Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

What is Ethereum? What is ETH Used For?

Ethereum is a decentralised blockchain-based open-source software platform that allows for the development of decentralised applications (dApps).

In this article...

- Discover the factors driving investor interest in Ethereum.

- Explore the potential of Ether and its role in the crypto market.

- Should you buy Ether? Learn the pros and cons

Ethereum's decentralised status is enabled by smart contract technology. Since it is an open-source software, source code is available to the public. In other words, it is open to inspection, modification, and distribution by anyone.

What is Ethereum? A Brief History

The creator of Ethereum, , first outlined the cryptocurrency in a white paper published in late 2013. Buterin envisioned a platform with a more robust scripting language that would go beyond Bitcoin's financial use cases.

The vision was to build a decentralised Turing-complete computing platform for smart contracts, programmable money, and decentralised applications.

Buterin and the other Ethereum cofounders started a crowdsourcing initiative to fund their project in 2014. The campaign raised over $16 million from the sale of ETH tokens to participants. On July 30, 2015, Ethereum made its official launch, effectively creating its "genesis block."

Ethereum has undergone planned upgrades over the years to improve the project's functionality. In 2016, the network was hacked and $50 million of the $150 million raised by The DAO, a decentralised organisation (DAO), was stolen.

This raised concerns about Ethereum's security, resulting in a hard fork that split the blockchain into two blockchains: Ethereum (ETH) and Ethereum Classic (ETC).

What are smart contracts?

A smart contract is a self-executing program that automates predetermined actions specified in an agreement between parties.

Smart contracts typically carry out the terms and conditions agreed upon between the parties in an "if, then" fashion. Once executed, smart contracts are irreversible.

Smart contracts eliminate the need for a centralised party to facilitate a transaction, powering decentralisation in Ethereum and other blockchain networks.

Asset transfers are done in a transparent and trustless manner. Transaction parties are not required to trust one another; if either party fails to honour the agreement, the Smart contract will not execute.

Smart contracts are a vital part of decentralised applications. They are responsible for the decentralised aspect of decentralised apps.

ERC-20 is the technical standard that governs the implementation of fungible tokens in smart contracts on Ethereum. It enables developers to create “smart-contract-enabled tokens” that can be used with other Ethereum products and services.

Fungible tokens are anything that is not unique and can be transferred such as an asset, ownership, or cryptocurrency.

How are smart contracts different to traditional contracts

Traditional contracts are collections of legally binding clauses written in a natural, human-readable language. Most traditional contracts include a written agreement signed by the two transacting parties and witnessed by an impartial third party to attest to their authenticity.

The most significant difference between smart contracts and traditional contracts is the involvement of a third party. Other distinctions manifest in:

Contract Creation

Traditional contracts entail a lengthy and time-consuming process that usually involves printing, signing, and scanning.

When parties must meet in person, the process becomes even more time-consuming. The entire process can take several days.

Using a ready-made contract platform like Ethereum, smart contracts can condense this process to a few minutes.

Contract Execution

To fulfill a traditional contract, the paying party must manually pay the promised quantities on time, and the receiving party must manually confirm payments.

This process necessitates more organisational efforts on the part of both parties. Remittance is automated and happens automatically in smart contracts when the agreed-upon and coded criteria are met.

Cost

Due to additional fees charged by third parties, traditional contracts are more expensive. When potential contract difficulties, such as arbitration, are involved, they also come with "hidden expenditures."

Smart contracts eliminate all of these costs, making them significantly less expensive.

Errors

Traditional contractual processes have a high potential for manipulation or error. This usually leads to lengthy periods of court battles.

Smart contracts, on the other hand, are fully automated, and any manipulations are easily detectable. In addition, erroneous code will not run properly.

DApps: What Are They and How Do They Work?

Decentralised applications (dApps) are open-source digital software programs that run on a blockchain or peer-to-peer (P2P) computer network rather than a single computer. DApps are thus independent of a centralised authority.

DApps are possible because their backend code (smart contracts) runs on a decentralised network (in this case, Ethereum) rather than a centralised server.

Ethereum-based dApps rely on the network for storage and security. The frontend and user interface code of a dApp can be written in any coding language, just like conventional apps.

Once they have been deployed, dApps are extremely difficult to modify.

Most developers prefer to build their dApps on Ethereum because it has a large and active developer community that ensures updates are released on time. Furthermore, the network has cutting-edge developer tools such as EVM and a variety of app templates, which speeds up coding.

