Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Fear and Greed Index Hits "Greed". Time to Buy Bitcoin?

How do investors know when it is the right time to buy Bitcoin? They don't, but they can use some tools to guess.

In this article...

- Is now the right time to buy Bitcoin?

- Understand market sentiment and timing.

- Make informed investment decisions.

When should investors ? It is like answering the question, “How long is a piece of string”? Everyone has a different answer. However there are some interesting tools that enthusiasts can use to make their decisions.

While some of these tools certainly are interesting (like the Bitcoin Rainbow chart) the jury is still out as to whether you can use them reliably to gauge whether it is a good time to buy or sell your Bitcoin.

What is the Fear and Greed Index?

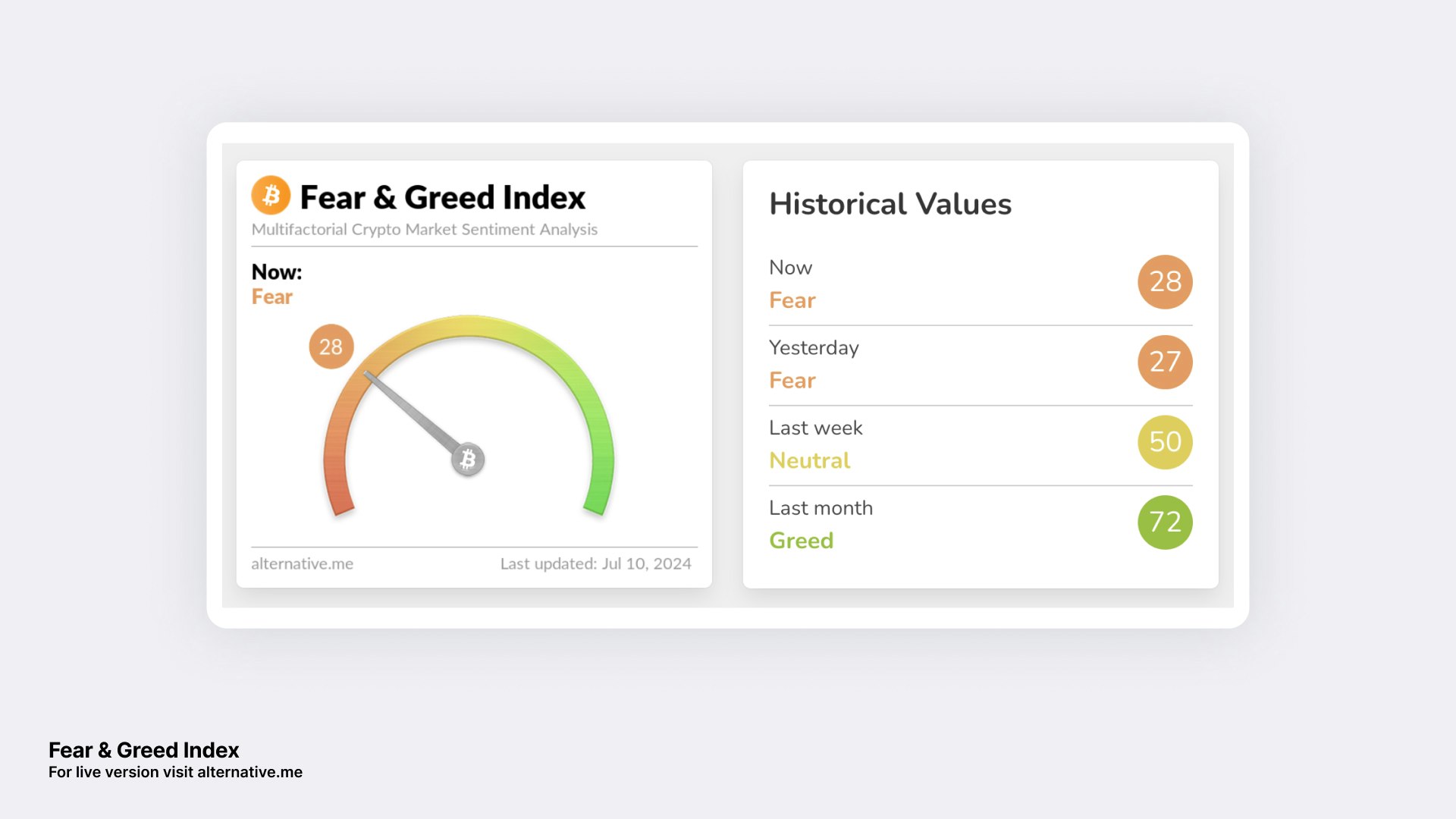

One of these tools is the “”. It is a widely-watched sentiment gauge for the cryptocurrency market. And, at the time of writing (30 May 2024), it has recently moved into the "greed" zone.

What is the “Greed Zone”?

The greed zone signals a notable shift in investor sentiment towards optimism and a heightened appetite for risk. But what does this mean for the future price of Bitcoin?

