Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

What is an Altcoin? What are Altcoins for?

The term altcoin is derived from two words: “alternative” and “coin.” It refers to any cryptocurrency other than Bitcoin.

In this article...

- Beyond Bitcoin: Explore altcoins.

- Discover the diverse crypto world.

- Get some guidance on how you can actively look for your next crypto investment.

What is an altcoin? Bitcoin (BTC) is the most well-known among the now tens of thousands of cryptos. However, there’s a whole universe of digital currencies beyond , collectively known as altcoins. In this article, we’ll explain what altcoins are, their purpose, and how they differ from Bitcoin.

What is an Altcoin?

The term altcoin is a blend of “alternative” and “coin.” It pretty much means all cryptocurrencies and tokens that are not Bitcoin.

Some people consider to be an OG and not an altcoin. But in this article, we are throwing Ethereum into the altcoins basket.

Altcoins exist on various blockchains, each designed with a different use in mind.

Types of Altcoins

The crypto market now boasts a mind-boggling array of altcoins. Here are some of them.

Meme Coins

Meme coins are often created as a joke or for entertainment. (DOGE), inspired by the popular “Doge” meme, is a prime example. Other examples are and . While these can be started as a joke, they can end up being really valuable and have great communities around them.

(Please note CoinJar's specific to memecoins.)

Stablecoins

These are cryptocurrencies designed to maintain a consistent value. They do this by being paired with other assets, like US dollars. Take for example, .

USD Coin (USDC) is a cryptocurrency designed to maintain an aligned value (or stable value) to one USDC equal to one U.S. dollar.

The company that runs USD Coin keeps one US dollar for every USD Coin issued, so it is said to be “pegged” to the dollar. Some stablecoins have become “” before, so it’s not a foolproof system all of the time.

USDC became unpegged because 8% of their reserves were held in a bank that collapsed. However it soon resumed its dollar value after initially falling in price.

Utility Tokens

A utility token is a crypto token that allows users to do things in a project’s ecosystem. For example, in crypto gaming, many gaming ecosystems rely on utility tokens to empower their in-game economies and interactions.

Utility tokens are pretty much used as gaming platform currency.

Gamers can use them to buy weapons, or vehicles for their avatars. Some gaming platforms issue utility tokens as rewards for achievements or milestones. Players can then use these tokens to unlock new levels within the game.

Tokens can also grant access to exclusive areas or hidden content within the game world.

Governance Tokens

These tokens grant voting rights within a blockchain network. They influence decisions related to protocol upgrades, funding allocation, and other governance matters. Chainlink (LINK) is an example of a governance token.

Industry-Specific Coins

Some altcoins cater to specific industries or niches. For example, (XRP) aims to revolutionise cross-border payments.

Altcoins vs. Bitcoin

Altcoins attempt to address perceived limitations in Bitcoin (and sometimes, Ethereum).

For example, altcoins often offer more cost effective transaction fees than Bitcoin. Some altcoins process transactions in a more effective manner due to different consensus mechanisms.

For example, Stellar (XLM) is known for its incredibly performing blockchain. Payments are verified and settled within seconds, and the average transaction cost is — around 0.00001 Lumen (Stellar’s token), which translates to approximately $0.0000011 per transaction based on Lumen’s current pricing.

Bitcoin transaction fees , however fees can range from under a dollar to sometimes even US$35.

What is an altcoin: Conclusion

The future of some altcoins looks bright and the cryptocurrency markets remain fascinating to many. As long as their underlying blockchains remain active and continue to evolve, altcoins will persist. Whether they’ll surpass Bitcoin or carve out their own niches is anyone’s guess. However altcoins like XRP are already being used in the banking industry, and there are no signs of uptake slowing down.

While Bitcoin may be the star of the show, altcoins add color and depth to the crypto universe.

Frequently Asked Questions

What is an altcoin?

An altcoin is a term used to describe all cryptocurrencies other than Bitcoin (BTC). These digital assets belong to the blockchains for which they were explicitly designed.

Some people consider altcoins to be all cryptocurrencies other than Bitcoin and Ethereum (ETH) because most cryptocurrencies are forked from one of the two major networks.

There are pros and cons to investing in altcoins like Bitcoin Cash and Dogecoin so do your own research.

What are altcoins used for?

Altcoins serve various purposes, including:

Smart Contracts: Some altcoins, like Ethereum, enable smart contracts, which are self-executing agreements with predefined rules.

Utility Tokens: Altcoins can function as utility tokens, providing access to specific services or features within a blockchain ecosystem.

Governance Tokens: Certain altcoins grant holders voting rights and influence over network decisions.

Digital Assets: Altcoins represent digital assets that can be traded and stored electronically. Transaction Processing: Altcoins facilitate transaction processing within their respective networks.

Price Fluctuates: Like any investment, altcoin prices fluctuate in response to market demand and supply.

What are the types of altcoins?

Altcoins come in several types based on their design and purpose:

Payment Tokens: Used for transactions (e.g., USD Coin (USDC)).

Stablecoins: Pegged to other assets (not crypto) like fiat currencies.

Security Tokens: Represent ownership in an asset or company.

Meme Coins: Created for fun or as a joke (e.g., Dogecoin).

Governance Tokens: Provide voting power in decentralised networks.

How are altcoins created?

