Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong.

Onchain: Another Moon Landing, Unethical Auditors, and Blinks

July 3, 2024Dive into our latest newsletter covering groundbreaking space ventures, blockchain security scandals, and Solana's innovative tech strides. Plus, discover a fascinating moon-related fact inspired by Japanese folklore!

Story One

Another Moon Landing

Back in the day, countries competed to be the first to shoot object XYZ into space. The Soviet Union gained a lead when it managed to send a dog to space (RIP ), but eventually, the US scored big by putting a man on the moon.

We've come a long way since then. Countries now measure themselves by who can elect the most idiotic leaders, and they don't have time for space. Space exploration is now spearheaded by heavily VC-funded startups and the ultra-rich.

But before the ultra-rich step on the moon, the moon's craters will welcome the Bitcoin Whitepaper. As part of the soon-launching which covers what's happening in the Space economy, award-winning documentary maker Torsten Hoffman decided to bring p2p cash to the moon.

After all, what better place to store such valuable IP? It's packaged to survive for millions of years and is protected from radiation, EMP, corrosion, and extreme temperatures. That's more than we can say about ourselves here on Planet Earth these days.

Takeaway: If you liked Cryptopia (Hoffman's previous documentary), you should definitely check out . I suggest Deep Ocean Exploration for the next documentary.

Story Two

Unethical auditors

"You either die a hero or live long enough to become a villain."

Certik, a so-called blockchain security company, has gone past its hero arc and entered its villainous phase. Fortunately for us, they aren't acting nearly as clever as the Joker. Earlier in June, they reported a bug to Kraken that, if exploited, could lead to millions in losses. So far, so normal.

Except that instead of using the bug to withdraw a minimum amount, they moved an entire $3 million off the exchange's balance sheet. And they didn't stop there; they went on to transfer the funds to Tornado Cash after their conduct became public. With pressure mounting, they eventually decided to give back the obtained funds.

One problem seldom arrives alone. I'd like to consider this incident just an Overture to what could lead to Certik's collapse. On June 25th, Pop Punk, a CT celebrity, called out the bug bounty platform incubated by Certik Chain—their attempt at decentralizing the audit process.

Usually, bugs are supposed to go to the protocol. Instead, they are reported to a domain with certik in the name - suggesting that Certik is front-running bug bounty reports to secure the rewards.

Takeaway: Certik has had shady practices for some time, from highly annoying salespeople to . Certik deserves to go bust for this alone. But the bigger issue persists: how do you incentivize hackers to report bugs instead of simply exploiting them?

Story Three

Blinks

Unethical auditing is one way to gain attention; the morally more correct one is to follow Solana's path: shipping. If Solana continues launching new features at the rate they've been, they'll easily outpace the Ethereum Roadmap, which, anyway, requires a PhD in roadmap.

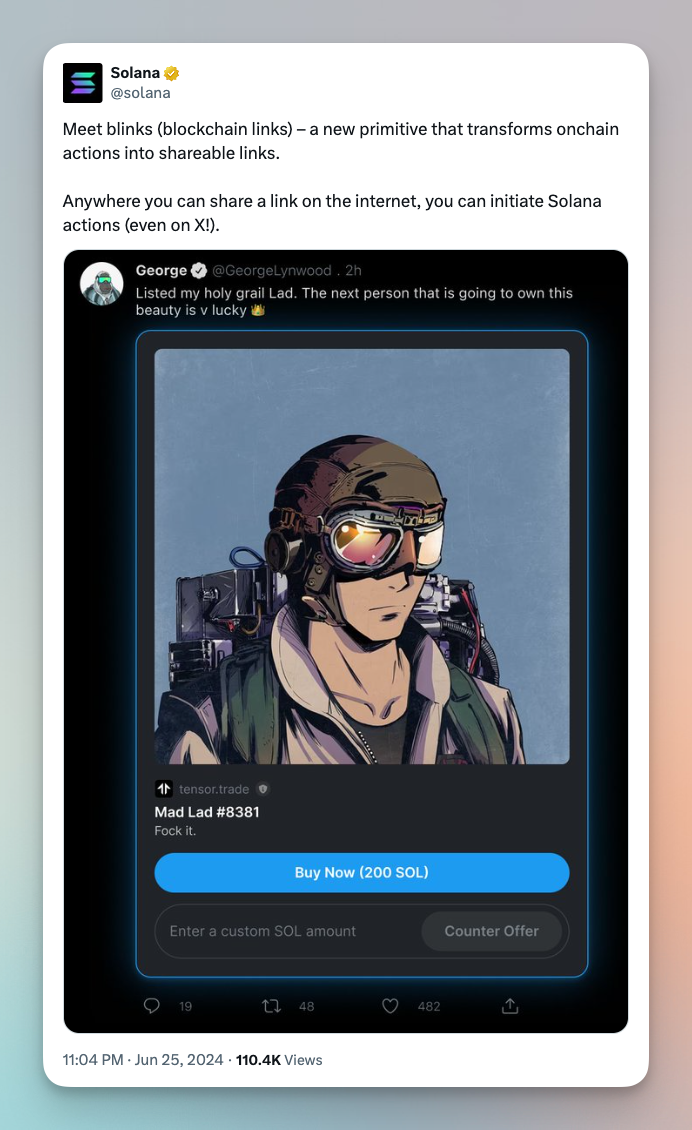

After bringing ZK compression to their chain in June, the latest idea from the manlets is: Blinks. Not related to the Kpop star of the same name (which I only found out existed thanks to X search), the term stands for Blockchain Links. Creativity in naming: not great, functionality on the other hand, pretty exciting.

With Blinks, any Solana action can be turned into a shareable, meta-data-rich link. That means things like transacting, voting, and minting can be embedded in other websites by copypasta.

For now only integrated with X, it's assumed further support will follow. Imagine buying NFTs straight from the TL; that's what Blinks does.

Takeaway: Kudos to Solana. I still have doubts, though. Hear me out: X has payment licenses and a billionaire owner bleeding money. Plus, he has a lot of child support to pay, and it would seem this number will only increase. Someone needs to make a prediction market for his child count. How long will Elon allow others to earn money on his platform without him getting anything out of it?

Fact of the week: Speaking of the moon, according to Japanese Folklore, a rabbit lives on the moon making rice cakes. This is based on their interpretation of the dark areas of the moon. It's also the reason why the protagonist of Sailor Moon is called Usagi Tsukino, translating to Moon Rabbit. The more you know 🌈

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: .

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

EU residents: CoinJar Europe Limited (CRO 720832) is registered as a VASP and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s .

More from CoinJar Blog

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service.

We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in the UK by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.