Crypto SMSF | Cryptocurrency Self Managed Super Fund

Super, meet crypto.

Why choose CoinJar for your SMSF?

Local customer support

Our experienced and friendly SMSF support team is here to help, 9am-2am Mon-Fri and 9-5:30pm Sat-Sun (AEST).

Secure and reliable

Australia’s longest-running crypto exchange with industry-leading account security. Registered with AUSTRAC.

Low fees

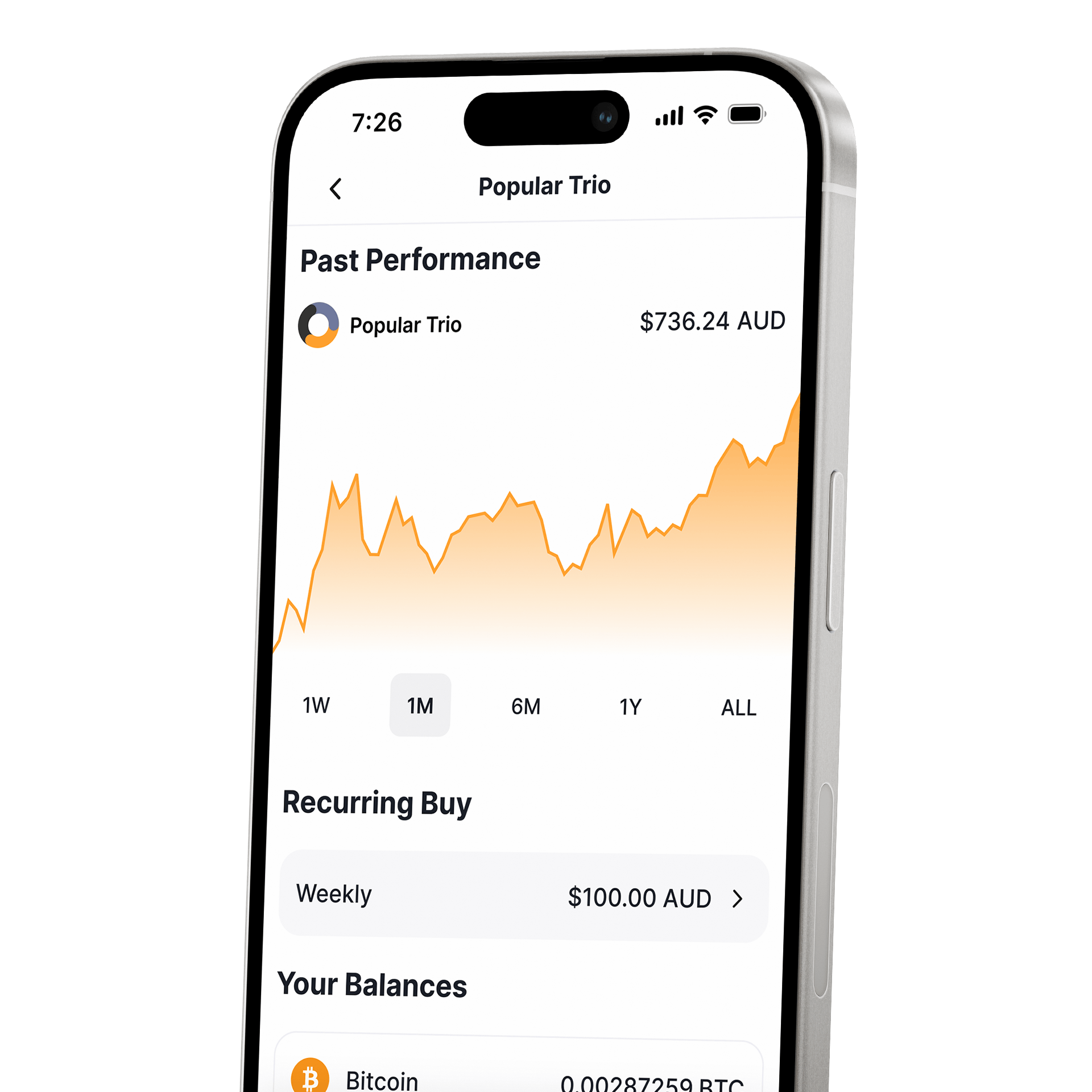

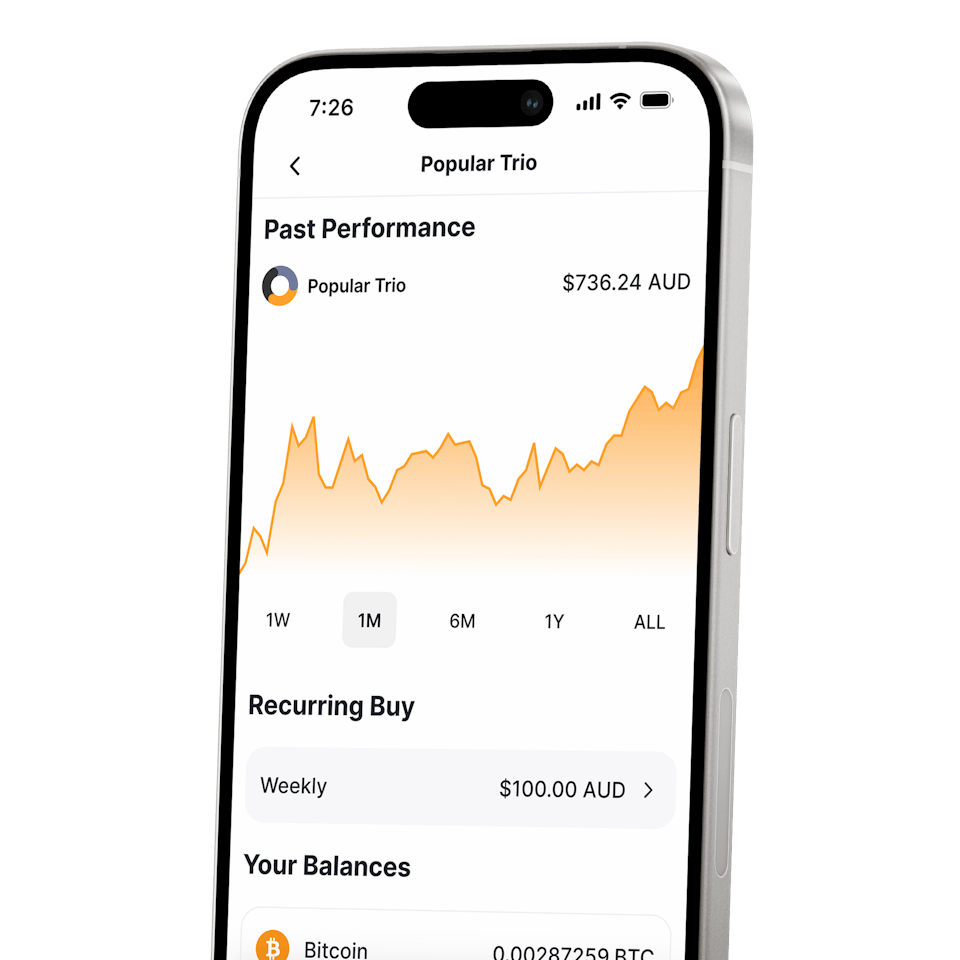

0% - 0.1% fees on CoinJar Exchange. Fees as low as 1% on CoinJar mobile and web apps.

Simple EOFY reporting

Single-click tax documents in PDF and CSV plus automatic integration with leading crypto tax apps.

100% Australian

We’re proud to be a fully Australian exchange, not a brokerage for unregulated international players.

Over-the-counter service

Personalised OTC accounts available for high volume trades.

Automate your SMSF taxes with BGL through Crypto Tax Calculator or Syla

Simplify your taxes

How do I add cryptocurrency to my SMSF?

Risks and Responsibilities

Adding cryptocurrency to an SMSF can significantly increase the risk profile of your fund. Given the volatility of the cryptocurrency markets, there is the possibility of low or negative returns on your investment and you will not have access to the Australian Financial Complaints Authority in relation to your investment in cryptocurrency.

SMSF members are wholly responsible for ensuring that their fund is compliant with the regulations contained in the Superannuation Industry (Supervision) Act and must maintain compliance even if the law changes. Members must also ensure that any cryptocurrency investments comply with the fund’s trust deed and investment strategy.

