Claim your free €20 Bitcoin bonus now! Just verify your ID. Weekly payouts every Friday! Don't invest unless you're prepared to lose all the money you invest.

Buy Kyber Network (KNC) in Ireland With EUR | CoinJar

Kyber Network

KNC

Overview

What is Kyber Network?

Why buy KNC? Kyber Network Crystal is a native token of the Kyber Network, a decentralised protocol that facilitates the exchange of , including cryptocurrencies. So what is Kyber Network? Why would you consider investing in it? Let's find out.

What is Kyber Network?

acts as a liquidity hub for crypto trading and decentralised finance (DeFi). Here are some key points:

Liquidity aggregation

Kyber aggregates liquidity from various sources, including decentralised exchanges (DEXs) and liquidity pools. This ensures that traders can access competitive rates when swapping tokens.

Instant swaps

Traders can instantly swap tokens without leaving their wallets. Kyber’s technology connects deep liquidity from diverse sources, providing seamless and efficient transactions.

Liquidity providers

KNC holders can participate as liquidity providers by depositing tokens into Kyber pools. They earn swap fees and farm rewards while maintaining high capital efficiency.

Governance

KyberDAO, a Decentralised Autonomous Organisation, allows KNC holders to vote on governance proposals. By staking KNC tokens, you can shape Kyber’s future and earn rewards from trading fees.

Why Consider Buying KNC?

Liquidity and efficiency

Kyber Network ensures optimal liquidity for traders. By aggregating liquidity from multiple DEX protocols, it offers competitive rates for token swaps. Whether you’re a trader or a DeFi user, KNC’s liquidity benefits are hard to ignore.

Earning opportunities

As a liquidity provider, you can earn swap fees and rewards by depositing tokens into Kyber pools. The capital efficiency ensures that your assets work harder for you.

Governance participation

Staking KNC tokens allows you to actively participate in Kyber’s governance. Your votes influence decisions that shape the network’s future, and you earn KNC rewards in the process.

Battle-tested reliability

Kyber’s technology has facilitated over $7 billion in trades. Developers are able to build on Kyber with confidence.

Conclusion

Kyber Network Crystal (KNC) plays a crucial role in DeFi liquidity and governance. Whether you’re a trader, liquidity provider, or simply interested in the DeFi space, KNC can help facilitate the exchange of digital assets.

Buy using a bank transfer!

Buy Kyber Network using a bank transfer. Get cash in your account with SEPA. Convert crypto-to-crypto with a single click.How to buy Kyber Network with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Featured In

CoinJar App

All-in-one crypto wallet

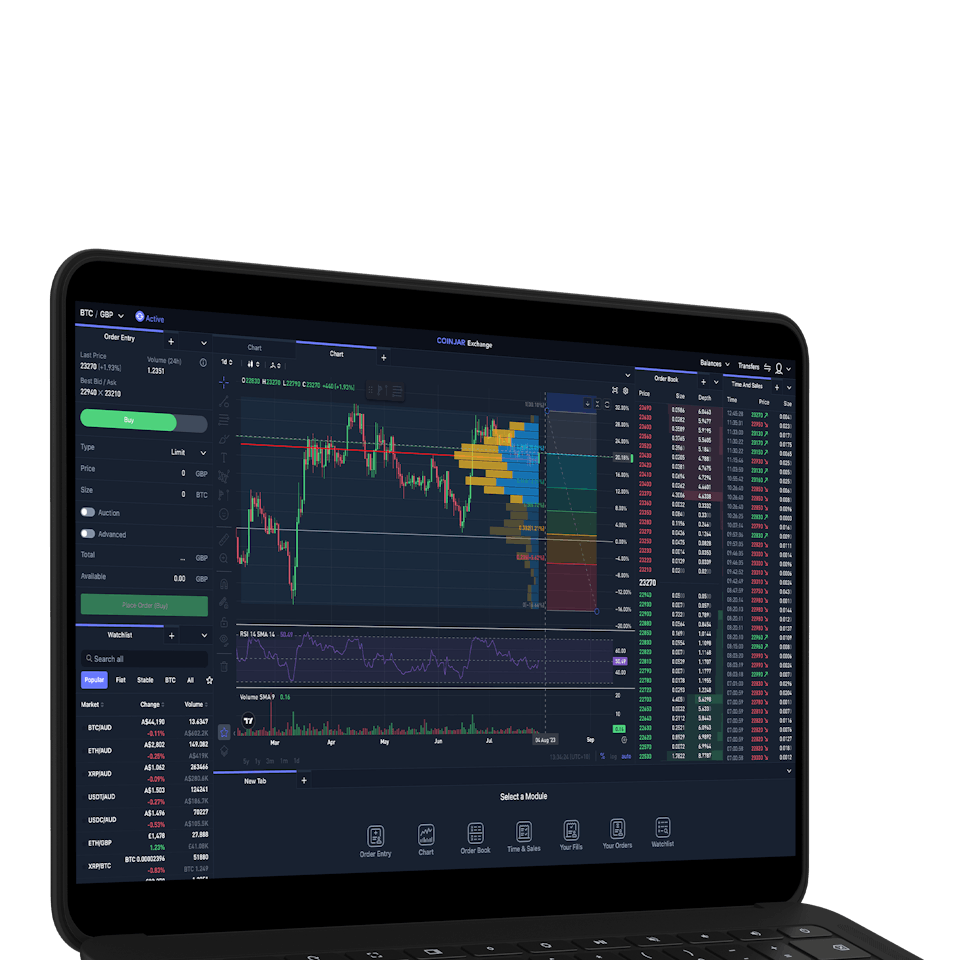

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Kyber Network Crystal (KNC)?

KNC is the native token of Kyber Network, a decentralised liquidity protocol built on the Ethereum blockchain. It plays a crucial role in facilitating instant settlement of tokens and ensuring liquidity for traders and DeFi users.

CoinJar Europe Limited (CRO 720832) is registered and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.