Decoding the Fear and Greed Index

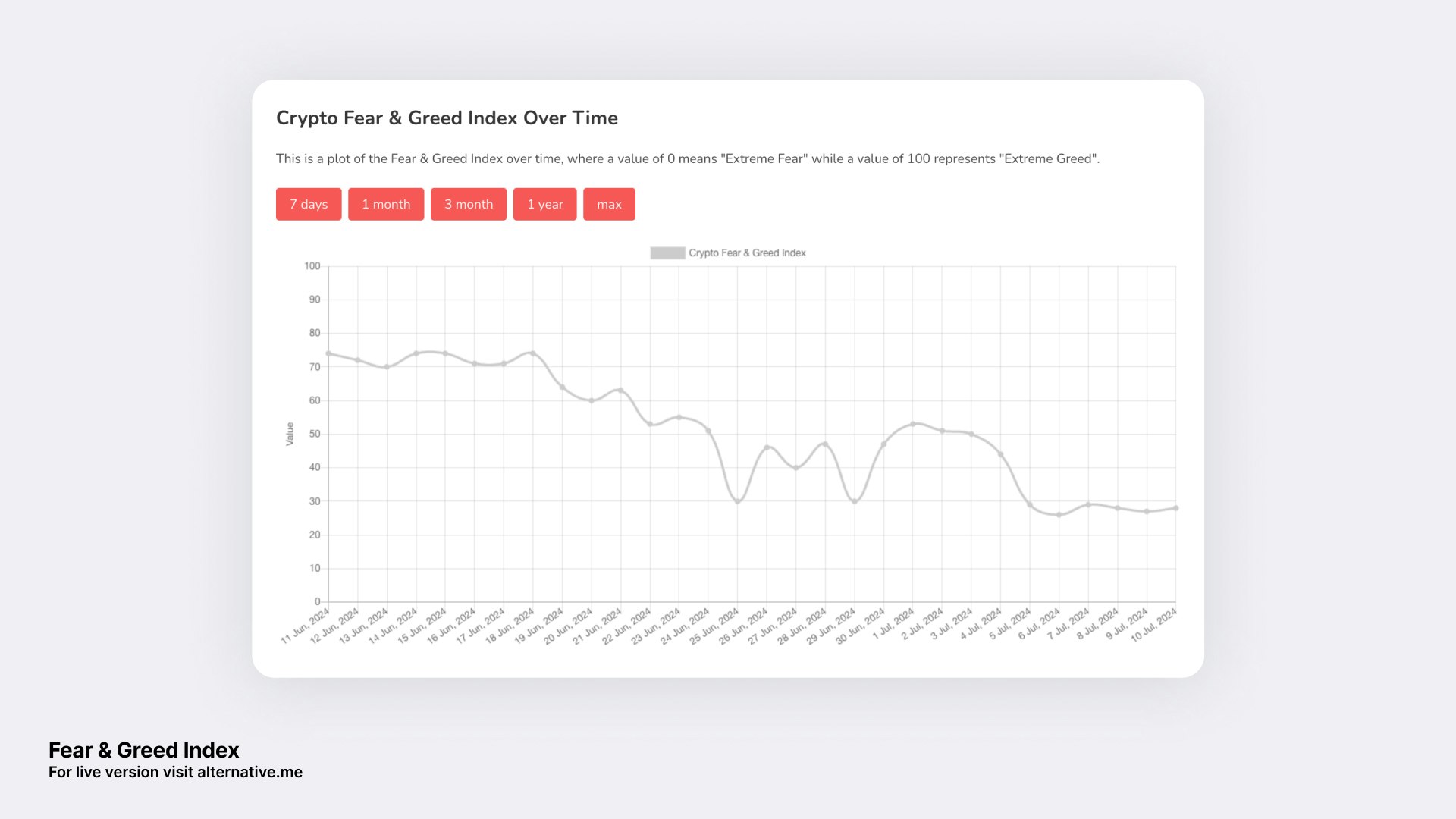

The Fear and Greed Index measures market sentiment by analysing various factors, including price volatility, trading volume, social media trends, and market dominance. The index ranges from 0 ("extreme fear") to 100 ("extreme greed").

A reading in the "greed" zone suggests that investors are becoming overly confident, which could lead to a market correction. However, it can also indicate a strong bullish trend and possible positive investment returns.

Factors fuelling the shift to “Greed”

Several factors have likely contributed to the recent surge in bullish sentiment.

Firstly, major financial institutions and corporations have shown in Bitcoin, adding it to their balance sheets and launching crypto-related services.

Bitcoin is becoming more as a form of payment, with major retailers and companies accepting it.

Should investors buy Bitcoin?

The shift to "greed" could signal a few potential scenarios for Bitcoin's price.

Continued upward momentum

If the current bullish trend persists and more investors jump on the bandwagon, Bitcoin's price could continue to climb.

Yikes! Market correction

A reading of "greed" can also act as a warning sign, potentially leading to a short-term market correction as some investors sell up to cash in on profits.

Consolidation

The market could enter a period of consolidation, and prices may stabilise before the next significant move.

