Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

Buy SushiSwap (SUSHI) in the USA With USD | CoinJar

SushiSwap

SUSHI

Overview

What is SushiSwap?

Why investors buy SUSHI: SushiSwap, a exchange (DEX), has been making itself known in the crypto world. But what exactly is it, and why are investors interested in it? Let’s take a look at SushiSwap’s popularity and why its token, SUSHI, is an interesting investment choice.

One-Stop shop for passive income

offers a diverse range of passive income opportunities, setting it apart from other DEXs.

Here’s how it works.

Liquidity pools

SushiSwap allows investors to provide liquidity by participating in liquidity pools. These pools enable users to earn fees on the exchange for tokens listed on the platform. What’s unique is that SUSHI operates on 20 different blockchains.

Yield farming

Liquidity providers receive LP tokens, which they can use for yield farming. Yield farming involves staking LP tokens to earn additional SUSHI tokens. Unlike Uniswap, SushiSwap supports this functionality, making it a go-to platform for yield-seeking investors.

Utility token

SUSHI is not just a governance token; it’s a utility token. Investors benefit from its practical use within the ecosystem.

Gas-efficient borrowing

The BentoBox smart contract acts as a token vault. By depositing tokens into BentoBox, users earn more tokens over time. The key advantage? Gas-efficient interactions with decentralised applications (dApps).

Gas fees are transaction fees on the Ethereum blockchain. BentoBox minimises gas costs, making it an attractive feature for investors.

Flexibility

The decentralised exchange operates without intermediaries. Users trade directly with liquidity pools via non-custodial wallets. This design reduces the risk of hacks and provides flexibility in coin selection.

Conclusion

SushiSwap’s unique features and utility token, SUSHI, make it an appealing choice for investors. As the crypto industry continues to grow, SUSHI is expected to grow in importance.

Bank transfer, debit card or crypto?

Buy SushiSwap instantly with your bank account, Visa or Mastercard debit card. Get cash in your account with ACH. Convert crypto-to-crypto with a single click.How to buy SushiSwap with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

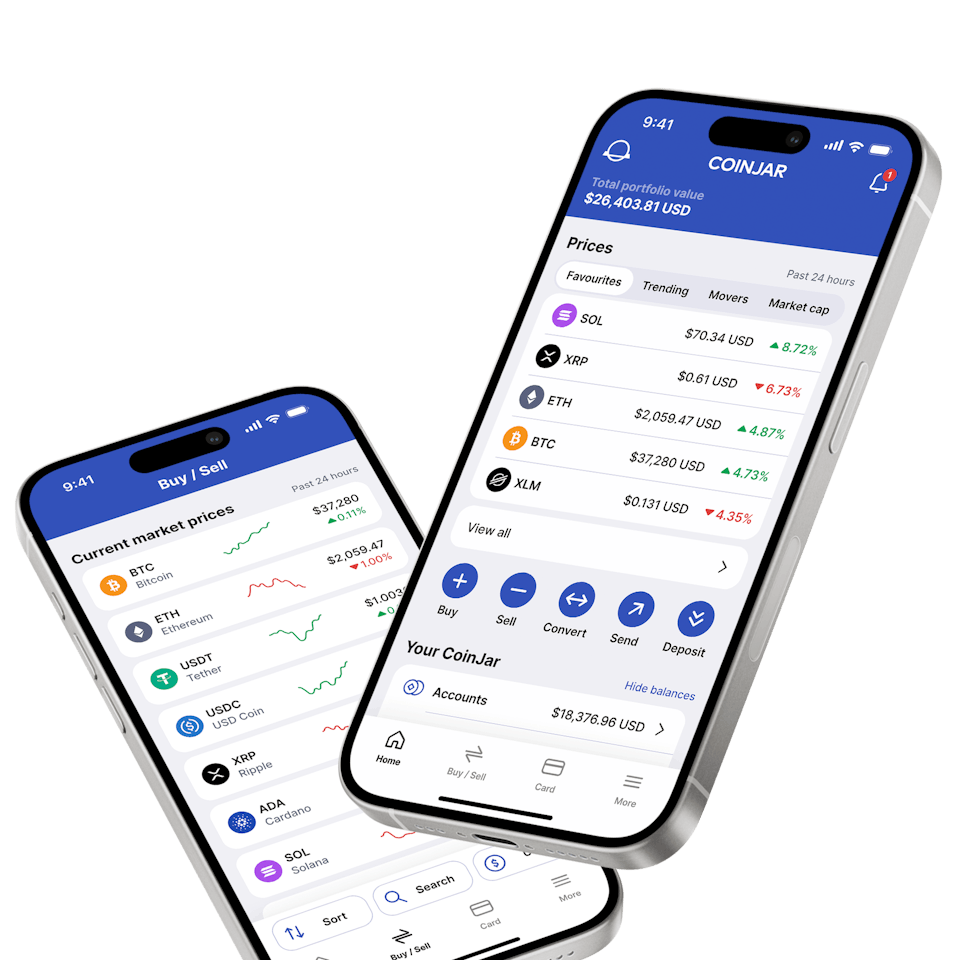

CoinJar App

All-in-one crypto wallet

Frequently asked questions

What is SushiSwap?

SushiSwap is a decentralized exchange (DEX) that allows users to trade crypto assets without intermediaries. It was created in 2020 as a fork of Uniswap, another popular DEX.

How does SushiSwap differ from traditional exchanges?

Unlike centralized exchanges, SushiSwap operates on smart contracts. Users trade directly with liquidity pools, eliminating the need for a central authority.

What are liquidity pools?

Liquidity pools are pools of tokens provided by users to create liquidity for trading pairs. By adding tokens to these pools, users can earn trading fees and SUSHI rewards.

What is SUSHI?

SUSHI is the governance token of SushiSwap. Holders can participate in decision-making and propose changes to the protocol.

How do I create liquidity on SushiSwap?

To create liquidity, deposit an equal value of two tokens into a liquidity pool. In return, you then can receive LP tokens. This represents your share of the pool.

What are automated market makers (AMMs)?

AMMs like SushiSwap use algorithms to determine token prices based on supply and demand.

They facilitate decentralized trading without order books.

Who is Chef Nomi?

Chef Nomi is the pseudonymous creator of the exchange and crypto. Initially controversial due to withdrawing developer funds, Chef Nomi later returned them to the project.

What additional features does SushiSwap offer?

What additional features does SushiSwap offer?

BentoBox: A smart contract vault for efficient token interactions.

Gas-efficient borrowing: Minimizes transaction fees.

Yield farming: Stake LP tokens to earn more SUSHI.

Is SushiSwap a safe investment?

As with any crypto asset, risks exist. Do thorough research and consider professional advice.

Who created SUSHI?

The SushiSwap decentralized exchange (DEX) was founded by pseudonymous developers Chef Nomi and SushiSwap 0xMaki. SUSHI can be used in both decentralized finance (DeFi) and other centralized crypto exchanges.

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.