Examples of dApps built on Ethereum include Uniswap, MakerDAO, 1Inch, and Rarible.

How is Ethereum different to Bitcoin?

Ether (ETH) is the second largest cryptocurrency by market cap after Bitcoin (BTC). Ether and Bitcoin have many similarities, such as being native tokens to their respective ecosystems, but they also have many differences. Here are some key distinctions between the two cryptocurrency coins.

Ethereum is referred to as "the world's programmable blockchain," and it supports smart contract technology, which powers various applications such as DeFi and NFTs.

Bitcoin was developed to support the bitcoin (BTC) cryptocurrency, which is a digital alternative to traditional currencies. As a result, it serves primarily as a store of value and a medium of exchange. However, it is worth noting that Bitcoin has recently begun to integrate smart contract technology.

Ethereum and Bitcoin also differ greatly in the number of coins in supply. The maximum supply of bitcoin is 21 million, with 19.3 million already in circulation. All BTC coins will be in circulation by 2140 when they have all been mined.

Ether has an infinite supply. Ether relies on various mechanisms, such as staking, to remain deflationary. There are currently over 122 million ether coins in circulation.

Since September 2022, Ethereum has used a proof-of-stake (PoS) consensus mechanism, whereas Bitcoin uses a more energy-intensive proof-of-work (PoW) consensus mechanism.

Staking

Since the merge, the Ethereum network now uses staking rather than mining to verify transactions. A user must stake at least 32ETH to become an Ethereum validator. The more ETH they have staked, the more likely they are to be chosen by the network algorithm to add the next block to the blockchain.

With the current price of ETH hovering around $1800, 32 ETH equates to $57,600, which may be out of reach for the average investor.

Individual investors can pool their resources in what is known as a staking pool to form one powerful validator, and then share the rewards. The underlying Ethereum protocol generates new ether tokens to reward validators in a process known as minting.

Scaling Ethereum: Layer-1 vs Layer-2 vs Layer-3 Networks

To comprehend layer-2 networks, we must first define layer-1 networks and scalability. Layer 1 refers to the fundamental base network and underlying infrastructure of a blockchain, such as Bitcoin and Ethereum.

Scalability is the ability of a network to handle increasing processing demands.

Scalability has been one of Ethereum's major issues since its inception. When the network experiences increased usage, it experiences network congestion, which causes transaction fees to skyrocket.

Layer-2 networks were created to address this issue. Layer-2 networks are separate blockchain networks built on top of the layer-1 network to improve scalability and efficiency while maintaining its security and decentralisation.

Layer-2 networks increase transaction speed while lowering costs. Ethereum Layer-2 networks include Polygon (MATIC), Optimism (OP), and Arbitrum (ARB).

While they may solve scalability issues, Layer-2 networks cannot facilitate communication across different networks. This necessitated the development of a new set of solutions known as layer-3 networks.

Layer-3 refers to a network layer that is added on top of Layer 2 to increase scalability, improve privacy, and facilitate communication across layers and networks.

Most blockchain-based applications and games are layer-3 solutions because they support multiple blockchain platforms through a single app.

Ethereum Price History

Ethereum (ETH) was trading at US$1,803.97, up 0.51% on the day at the time of writing. Furthermore, ETH has increased by 50.73% since the start of the year.

Ethereum held an Initial Coin Offering (ICO) in August 2014 and sold 50 million ETH for US$0.31 per coin, raising over $16 million.

During the 2017 bull market, Ethereum reached $US100 for the first time and peaked at US$414 in June before dropping. Over the next year, Ethereum grew in popularity as the crypto narrative gained traction.

In 2018, the price of ETH skyrocketed to US$1,418 before plummeting again. For the next three years, ETH remained below this all-time high. ETH reached a new all-time high of US$4,379 in 2021, which has yet to be broken.

Summary

Ethereum is a revolutionary blockchain technology (using proof-of-stake consensus) that goes beyond simply enabling digital currencies. It provides a decentralised platform for a wide range of decentralized applications, including financial services, decentralised exchanges, and the creation of digital assets like non-fungible tokens (NFTs).

Unlike traditional systems, Ethereum operates without a central authority, relying instead on a network of computers / network participants to validate transactions and protect the network. This allows for greater transparency, and accessibility, as per other decentralized blockchains.

