Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Onchain: SBF guilty, Aragon DAOn, and an L2 boom and bust

November 8, 2023

Story One

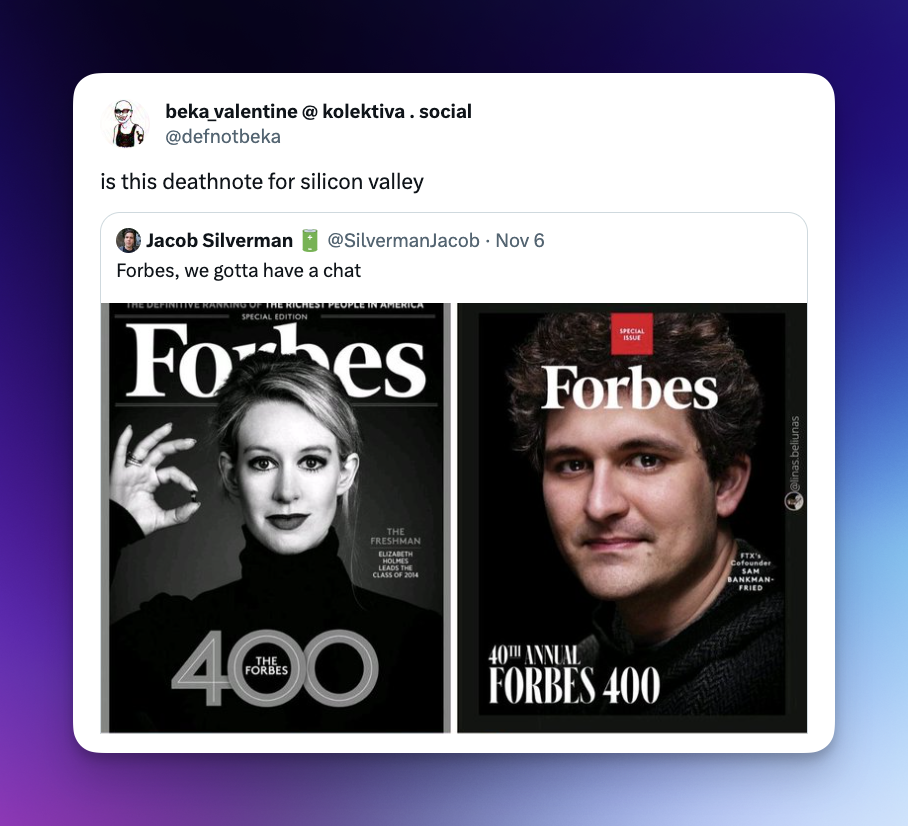

SBF guilty

Sam Bankman Fried, also known as the guy who ruined the reputation of Effective Altruism for the foreseeable future, has been found guilty on seven criminal counts, including wire fraud, commodities fraud, and money laundering. This verdict probably doesn't come as a surprise to anyone who's followed the trial where his ex-girlfriend dropped some bombshells, such as FTX working with Thai prostitutes and bribing Chinese government officials. These are just examples of various terrible business decisions Sam made under the banner of his crooked idea of utilitarianism. Ultimately, the FTX collapse will go into the history of crypto as one of the biggest frauds in the industry, with losses in the billions. Let's not talk about the further distrust in the public it has instilled.

On that note, at least the U.S. attorney had a more nuanced view, stating that the industry might be new, but the crime wasn't. Lying, stealing, and cheating are all crimes with long-standing history.

Takeaway: The biggest irony is, once again, that crypto already has the tools to prevent fraudulent balance sheets. It's putting businesses on chain or using onchain proofs.

Story Two

Aragon DAOn

The Aragon Association, the governing body of the aragonOS software, a set of tools to create DAOs, has announced that it's . As part of the process, they'll distribute over 86k ETH, roughly $115 million, to the ANT token holders.

Aragon had seen a lot of turmoil in recent months after the team failed to empower its token holders with voting rights on the use of treasury funds. Despite a vote in favor of it last year, during the transition period, the team first delayed the process, only to then abandon the idea completely in light of a "51% attack". This supposed attack was run by a group calling themselves risk-free value raiders who realized that the market cap of the ANT token was lower than the value held in the treasury.

According to their math, if the raiders managed to vote for a payout or dissolution of the funds, they'd be able to capture the difference in value. In the end, even though that first attempt failed, Aragon's DAO ambitions were shut down for now, and the core product team shared that they'd continue working in a more product-focused structure.

Takeaway: DAOs are complicated, and making votes purchasable can have some adverse outcomes. It'll be interesting to see if similar attacks occur in the future whenever a DAO has failed to gain significant traction, yet the market cap of its governance token is below the value of its treasury. 👀

Story Three

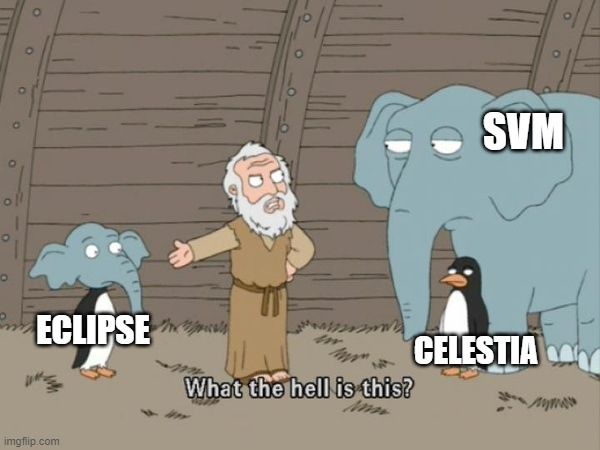

L2 boom and bust?

2023 has truly been the year of Layer 2s, from living a more niche existence to becoming the quickest hack for hype and VC funding (before AI came along.) For a while, it seemed everyone was either launching new Layer-2s or transitioning their existing L1 chains to L2s to stay relevant. And then we even started seeing things like : an L2 that uses Solana's Virtual Machine and Data Availability from Celestia, winning the contest for buzzword heaviest rollup.

Even though L2s now have a scaling factor of 5x, meaning that they have increased transactions that eventually settle on Ethereum 5-fold, activity on them is starting to die down. , with Ethereum mainnet reclaiming some of its dominance.

The pattern on most L2s is pretty clear. A flurry of initial high activity is followed by a cool-down period where people realize that maybe there won't be an airdrop (Base) or that it's simply not worth the hassle going there when you can achieve what you want more easily elsewhere (Ethereum mainnet).

Takeaway: With so many L2s around, the question starts to arise: when do we have enough, and why would anyone even care when there's so little differentiation? In the end, they all make transaction fees cheaper.

Fact: If you think that all of web3 is a little nuts, you'd be right. But if you believe that all the things we call nuts are actual nuts, you're not. Walnuts, Peanuts, and Pistachios all technically aren't. Walnuts are seeds, and so are Pistachios. Peanuts, even more strangely, are classified as legumes because they grow underground. 🥜

Naomi from CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: .

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

EU residents: CoinJar Europe Limited (CRO 720832) is registered as a VASP and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s .

More from CoinJar Blog

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits. CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.