It’s not magical oracle

While the Fear and Greed Index is a valuable tool, it's crucial to remember that it's just one indicator.

Other factors, such as what is going on in the world can also significantly impact Bitcoin's price. Elections, wars, what the stock market is doing, these all are factors in how markets react.

Conclusion: Fear and Greed Index and buying Bitcoin

The move into the "greed" zone is possibly a positive sign for Bitcoin, reflecting growing optimism and confidence in the cryptocurrency.

Investors should remain cautious as no one knows for sure what will happen. However it is fun watching such tools, even if you don’t necessarily heed their call to buy Bitcoin.

Frequently asked questions

What payment method can investors use to purchase Bitcoin (BTC) on CoinJar?

If investors want to buy Bitcoin (BTC), CoinJar supports various payment methods, including credit card, debit card, and bank transfers. Choose the option that's most convenient for you.

How do investors sell Bitcoin that I've purchased on CoinJar?

To sell Bitcoin, navigate to the "Sell" tab within the CoinJar platform. Enter the amount of Bitcoin you want to sell and follow the prompts to complete your transaction.

What is the difference between buying Bitcoin directly and investing in Bitcoin ETFs?

Buying Bitcoin directly means you own the digital asset itself. Bitcoin ETFs (exchange-traded funds) track the price of Bitcoin but don't give you ownership of the underlying coins.

How does the Bitcoin network confirm my purchase of Bitcoin?

Your Bitcoin purchase is recorded on the blockchain, a decentralized ledger technology, using blockchain technology. Miners on the Bitcoin network confirm transactions and add them to the blockchain.

Is it safe to store the Bitcoin I buy on CoinJar?

CoinJar Wallet: CoinJar provides its own wallet service. It is convenient, however being an online wallet there is a risk that it may be a victim of a cyberattack. Online wallets are also called “hot wallets”.

External Wallets: If you want to hold on to your Bitcoin for a while, you can transfer your Bitcoin to an external wallet. Hardware wallets are also known as “cold wallets” (like Ledger or Trezor) and these are effective for long-term storage as they are offline and seriously difficult to hack.

CoinJar has been operating since 2013. CoinJar keeps the vast majority of customer assets in cold storage or private and maintains full currency reserves at all times.

What determines the amount of Bitcoin I can purchase on CoinJar?

The amount an investor can buy depends on your available funds, the current market price of Bitcoin, and any applicable limits on your CoinJar account.

How does the principle of supply and demand affect the price of Bitcoin?

Bitcoin's price is heavily influenced by supply and demand dynamics. Increased demand with limited supply typically drives prices up, while the reverse is also true.

Is investing in Bitcoin suitable for everyone?

Bitcoin is a digital asset with price volatility. Only invest what you can afford to lose, and consider it one part of a diversified investment portfolio.

Why do I need a Bitcoin wallet if Bitcoin is a digital currency?

A Bitcoin wallet stores the private keys that prove your ownership of Bitcoin. It's essential for sending, receiving, and managing your Bitcoin holdings.

What is the Fear and Greed Index?

The Fear and Greed Index is a sentiment analysis tool that measures the emotions and sentiment of the crypto market on a scale of 0 to 100.

A score closer to 0 indicates "extreme fear," while a score closer to 100 suggests "extreme greed."

How is the Fear and Greed Index calculated?

The index is calculated by combining several factors related to market momentum, including volatility, market capitalisation, buying volumes, social media sentiment, and search trends.

What does the Fear and Greed Index tell me about the crypto market?

The index claims to provide insight into the overall sentiment of the crypto market.

High values (greed) often coincide with bull runs, while low values (fear) may suggest the market is due for a correction.

However no one has a crystal ball and nothing is certain in crypto.

How can I use the Fear and Greed Index to my advantage?

The index can be a valuable tool for identifying potential buying opportunities. When the index is low and indicates "fear," it may suggest that prices are undervalued and a good time to buy.

However, it's important to remember that the index is just one factor to consider and should not be the sole basis for investment decisions.

What are some limitations of the Fear and Greed Index?

While the Fear and Greed Index can be a helpful tool, it's essential to understand its limitations. Market volatility can cause rapid shifts in sentiment, and the index may not always accurately reflect the underlying market conditions.

Additionally, the index is based on historical data and may not be predictive of future market movements.

Is the Fear and Greed Index only for crypto?

It focuses on the crypto fear and greed index, but similar indices exist for traditional markets like stocks. The principles of sentiment analysis and market momentum apply across different asset classes.

Suggested Articles

What is Bitcoin (BTC)? What is "Digital Gold" Used For?

What is Bitcoin? It is a digital currency that can be traded, exchanged, and used as a form of payment independent of central banks and governments.What is Ethereum? What is ETH Used For?

Ethereum is a decentralised blockchain-based open-source software platform that allows for the development of decentralised applications (dApps).What Is Crypto? How do Cryptocurrencies Work?

Crypto has become incredibly popular. But how does this digital currency work? And are there cryptos other than Bitcoin?Browse by topic

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.