Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

Buy Balancer (BAL) in the USA With USD | CoinJar

Balancer

BAL

Overview

What is Balancer?

Buy Balancer (BAL): Balancer is a decentralized finance (DeFi) protocol running on the . Its primary goal is to incentivise a distributed network of computers to operate a decentralized exchange where users can buy and sell any cryptocurrency. Think of as a unique type of index fund within the crypto world.

How Does Balancer Work?

Balancer pools

Balancer pools are at the heart of the Balancer protocol. These pools are created by users who bundle together various cryptocurrencies from their portfolios.

Each Balancer pool can contain up to eight different tokens. The value of a pool is determined by the percentages of each token within it.

For example, a Balancer pool might start with 25% Ethereum (ETH), 25% DAI, and 50% Aave (LEND).

Self-balancing mechanism

Balancer uses smart contracts to ensure that each pool maintains the correct proportion of assets, even as individual token prices fluctuate.

If the price of a specific token increases significantly (e.g., LEND doubles in value), the pool automatically reduces its holding of that token to maintain the original weight distribution.

Liquidity providers (those who deposit assets into the pool) continue to earn fees during this rebalancing process.

Incentives for liquidity providers

There’s good news for users that provide liquidity to a Balancer pool. They earn part of the trading fees that are paid by traders who use their funds.

These liquidity providers are rewarded with a custom cryptocurrency called BAL.

By depositing assets into Balancer pools, they contribute essential liquidity to the network, enabling smooth trading for other users.

Why do investors buy BAL?

Liquidity mining

Investors buy BAL tokens to participate in liquidity mining. By staking their assets in Balancer pools, they earn BAL tokens as rewards.

Liquidity mining incentivises users to provide liquidity, which is crucial for the efficient functioning of decentralised exchanges.

Governance rights

BAL holders have governance rights within the Balancer ecosystem.

They can vote on proposals related to protocol upgrades, fee structures, and other important decisions.

This democratic governance model allows the community to shape the future of Balancer.

Speculation

Like any other cryptocurrency, some investors buy BAL tokens speculatively, hoping that their value will appreciate over time.

As Balancer gains popularity and adoption, demand for BAL may increase.

Conclusion: Buy Balancer (BAL)

Balancer’s innovative approach to liquidity provision and self-balancing pools sets it apart from other decentralised exchanges like Uniswap and Curve. As the DeFi space continues to evolve, Balancer remains an essential player, attracting both liquidity providers and investors seeking exposure to this dynamic ecosystem.

Bank transfer, debit card or crypto?

Buy Balancer instantly with your bank account, Visa or Mastercard debit card. Get cash in your account with ACH. Convert crypto-to-crypto with a single click.How to buy Balancer with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

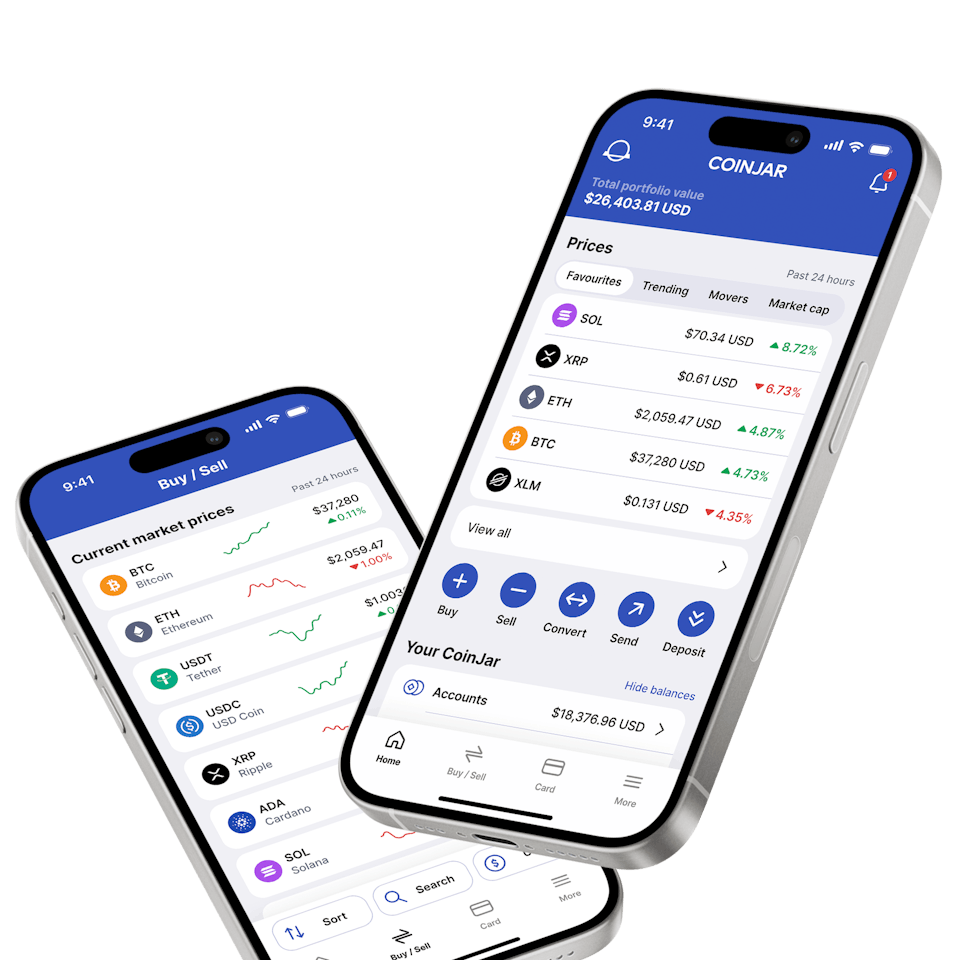

CoinJar App

All-in-one crypto wallet

Frequently asked questions

What is Balancer?

Balancer is an Ethereum-based Automated Market Maker (AMM) protocol that serves as both a decentralised exchange (DEx) and a self-balancing portfolio management tool.

It allows traders to provide liquidity for their ERC-20 tokens and offers a unique approach to managing portfolios within the crypto space.

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.