Claim your free €20 Bitcoin bonus now! Just verify your ID. Weekly payouts every Friday! Don't invest unless you're prepared to lose all the money you invest.

Buy Litecoin (LTC) in Ireland With EUR | CoinJar

Litecoin

LTC

Overview

What is Litecoin?

Why investors buy Litecoin: What is Litecoin and how do I buy it? We break it down for you.

What Is Litecoin (LTC)?

Litecoin (LTC) is often referred to as the “silver to Bitcoin’s gold.” It is a well-established cryptocurrency. Created by former Google and Coinbase engineer Charlie Lee in 2011, was one of the earliest (a term used for cryptocurrencies other than Bitcoin).

Litecoin’s Origins and Purpose

Lee designed to address some of Bitcoin’s limitations. Bitcoin’s slow transaction processing speed at the time (around five transactions per second) frustrated merchants who wanted to accept it as payment.

Litecoin had a transaction speed of 54 transactions per second and generated new blocks approximately every 2.5 minutes. This improvement was appealing for merchants seeking quicker settlements.

However, in 2018, the was developed and went live in 2018. This was a solution that made Bitcoin transactions much, much more effective.

Despite this, Litecoin has stayed popular, especially with crypto OGs. At the time of writing, it remains in the top 20 by market capitalisation.

Considering there are now over 20,000 cryptocurrencies in the world, that’s pretty good going.

The Role of the Litecoin Foundation

The Litecoin Foundation actively contributes to the development and adoption of Litecoin. It forms partnerships, explores funding opportunities, and engages in initiatives that promote Litecoin’s growth.

Litecoin as a Market Indicator

Litecoin often serves as a leading indicator for the broader cryptocurrency market. The general vibe that gets thrown about is that “Litecoin lights the path that leads the way to alt season.”

Traders closely monitor LTC’s price, even if they don’t directly trade it. When Litecoin gains momentum, risk appetite spreads, and smaller markets prepare for potential explosive gains.

Technical details

The computer code underlying Litecoin closely resembles that of Bitcoin. Like Bitcoin, Litecoin operates with a fixed supply and undergoes halving events. Over time, mining rewards decrease, maintaining scarcity.

Litecoin relies on a proof-of-work consensus mechanism, like Bitcoin. But Litecoin has four times the supply of Bitcoin, with a maximum of 84 million LTC.

Litecoin offers cost-effective transactions relative to other cryptocurrencies.

Litecoin’s resilience

Despite the challenges faced by the broader crypto market in 2023, Litecoin has demonstrated resilience multiple times.

Unlike Bitcoin, which historically tends to surge in demand after halving events due to reduced supply, Litecoin has struggled to increase in price after events which typically work for Bitcoin’s price.

Litecoin was launched in 2011, with a price of US$4.31. From there it was a bit of a rollercoaster ride. An all-time low of US$1.24 was hit in January 2015, and the all-time high was US$388.80 in 2021. So it has been a of peaks and troughs.

Despite growing network usage and increasing Litecoin payments, significant price surges since 2021 have been elusive.

At the time of writing (April 11, 2024), LTC is US$97.09. While the price is down currently from its former highs, the thing to keep in mind is that Litecoin historically, has bounced back from dips in its price.

The performance of most cryptocurrency can be highly volatile, with their value dropping as quickly as it can rise. Past performance is not an indication of future results. You should be prepared to lose all the money you invest in cryptoassets.

Fundamental strengths

There are some points of difference that keep Litecoin in the game. The number of Litecoin users continues to expand, evident in the .

This sustained interest in Litecoin’s longevity and utility.

Litecoin’s competitive transaction fees position it as a potential token creation platform.

As decentralised finance (DeFi) and non-fungible tokens (NFTs) become more widely adopted, Litecoin’s scalability and cost-effectiveness could become valuable assets.

While still popular, Litecoin doesn’t always grab headlines like Bitcoin. Some investors prioritise other cryptocurrencies with more “buzz”.

And keep in mind that Litecoin faces competition from newer altcoins and projects.

However, as an early crypto, Litecoin remains in the top coins by market capitalisation.

Why investors buy Litecoin: Conclusion

Litecoin (LTC), created by Charlie Lee, is a popular cryptocurrency known for its effective transaction processing and competitive fees. It serves as a digital silver to Bitcoin’s gold, offering a reliable alternative for everyday transactions.

While one of the oldest cryptocurrencies, Litecoin remains a valuable cryptocurrency with practical use cases.

