Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

Buy Badger DAO (BADGER) in the USA With USD | CoinJar

Badger DAO

BADGER

Overview

What is Badger DAO?

Buy BADGER: Badger DAO is a decentralised autonomous organisation (DAO) that aims to bridge the gap between Bitcoin and decentralised finance (DeFi). BADGER is the native governance token of Badger DAO.

This digital badger metaphorically digs tunnels to connect the world of with the ecosystem of and other smart contract platforms.

Why people buy BADGER DAO tokens and trade BADGER DAO tokens

Bitcoin collateralisation

allows users to use their Bitcoin (BTC) as collateral in DeFi applications. Imagine you have some BTC sitting in your wallet, and you want to put it to work. Badger lets you do just that by minting synthetic Bitcoin tokens (eBTC) that represent your BTC holdings. These eBTC tokens can then be used across various DeFi protocols.

Yield farming and staking

Badger incentivises users to participate in its ecosystem by offering rewards. You can stake your BADGER tokens or provide liquidity to the Badger Sett vaults (where eBTC is used as collateral).

In return, you earn more BADGER tokens or other tokens.

Governance

BADGER holders have a say in the governance of the protocol. They can vote on proposals, upgrades, and changes to the system. It’s like being part of a digital democracy where your BADGER tokens are your voting power.

How the BADGER DAO Works

Minting eBTC and Beyond

Badger DAO offers various ways to put your Bitcoin to work in the world of decentralised finance (DeFi). One option is to leverage their eBTC protocol: Minting eBTC: Deposit your BTC into Badger's eBTC vault. In return, you'll receive eBTC tokens, a representation of your BTC that can be used across DeFi.

Staking for Rewards: Stake your eBTC in Badger's Sett vaults to earn additional BADGER tokens—the platform's governance token.

Yield Farming: Provide liquidity to Badger Sett pools with your eBTC, earning even more tokens as a reward for helping to facilitate trading activity.

Badger: A Full Suite of Bitcoin-Powered DeFi

eBTC is just one of the many ways Badger allows you to maximise the potential of your Bitcoin holdings. They have a range of vaults and strategies.

Governance participation

As a BADGER holder, you can participate in governance proposals. Whether it’s deciding on new features, adjusting parameters, or allocating funds, your voice matters.

Why Badger DAO?

Financial literacy

Badger DAO introduces people to the world of decentralised finance. It’s like a crash course in how crypto works beyond just buying and holding.

Hands-on experience

Users can learn by doing. They can stake tokens, and actively participate in governance. It’s a practical way to understand blockchain technology.

Future opportunities

DeFi is growing. Understanding projects like Badger DAO opens doors to potential careers in blockchain development, finance, or governance.

Conclusion: Badger DAO

Badger DAO is like a digital bridge connecting Bitcoin’s value to DeFi. It’s a playground for financial innovation.

It is important to note that BADGER tokens are a means by which users may utilise and govern Badger DAO protocols. Badger DAO does not recommend purchasing BADGER tokens for speculative investment purposes. BADGER tokens may lose value and may have no market.

Bank transfer, debit card or crypto?

Buy Badger DAO instantly with your bank account, Visa or Mastercard debit card. Get cash in your account with ACH. Convert crypto-to-crypto with a single click.How to buy Badger DAO with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these simple steps.Featured In

