Claim your free €20 Bitcoin bonus now! Just verify your ID. Weekly payouts every Friday! Don't invest unless you're prepared to lose all the money you invest.

Buy Maker (MKR) in Ireland With EUR | CoinJar

Maker

MKR

Overview

What is Maker?

Why do investors buy Maker (MKR)? As the market , investors are seeking opportunities beyond the usual suspects. Enter Maker (MKR), a decentralised finance (DeFi) gem that is worth looking into.

Why MKR?

“Maintenance” and governance

Maker is the backbone of the Dai stablecoin, which is soft-pegged to the US dollar. It stays at around $1 using smart contracts. As a MKR holder, you can participate in the governance of the MakerDAO ecosystem.

When Dai deviates from the US$1 value, MKR holders can vote on adjustments to “stability fees” (Collateral Asset Stability Fees are in essence fees that are used to ensure alignment to the value between DAI and the USD) or other mechanisms to bring it back in line.

Collateralised Debt Positions (CDPs)

MKR plays a crucial role in managing CDPs. These allow users to lock up collateral (usually Ethereum) and mint Dai. MKR holders vote on critical decisions related to CDP management.

Positive investor return potential

MKR’s scarcity and utility make it attractive to some investors. As the DeFi space , demand for Maker’s services increases, potentially driving up MKR’s value.

Innovation

MakerDAO its ecosystem, making MKR a forward-thinking investment.

Community

There is an active community of DeFi enthusiasts who believe in Maker’s mission. This makes it a fun crypto to be involved with.

Risk management

MKR acts as a buffer against system losses. In extreme scenarios where the value of collateral drops significantly, MKR is auctioned to cover the deficit,ensure the peg to $1 USD and ensures the maintenance of the Maker system.

Incentives for maintenance

MKR holders are rewarded with Dai rewards for participating in governance. This encourages active involvement and ensures alignment with the platform’s long-term success.

Decentralised Finance (DeFi) ecosystem

By holding MKR, you could contribute to the growth and innovation of decentralised finance.

Buy using a bank transfer!

Buy Maker using a bank transfer. Get cash in your account with SEPA. Convert crypto-to-crypto with a single click.How to buy Maker with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Featured In