Altcoins are often forked from existing blockchains (e.g., Bitcoin or Ethereum). Developers modify the codebase to create a new coin with different features or capabilities.

Some altcoins emerge through initial coin offerings (ICOs), where tokens are sold to fund development.

What is Proof of Work (PoW) vs. Proof of Stake (PoS)?

Altcoins may use different consensus mechanisms, such as PoW (like Bitcoin) or PoS (like Ethereum).

PoW involves miners solving complex mathematical puzzles to validate transactions.

PoS relies on validators who hold and “stake” coins to protect the network.

What is market cap and price in altcoins?

Altcoins’ market cap reflects their total value based on circulating supply and current price.

The crypto market experiences price fluctuations due to various factors.

Is Ethereum and its network an altcoin?

Some say yes, some say no. Ethereum (ETH) is a prominent crypto known for its smart contract capabilities. It operates on the Ethereum blockchain, supporting a wide range of decentralised applications.

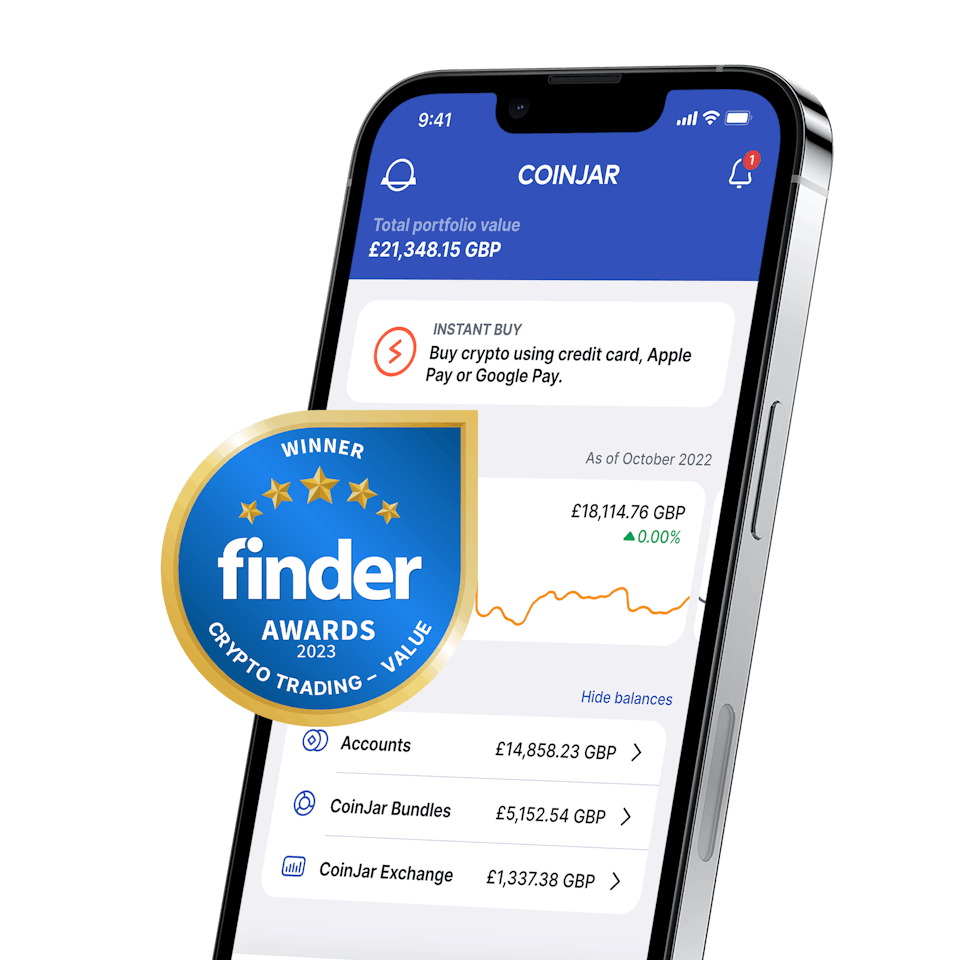

Is buying cryptocurrency safe and legal?

While crypto investments carry risks, CoinJar prioritises security with offline storage and robust protocols. It is convenient, however it is an online wallet, so there is a risk that it may be a victim of a cyberattack. Note the standard risk warning at the bottom of this article.

This article should not be deemed to be investment advice and all readers should seek independent financial advice before investing in any form of asset.

Cryptocurrency is not regulated in the UK. It's vital to understand that once your money is in the crypto ecosystem, there are no rules to protect it, unlike with regular investments. You should not expect to be protected if something goes wrong. So, if you make any crypto-related investments, you’re unlikely to have recourse to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

Remember: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

.

Finder Awards Winner 2023

CRYPTO TRADING - VALUE

Suggested Articles

What is Bitcoin (BTC)? What is "Digital Gold" Used For?

What is Bitcoin? It is a digital currency that can be traded, exchanged, and used as a form of payment independent of central banks and governments.What is Ethereum? What is ETH Used For?

Ethereum is a decentralised blockchain-based open-source software platform that allows for the development of decentralised applications (dApps).What Is Crypto? How do Cryptocurrencies Work?

Crypto has become incredibly popular. But how does this digital currency work? And are there cryptos other than Bitcoin?Browse by topic

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.