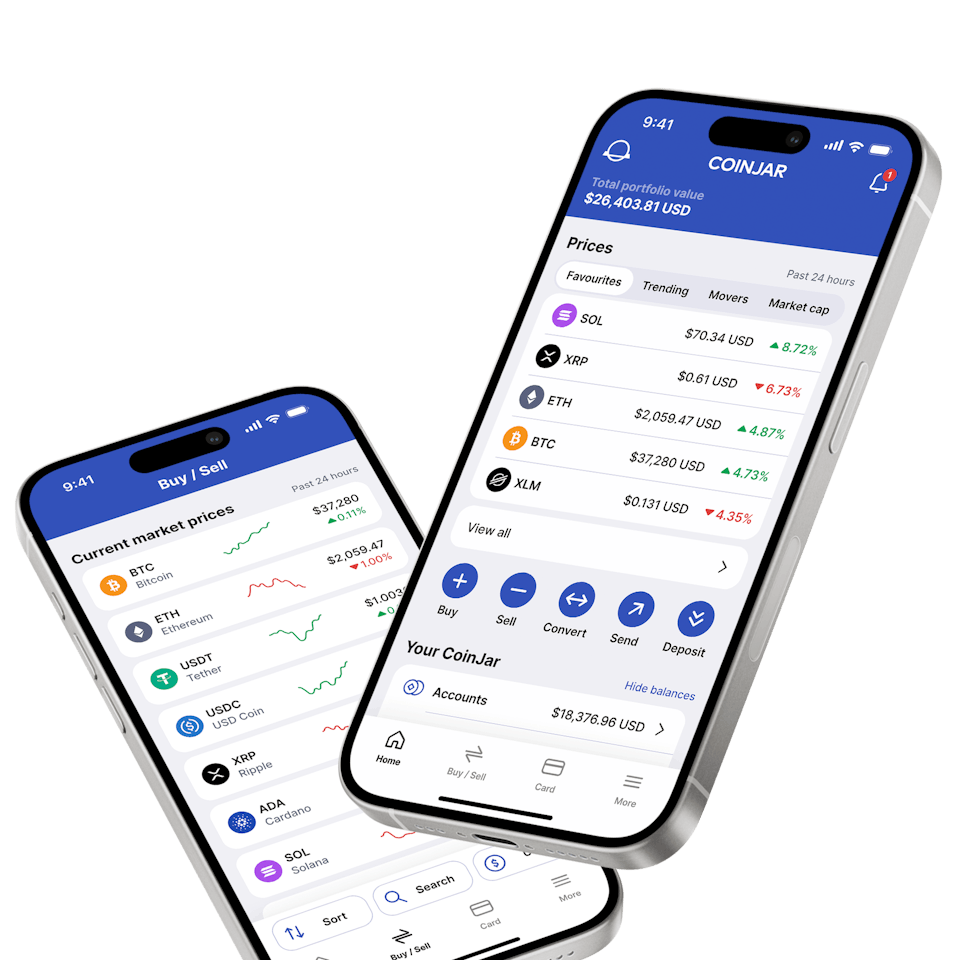

CoinJar App

All-in-one crypto wallet

Frequently asked questions

What are Badger tokens?

Badger tokens are the native cryptocurrency of the Badger DAO ecosystem, used to govern the decentralised autonomous organisation and participate in various DeFi applications within the ecosystem.

How does Badger DAO work?

Badger DAO is a decentralised autonomous organisation focused on building products and infrastructure to bring Bitcoin to decentralised finance (DeFi). It aims to create a suite of products that implement Bitcoin as collateral across different DeFi platforms.

Who is Chris Spadafora?

Chris Spadafora is the founder of Badger DAO. He is a prominent figure in the cryptocurrency community, driving the vision and development of the Badger DAO ecosystem.

What is the circulating supply of Badger tokens?

The circulating supply of Badger tokens refers to the total number of tokens that are currently available and in circulation on the market. This supply can fluctuate based on token emissions and burns.

How does Badger DAO implement Bitcoin as collateral?

Badger DAO uses smart contracts to allow users to deposit Bitcoin, which is then used as collateral in various DeFi applications. This process helps in bridging Bitcoin with the Ethereum-based DeFi ecosystem.

What is a DeFi aggregator?

A DeFi aggregator is a platform that consolidates various decentralised finance (DeFi) services and applications into one interface, allowing users to access multiple DeFi protocols without needing to interact with each one individually. Badger DAO functions as a DeFi aggregator specifically for Bitcoin.

What are flash loan mitigation measures?

Flash loan mitigation measures are protocols put in place to prevent the abuse of flash loans, which can be used to manipulate markets or exploit smart contracts. Badger DAO implements various protection measures to protect against these types of attacks.

How can investors buy Badger tokens?

You can buy Badger tokens on various cryptocurrency exchanges that list BADGER. Ensure you have a digital wallet to store your tokens in a protective manner, after purchase.

What is the role of the Badger operations team?

The Badger operations team is responsible for maintaining and developing the ecosystem, ensuring that the infrastructure is protected, functional, and continuously improving.

How does the Badger DAO ecosystem benefit token holders?

Token holders benefit from governance rights, allowing them to vote on proposals that shape the future of the ecosystem. They can also earn rewards through staking and participating in the DAO's DeFi applications.

What does it mean for Badger DAO to be a decentralised autonomous organisation?

As a decentralised autonomous organisation, Badger DAO is governed by its community of token holders rather than a central authority. Decisions are made through a consensus mechanism where token holders propose and vote on changes.

How does Badger DAO ensure real-time operations?

Badger DAO leverages smart contracts and blockchain technology to ensure real-time operations and transparency. Transactions and governance votes are executed instantly, ensuring an efficient and responsive ecosystem.

What digital assets are supported by Badger DAO?

Badger DAO primarily focuses on integrating Bitcoin into DeFi but also supports other digital assets through various smart contract interactions and partnerships with other DeFi protocols.

How are Badger tokens pegged to the price?

Badger tokens themselves are not pegged to the price of any asset. However, certain synthetic assets or wrapped tokens within the Badger DAO ecosystem may be pegged to the price of Bitcoin or other cryptocurrencies.

To check the price of BADGER 24 hours a day, check the top of this page.

How frequently is the supply of Badger tokens updated?

The supply of Badger tokens is updated in real-time and can be checked on various blockchain explorers. Changes in supply can occur due to token emissions, burns, or other protocol updates.

What are the primary DeFi applications in the Badger DAO ecosystem?

The primary DeFi applications in the Badger DAO ecosystem include lending, borrowing, yield farming, and liquidity provisioning using Bitcoin as collateral.

How long does it take for transactions to be processed in Badger DAO?

Transactions in the Badger DAO ecosystem are processed in real-time, typically within seconds to a few minutes, depending on the network congestion and the specific DeFi application being used.

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.