets mirror the price movements of their underlying counterparts without requiring direct ownership.

How Does Synthetix Work?

Synthetix is, as the name suggests, a platform built on the Ethereum network for issuing synthetic versions of real world assets – what they call ‘synths’. This includes everything from other cryptocurrencies, to fiat currencies, commodities and real world stocks such as Netflix, Apple and Tesla.

One of the few major cryptocurrency platforms founded and based in Australia, Synthetix has developed a pooled collateral system that allows every possible synth pair to trade with the same, theoretically limitless liquidity.

Users lock up their SNX tokens and receive their chosen synth tokens in return – for example, sETH, sBTC, sOIL, sGBP. SNX is also used to pay for each trade, with the proceeds being distributed to those staking their coins as collateral. These users also receive general staking rewards.

Collateralisation

SNX holders can lock their tokens as collateral to mint synthetic assets. The more SNX they stake, the greater their borrowing power. This collateralisation mechanism ensures the stability and integrity of the system.

Synthetic Assets

Users can create synthetic assets (called Synths) by staking SNX. These Synths track the value of various assets, including cryptocurrencies (e.g., sUSD, sBTC), commodities (e.g., sGold), and even stock indices (e.g., sFTSE100).

Trading

Once minted, Synths can be traded on the Synthetix exchange. Traders can speculate on price movements without needing to hold the actual assets. For example, if you believe the price of gold will rise, you can buy sGold Synths.

Why Consider SNX?

Diversification

SNX allows investors to diversify their portfolios beyond traditional cryptocurrencies. By holding Synths pegged to different assets, users gain exposure to various markets without the complexities of direct ownership.

Yield Farming

Staking SNX in the Synthetix ecosystem earns rewards in the form of SNX inflationary rewards and Synth exchange fees. Yield farmers can maximise their returns by participating in liquidity pools.

Hedging

Synths provide an excellent hedging tool. If you’re worried about a market downturn, you can mint synthetic stablecoins (like sUSD) to protect your portfolio.

Conclusion: Synthetix Network Token (SNX)

In summary, Synthetix Network Token (SNX) unlocks a world of synthetic assets, offering diversification, privacy, and yield opportunities. As DeFi continues to grow, SNX remains a fascinating project worth exploring.

Bank transfer, debit card or crypto?

Buy Synthetix instantly with your bank account, Visa or Mastercard debit card. Get cash in your account with ACH. Convert crypto-to-crypto with a single click.How to buy Synthetix with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

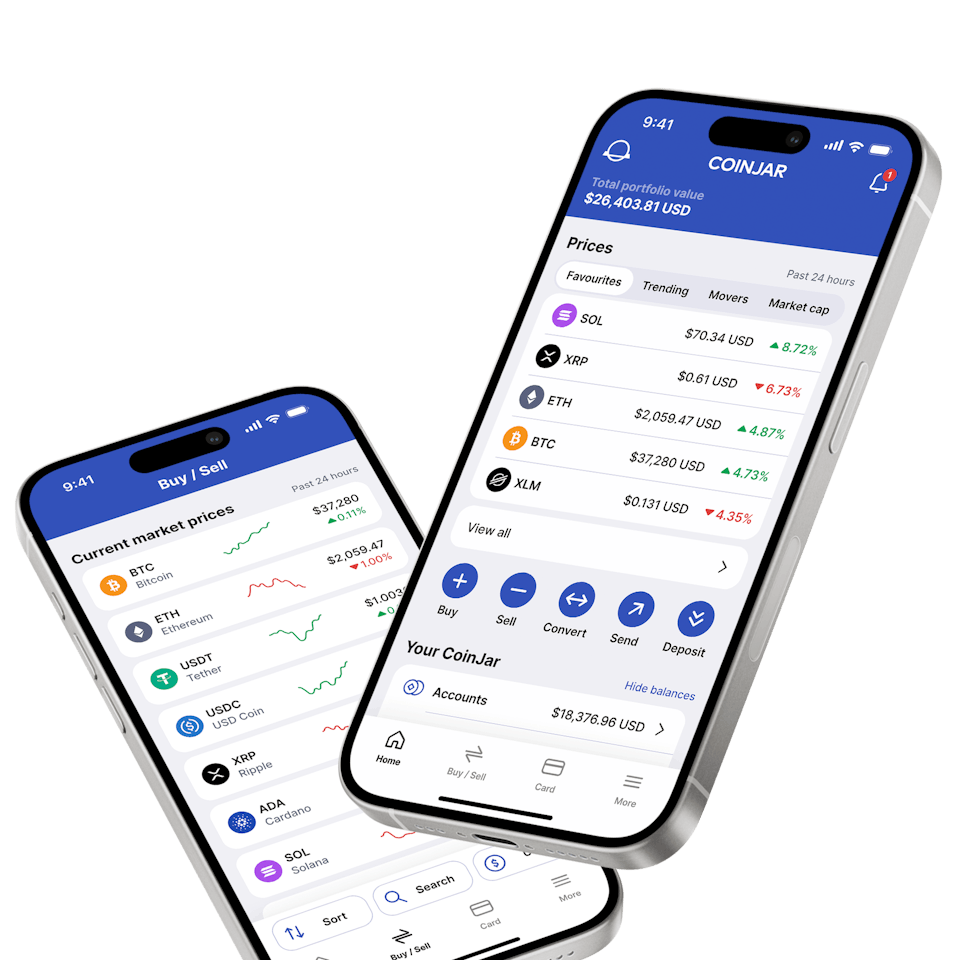

CoinJar App

All-in-one crypto wallet

Frequently asked questions

What is Synthetix Network Token (SNX)?

SNX is the native token of the Synthetix protocol. It serves as pooled collateral for minting synthetic assets (Synths) and participating in the ecosystem.

The Synthetix Network Token (SNX) is an Ethereum-based protocol that facilitates the development and exchange of synthetic assets. These synthetic assets, also known as “synths,” are digital financial instruments in the form of ERC-20 smart contracts.

They track and provide returns based on the value and performance of other assets without requiring you to hold those assets directly.

What is the Synthetix ecosystem?

The Synthetix ecosystem comprises various user-facing protocols and smart contracts. It enables the issuance of synthetic assets, allowing users to trade Synths.

How do Synths track the issuance of synthetic assets?

Synths are digital representations of real-world assets (like stocks, commodities, or fiat currencies). They track the issuance of synthetic assets on the Synthetix platform.

What are Spot and Futures Lyra?

Spot Lyra refers to the immediate trading of Synths at the current market price, while Futures Lyra involves trading Synths based on future price predictions.

Why should I buy Synthetix Network Tokens (SNX)?

SNX can be collateralised by SNX, ETH, and LUSD to mint Synths. It provides exposure to synthetic assets and offers deep liquidity and low fees.

What role does SNX play in the decentralised liquidity provisioning protocol?

SNX serves as a backend asset in the decentralised liquidity provisioning protocol, ensuring liquidity for Synths.

How does Synthetix enable the issuance of synthetic assets?

Synthetix Network Tokens (SNX) enable the creation of Synths, which represent real-world assets. These Synths can be traded on various platforms.

What is the role of Kwenta, 1inch, and Curve Atomic Swaps?

Kwenta, 1inch, and Curve facilitate trading and swapping of Synths. They use Lyra options polynomial automated mechanisms for efficient execution.

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.