We strongly recommend you seek professional advice before deciding to add cryptocurrency to your fund’s portfolio.

Blockchain Australia's 2023 Blockies Awards Winner

DIGITAL CURRENCY EXCHANGE OF THE YEARBlockchain Australia's 2023 Blockies Awards Winner

DIGITAL CURRENCY EXCHANGE OF THE YEAR

Set up your Crypto SMSF with CoinJar today

Send us a message and our Team will be in touch.

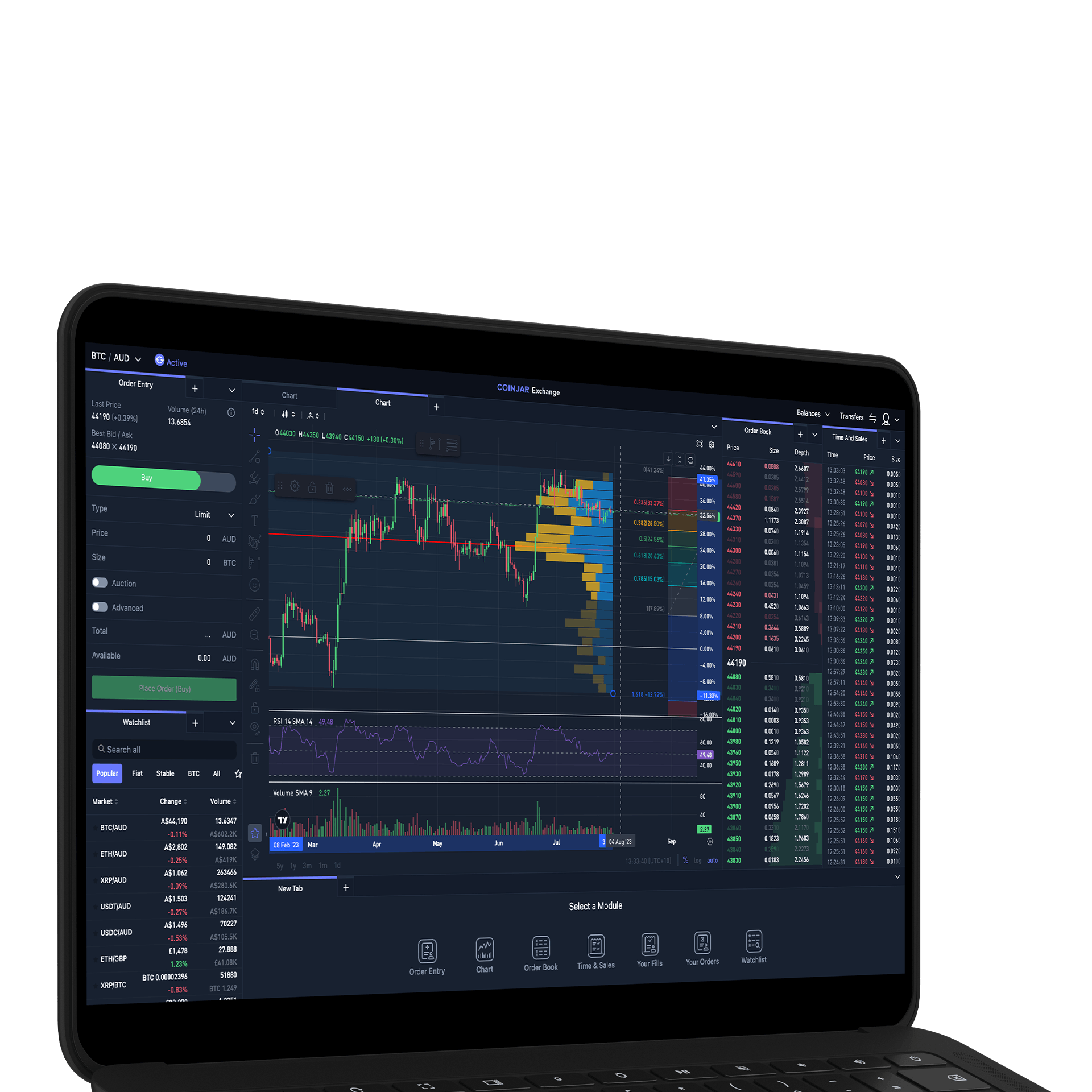

CoinJar Exchange

Trade with the best

CoinJar Exchange

Trade with the bestSecure, private & encrypted

Fraud protection

We employ multi-level data encryption, security audits and best practice organisation security to protect customer accounts. Our Support team uses advanced machine learning to recognise suspicious logins, account takeovers and financial fraud.