CoinJar App

All-in-one crypto wallet

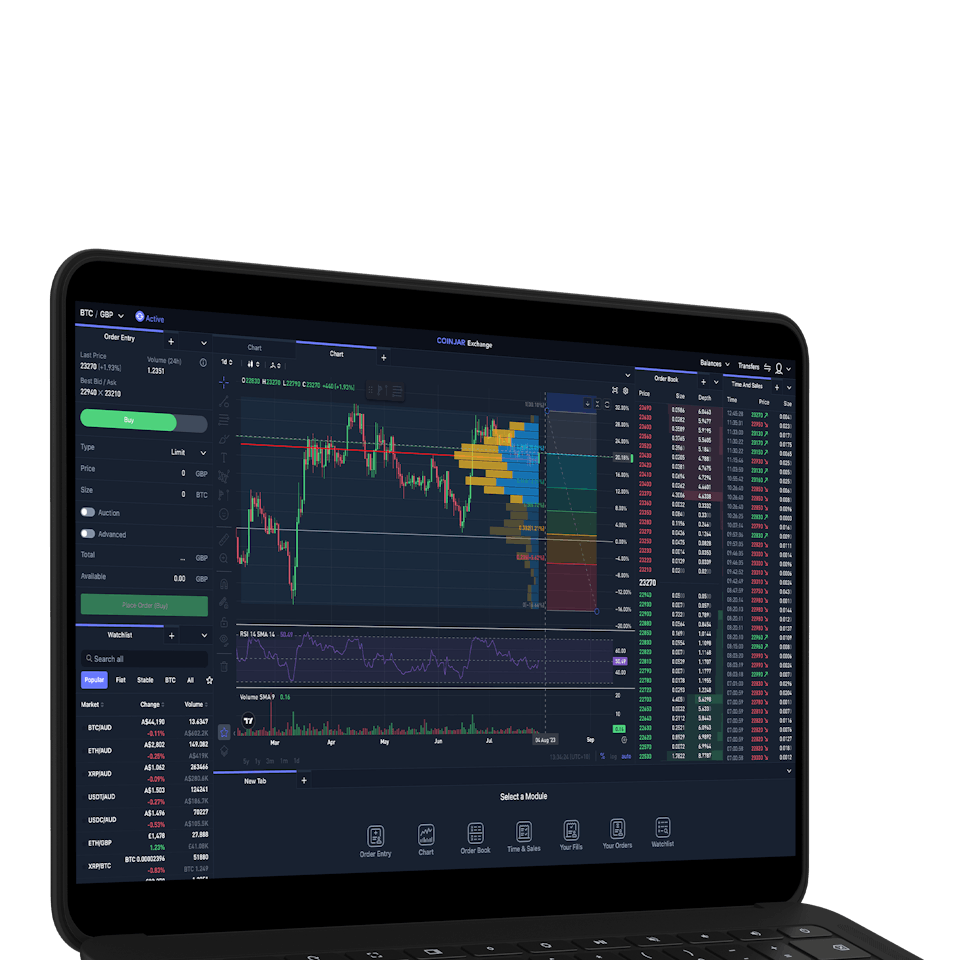

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Maker (MKR)?

Maker (MKR) is a governance token associated with the Maker Protocol, a decentralised finance (DeFi) platform built on the Ethereum blockchain.

MKR holders actively participate in decision-making related to the stability and management of the Dai stablecoin.

Why should I consider buying Maker (MKR)?

MKR serves as a crucial component of the MakerDAO ecosystem, allowing you to engage in governance and influence the protocol’s direction.

As a long-term investment, MKR offers exposure to the growing DeFi space and the adoption of digital currencies.

What is the Dai Savings Rate (DSR)?

The DSR is the interest rate earned by holding Dai in a Dai Savings Contract. MKR holders vote on adjusting this rate to maintain the stability of Dai.

Can I sell Maker (MKR) on CoinJar?

Absolutely! CoinJar allows you to both buy and sell MKR.

What role do smart contracts play in Maker (MKR)?

Smart contracts underpin the entire Maker ecosystem. They manage CDPs, stability fees, and other essential functions.

Is Maker (MKR) a good long-term investment?

While all investments carry risks, MKR’s utility and governance features make it an attractive choice for those interested in DeFi and digital assets.

Can I trade Maker (MKR) for other cryptocurrencies?

Yes! CoinJar allows you to trade Maker for other cryptocurrencies. Explore the available options within the exchange.

Where can I learn more about Maker (MKR)?

Visit the official website and stay informed about updates, community discussions, and project developments.

What is the Dai Savings Rate (DSR)?

The DSR is the interest rate earned by holding Dai in a Dai Savings Contract. MKR holders vote on adjusting this rate to maintain the stability of Dai.

What role do smart contracts play in Maker (MKR)?

Smart contracts underpin the entire Maker ecosystem. They manage CDPs, stability fees, and other essential functions.

What is the max supply of Maker MKR cryptocurrency?

The of MKR is 1,005,577 coins. It is an ERC-20 token built on the Ethereum blockchain and cannot be mined directly.

What is MakerDao with cryptocurrencies MKR and DAI?

MakerDAO is a decentralised autonomous organisation (DAO) that enables users to lend and borrow cryptocurrencies without intermediaries. It issues two main cryptocurrencies.

DAI: A stablecoin pegged to the US dollar, collateralized by other cryptocurrencies.

MKR: The governance token that supports DAI’s stability and allows holders to participate in decision-making within the MakerDAO ecosystem.

Does ‘maker’ mean selling and ‘taker’ mean buying Bitcoin?

In the context of trading, “maker” and “taker” refer to different roles.

Maker: Places limit orders on the order books, providing liquidity to the market.

Taker: Executes market orders by buying or selling immediately from existing orders on the books.

Makers are rewarded with lower fees for providing liquidity, while takers pay higher fees.

Can MakerDao MKR be mined?

No, MKR cannot be mined. Its supply is determined by market dynamics related to DAI stability.

What do DeFi apps use as collateral to lend to users?

DeFi apps use various cryptocurrencies as collateral, including Ethereum (ETH), Wrapped Bitcoin (WBTC), and other ERC-20 tokens.

Users lock up their collateral assets to generate stablecoins like DAI, which can be borrowed or lent within the DeFi ecosystem.

Is Maker DAO built on Ethereum?

Yes, MakerDAO is built on the Ethereum blockchain. Both DAI and MKR operate within the Ethereum ecosystem.

CoinJar Europe Limited (CRO 720832) is registered and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.