To buy Litecoin, create an account on a reputable cryptocurrency exchange that supports LTC, like CoinJar. Once you are verified, you can deposit funds from your bank account and exchange them for Litecoin.

Keep in mind that LTC’s trading volume can be volatile, so it’s essential to understand the risks before making a purchase.

Consider protecting your LTC in a personal wallet / cold wallet to protect against exchange-related risks.

Buy using a bank transfer!

Buy Litecoin using a bank transfer. Get cash in your account with SEPA. Convert crypto-to-crypto with a single click.How to buy Litecoin with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Featured In

CoinJar App

All-in-one crypto wallet

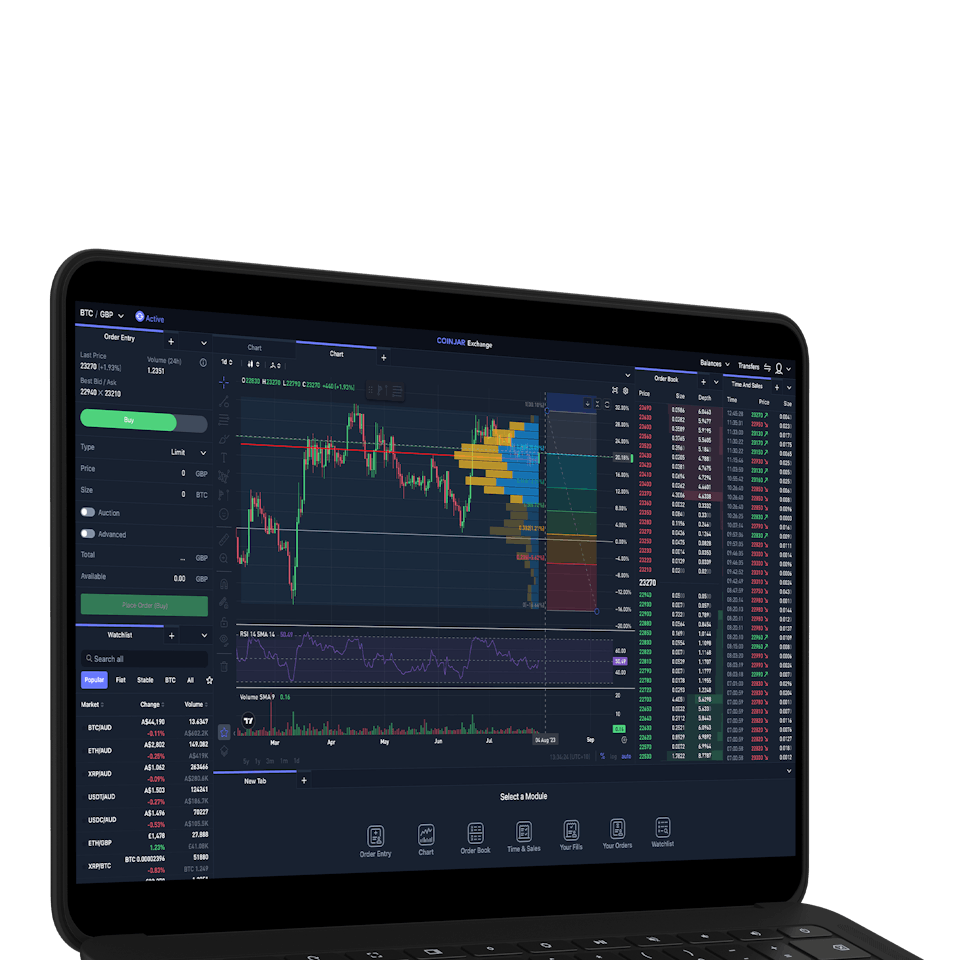

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is a Litecoin wallet?

Litecoin offers an official . Click here for more details. But you don’t need it to buy Litecoin, you can keep it in your CoinJar wallet.

Where is the best place to buy Litecoin?

The best place to buy Litecoin depends on your preferences. CoinJar has been in operation since 2013 and has .

How is the price of Litecoin determined?

The price of Litecoin is influenced by market demand and supply. Factors such as trading volume, investor sentiment, and overall market conditions play a role in determining its value.

How much does Litecoin cost to buy?

The cost of buying Litecoin varies based on the current market price. You can check real-time prices on the top of this page. At the time of writing, (April 8, 2024) Litecoin price is US$101.31.

Can you convert Litecoin to cash?

Yes, you can convert Litecoin to cash by selling it on an exchange and withdrawing the funds to your bank account.

CoinJar Europe Limited (CRO 720832) is registered and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.