Asset security

Our assets are secured by BitGo and Fireblocks, two of the most respected custody providers in the cryptocurrency space. We maintain full currency reserves at all times, with sufficient assets to cover more than 100% of our customer balances.

Trusted exchange

CoinJar is Australia's longest-running exchange, operating with no downtime since 2013. We’re backed by some of the world’s top investors and are fully registered and compliant with AUSTRAC and the Financial Conduct Authority UK (for AML purposes).Featured In

Frequently Asked Questions

Are there risks with a crypto SMSF account?

Digital currencies are highly volatile. Your investment could change significantly. SMSF trustees should seek financial advice before investing in crypto assets.

Can I transfer existing crypto into my CoinJar Crypto SMSF?

Yes, you can transfer existing crypto assets into your CoinJar Crypto SMSF account, but consult a tax professional to understand potential tax implications.

How do I set up a CoinJar Crypto SMSF Account?

Setting up a CoinJar Crypto SMSF Account involves establishing an SMSF and meeting regulations. CoinJar provides a platform and tools for managing crypto assets within the SMSF. Seek help from legal or financial advisors for SMSF setup.

Please explain the sole-purpose test?

SMSFs must be for retirement benefits only, according to the ATO. They likely won't meet requirements if members get financial benefits before retirement.

How do I custody my digital assets?

CoinJar provides a free, secure wallet for convenient crypto trading and easy auditing. Alternatively, you can self-custody crypto assets in a hardware wallet, but consult advisors for potential trust deed adjustments.

How does the ATO view crypto?

The ATO considers crypto as capital gains tax assets for SMSFs. You must keep records of crypto transactions for tax purposes.

How do I set up a fund's trust deed for SMSF crypto?

Your advisors can help set up everything for SMSF crypto investments, including the trust deed.

Do SMSFs pay tax on cryptocurrency?

Yes, they are subject to capital gains tax and income tax.

What is an investment strategy?

SMSFs in Australia must have an investment strategy, listing crypto as an allowable asset if planned. The strategy should detail investment plans and be tailored to individual circumstances.

Can you invest your superannuation into crypto?

Yes, you can add crypto to your SMSF with CoinJar, but consult professional advisors to ensure compliance with your trust deed and investment strategy. Also, check with the ATO here.

What are the benefits of setting up a crypto SMSF account with CoinJar?

We offer smooth onboarding, low trading fees, easy EOFY reporting, institutional-grade security, and local 7-day customer support.

Which cryptocurrencies can be bought with an SMSF?

You can buy any of the 70 cryptocurrencies we offer, including Bitcoin, Ethereum, XRP, DOGE, USDT, and PAXG.

Is it safe to set up a self managed super fund with CoinJar?

CoinJar prioritises asset safety with no security breaches or loss of funds since 2013. We keep most assets in cold storage and maintain full currency reserves.

What costs are associated with cryptocurrency SMSFs?

SMSF setup costs $1,500-$2,500+ and annual fees range from $1,200-$2,500+. See here for more details.

What documents are needed to open a CoinJar SMSF account?

You need to submit SMSF details, trust deed copy, and verify all trustees on CoinJar.

How long does it take to set up a CoinJar SMSF account?

Once we have all your documentation, one business day to a week.

Can I use my personal CoinJar account to set up an SMSF?

No, you need to create a specific SMSF account during sign-up. You can attach the same phone number to a personal and SMSF account, however.

Can I use CoinJar's Australian-based platform to manage cryptocurrency (a CGT asset) for my SMSF?

Yes, CoinJar offers an SMSF account with a secure wallet specifically for managing crypto assets.

Your information is handled in accordance with CoinJar’s Collection Statement.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.