Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

How a Construction Worker Lost $4,850 to a Scam

A tradie lost his hard-earned money to an online scam. Here's how it went down.

In this article...

- How did a 35-year-old construction worker lose $4,850 to the Microsoft AI Trading Scam?

- Requests to withdraw "profits" was met with excuses

- Don't ignore red flags in excitement for quick returns.

How did a 35-year-old construction worker lose $4,850 to the Microsoft AI Trading ? Here we explain what happened and what you need to look out for.

For the purposes of this article, the victim's real name has been changed to protect their privacy. We'll refer to them as James, a 35-year-old construction worker from New South Wales, Australia.

James never thought he would fall victim to a scam. He worked long hours on construction sites, providing for his family and saving diligently. But like many, the dream of financial freedom and the allure of quick returns pulled him in when he saw a Facebook ad promising extraordinary gains with minimal investment. The ad featured a well-known brand — — and appeared to offer a sophisticated AI trading solution.

"I saw the Microsoft logo and thought, 'How bad could it be?' They wouldn’t let scammers use their name, right?" James reflected. "I was wrong. Very wrong."

The start: Too good to be true

James first encountered the scam on a Facebook ad that claimed the Microsoft AI Trading Solution could turn an initial $250 investment into thousands of dollars within weeks. The ad displayed rapid growth charts and quotes from people claiming they had "quit their day jobs" after making significant returns.

"I’ve always been sceptical of those get-rich-quick schemes, but this looked so professional," James explained. "The ad said Microsoft and AI... I thought it was legit, you know?"

The website he was directed to after clicking the ad was slick and professional-looking, mimicking a legitimate trading platform with supposed ties to Microsoft and OpenAI. After reading through the promises of success and seeing familiar tech logos, James entered his details.

The bait: An enticing dialogue

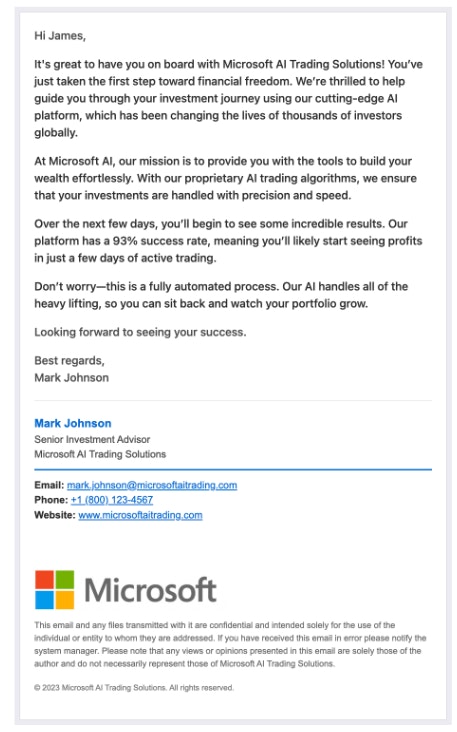

Not long after submitting his information, James received an email from a supposed investment advisor, urging him to act quickly to take advantage of the opportunity.

This was followed by a phone call from someone calling himself "Mark," who portrayed himself as a financial expert. That reassurance, paired with Mark’s calm confidence, convinced James to start with the minimum investment of $250. But it didn’t stop there.

The hook: More money, more promises

Within a few days, James logged into his dashboard and saw that his account balance had grown to over $1,000. Elated, he received another call from Mark, who pushed for a bigger investment.

Mark (Scammer): "See, James? You’ve already made $750 in profit! Now imagine if you invested $5,000 — you’d be seeing returns in the tens of thousands within a month!"

Still riding high on his early "success", James didn’t hesitate when Mark convinced him to invest a further $4,600 over the course of a few weeks.

"Mark kept telling me that the more I invested, the bigger my returns would be. He even said I could withdraw some profits soon, so I felt safe putting in more."

But that’s when things began to unravel.

The fall: The moment it became clear

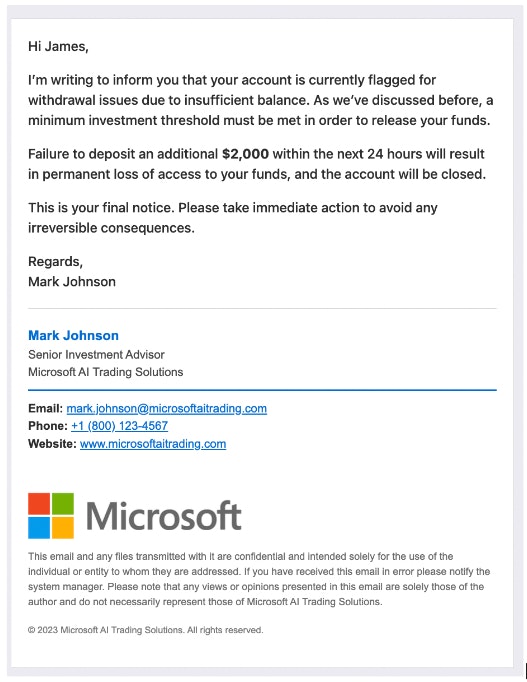

James tried to withdraw some of his profits, only to be met with excuses. The system flagged his withdrawal, and Mark began asking for additional deposits to “unlock” the funds.

James said, "I started getting nervous when I couldn’t withdraw anything. Mark told me it was because I needed to increase my account balance to hit some minimum threshold for withdrawals. That’s when I started to realise I’d been scammed."

As the days passed, Mark’s calls became less frequent, and the supposed “customer support” line was no longer operational. That $4,850 was gone, and James never saw a penny of it returned.

Reflection: What James learned

Looking back, James admits that he ignored the red flags in his excitement for quick returns.

"I should’ve known better. The minute they asked for more money to release my funds, I should’ve pulled out. But I got greedy — I thought I could make enough money to finally take a break from work and maybe buy my family a better house."

Despite his loss, James now realises the importance of caution when dealing with online investments.

"The scammers were so good at making everything seem legit. They made me feel like I was in control, but really, they were pulling all the strings."

How to protect yourself from scams like this

James’ story is an unfortunate but common one. Scammers often prey on hard-working individuals, using different tactics.

Fake endorsements: They use well-known brand names, such as Microsoft, to create false trust.

High-pressure sales tactics: Scammers push for quick decisions, urging victims to invest more by promising quick returns.

Excessive profit guarantees: Any platform promising unrealistic returns with no risk is likely fraudulent.

Withdrawal traps: Scammers often allow you to see fake profits but make it nearly impossible to withdraw any money.

Final thoughts

James wishes he had done more research before investing and urges others to be sceptical of any financial opportunity that seems too good to be true.

"The best advice I can give is: Don’t let excitement cloud your judgement. Always double-check the legitimacy of an investment before committing."

Suggested Articles

What is Bitcoin (BTC)? What is "Digital Gold" Used For?

What is Bitcoin? It is a digital currency that can be traded, exchanged, and used as a form of payment independent of central banks and governments.What is Ethereum? What is ETH Used For?

Ethereum is a decentralised blockchain-based open-source software platform that allows for the development of decentralised applications (dApps).What Is Crypto? How do Cryptocurrencies Work?

Crypto has become incredibly popular. But how does this digital currency work? And are there cryptos other than Bitcoin?Browse by topic

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.