Claim your free €20 Bitcoin bonus now! Just verify your ID. Weekly payouts every Friday! Don't invest unless you're prepared to lose all the money you invest.

Buy PAX Gold (PAXG) in Ireland With EUR | CoinJar

PAX Gold

PAXG

Overview

What is PAX Gold?

Buy Paxos Gold (PAXG): This is like a digital representation of gold stored by a third party.

Each token you buy is equal to one ounce of real, physical gold. You don't get to take the gold home, but you own it – kind of like having a valuable item in a deposit box.

Why buy Pax Gold?

Convenient to trade

You can buy and sell PAXG on cryptocurrency exchanges, just like Bitcoin or Ethereum. This makes it convenient to invest in gold, even if you don't have a lot of money to start.

Fractional ownership

You don't have to buy a whole ounce of gold at once. PAXG lets you buy small fractions, making gold investing accessible to more people.

Protection

The physical gold backing PAXG is stored in professional vaults, so you don't have to worry about keeping it safe yourself.

Transparency

Paxos, the company behind PAXG, regularly checks and verifies the gold holdings.

How does it work?

Investors can buy PAXG

You purchase PAXG tokens on a cryptocurrency exchange using regular money or other crypto.

Ownership recorded

Your ownership of the PAXG tokens – and the corresponding amount of gold – is recorded on a blockchain, a protected digital ledger.

Gold in the vault

The physical gold represented by PAXG is stored safely in vaults. You can even look up the serial numbers of the gold bars backing your tokens!

Trade or redeem

You can hold onto your PAXG, trade it for other crypto or regular money, or (if you own a large enough amount) redeem it for physical gold bars.

Should investors buy Pax Gold?

If you're interested in gold as an investment but like the convenience of using crypto, PAXG could be a good option. It's a way to combine the “historical investment stability” of physical gold with the flexibility of digital assets.

But remember, the price of gold can go up and down, and there's always the risk of the company behind it having issues. It's important to do your research and understand the risks before investing.

Buy using a bank transfer!

Buy PAX Gold using a bank transfer. Get cash in your account with SEPA. Convert crypto-to-crypto with a single click.How to buy PAX Gold with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Featured In

CoinJar App

All-in-one crypto wallet

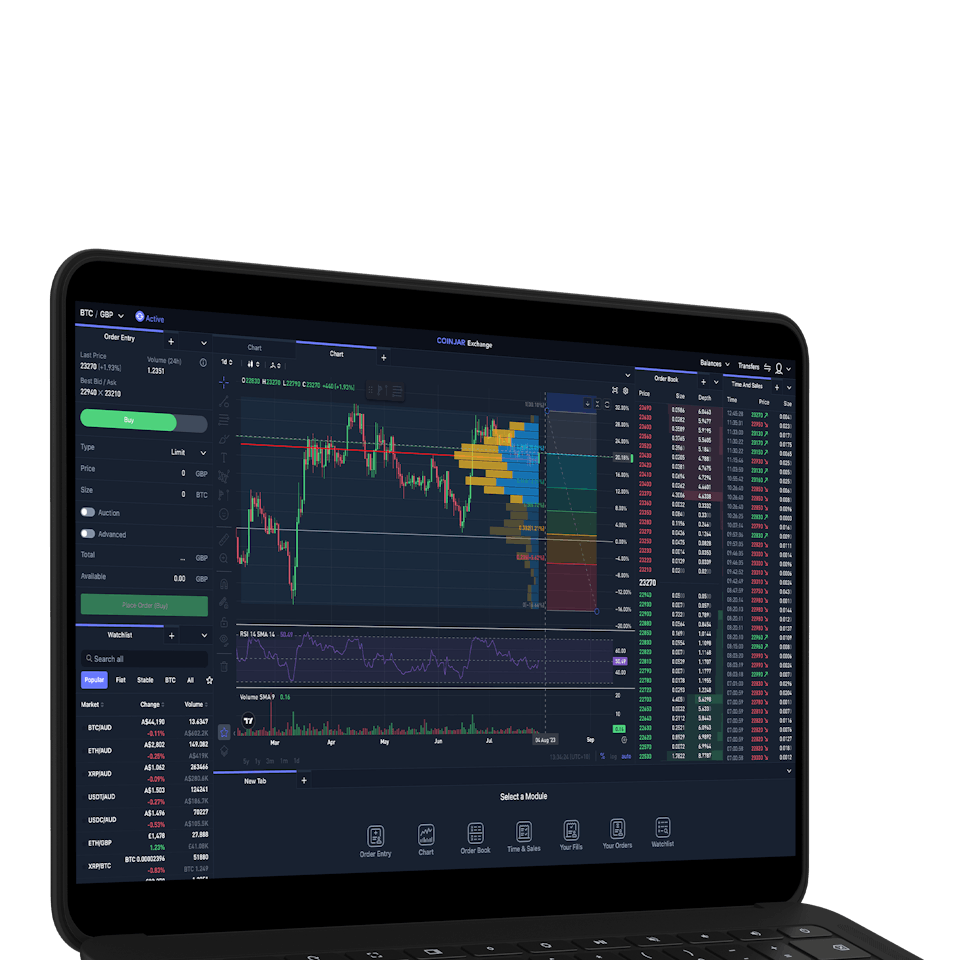

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Pax Gold (PAXG)?

Pax Gold (PAXG) is a digital asset representing one fine troy ounce of London Good Delivery gold bar stored in Brink's gold vaults. Each PAXG token is a digital representation of a specific amount of gold held in custody.

Who issues PAXG?

PAXG is issued by Paxos Trust Company, a financial institution known for its Paxos Standard (PAX) stablecoin.

Where is the physical gold backing PAXG stored?

The physical gold backing PAXG is securely stored in Brink's gold vaults, renowned for their security in precious metals storage.

How do I know the gold exists?

Paxos regularly undergoes audits to verify that the amount of gold bullion held in custody matches the outstanding PAXG tokens.

Can I redeem my PAXG for physical gold?

Yes, you can redeem your PAXG tokens for physical gold delivery, but only if you own a minimum amount, typically a Good Delivery gold bar.

What blockchain is PAXG on?

PAXG is an ERC-20 token, meaning it operates on the Ethereum blockchain.

How do investors buy Pax Gold?

You can buy Pax Gold (PAXG) on various cryptocurrency exchanges and platforms that support ERC-20 tokens.

Why would I buy Pax Gold instead of physical gold?

Pax Gold offers a convenient and protected way to invest in gold without the hassle of storing and insuring physical gold. It also provides fractional ownership, allowing you to buy a portion of an ounce of gold.

Is Pax Gold a good investment for capital management?

While Pax Gold offers some potential advantages for capital management due to its connection to the gold market, it's important to consult with a financial advisor before making any investment decisions.

What are the risks of investing in Pax Gold?

Like all investments, Pax Gold carries risks. The price of gold can fluctuate, and there's always the risk of the company behind it having issues.

CoinJar Europe Limited (CRO 720832) is registered and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.