Ethereum work is powered by its native cryptocurrency, Ether (ETH), which incentives users to participate in the network and enables them to pay for goods and services within the Ethereum ecosystem.

Frequently Asked Questions

Is Ethereum a good investment?

Cryptocurrencies are highly speculative, and investors should only invest what they can afford to lose. Having said that, Ethereum is one of the most solid investments in the crypto ecosystem. It is a seasoned market player with a first-mover advantage, backed by a strong developer network, and a go-to for decentralized activities.

In addition, Ethereum is home to other well-known projects like Polygon, The Sandbox, and Decentraland. Success in any of these projects means success in Ethereum too.

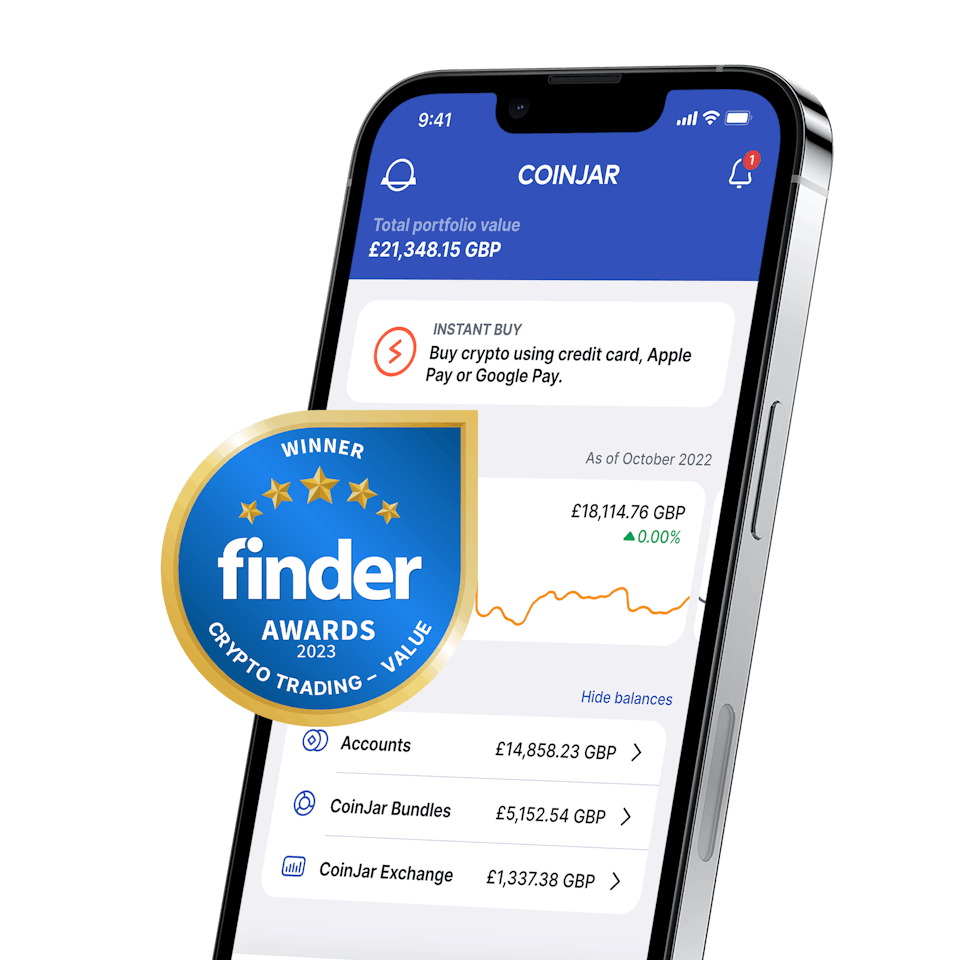

Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Suggested Articles

What is Bitcoin (BTC)? What is "Digital Gold" Used For?

What is Bitcoin? It is a digital currency that can be traded, exchanged, and used as a form of payment independent of central banks and governments.What Is Crypto? How do Cryptocurrencies Work?

Crypto has become incredibly popular. But how does this digital currency work? And are there cryptos other than Bitcoin?What is an NFT? NFTs or Non-Fungible Tokens Explained

NFTs or non-fungible tokens are a type of ‘token’ that is unique, with their identity recorded on a blockchain. We explain the NFT buzz.Browse by topic

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.