Claim your free €20 Bitcoin bonus now! Just verify your ID. Weekly payouts every Friday! Don't invest unless you're prepared to lose all the money you invest.

Buy Curve DAO (CRV) in Ireland With EUR | CoinJar

Curve DAO

CRV

Overview

What is Curve DAO?

Want to buy Curve DAO (CRV)? CRV is the governance token for Curve Finance, a (DEX) protocol. Unlike traditional exchanges, focuses on allowing users to swap between assets that have very similar underlying values with minimal slippage.

(An example of slippage in crypto is when you check the price of a crypto, then go to buy, but in the time between deciding and buying, the price has jumped. Slippage is the difference between the price you expected and the actual price you paid.)

Curve DAO is designed for stablecoin swaps and minimal volatility trading to avoid slippage.

Why does Curve DAO exist?

Curve DAO was created to give users a say in how the protocol operates. Here are some key points:

Governance

CRV holders can vote on proposals that impact the Curve platform. These proposals can include changes to the protocol’s parameters, fee structures, and new features.

Liquidity mining

Curve incentivises liquidity providers by rewarding them with CRV tokens. Liquidity providers play a crucial role in maintaining stablecoin pools, which are essential for efficient trading.

Staking and veCRV

CRV can be staked to earn veCRV (voting escrow CRV). veCRV holders have additional voting power and can participate in important decisions. The longer you stake CRV, the more veCRV you receive.

Why would someone want to buy CRV?

Governance influence

If you’re interested in shaping the future of Curve Finance, owning CRV gives you voting power. You can participate in governance proposals and help decide the direction of the protocol.

Liquidity mining rewards

By providing liquidity to Curve pools, you can earn CRV tokens. These rewards incentivise users to contribute to the platform’s liquidity, which benefits all traders.

Potential price appreciation

Like any other cryptocurrency, CRV’s price can fluctuate. Some investors buy CRV in the hope that its value will increase over time.

Interest in DeFi

If you’re curious about decentralised finance (DeFi), CRV provides exposure to a popular DEX protocol. Learning about Curve Finance and CRV can deepen your understanding of the DeFi ecosystem.

Conclusion: Why Buy Curve DAO (CRV)

Curve DAO plays a vital role in the DeFi landscape, offering stablecoin swaps and governance opportunities. Whether you’re a trader, liquidity provider, or simply interested in crypto, understanding CRV can enhance your knowledge of this exciting space.

Buy using a bank transfer!

Buy Curve DAO using a bank transfer. Get cash in your account with SEPA. Convert crypto-to-crypto with a single click.How to buy Curve DAO with CoinJar

Start your cryptocurrency portfolio with CoinJar by following these steps.Featured In

CoinJar App

All-in-one crypto wallet

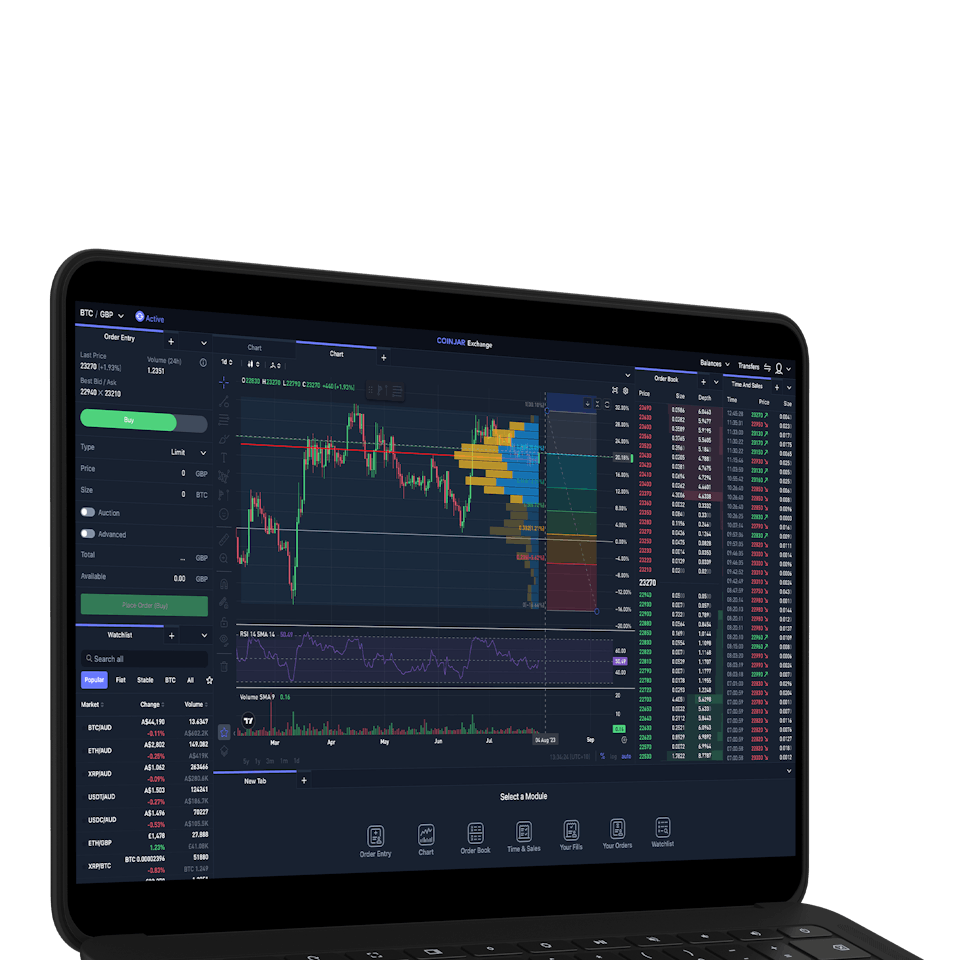

CoinJar Exchange

FOR PROFESSIONAL CRYPTO TRADERSCoinJar DCA & Bundles

AUTOMATE & DIVERSIFY YOUR PORTFOLIO

Frequently asked questions

What is Curve DAO Token (CRV)?

Curve DAO Token (CRV) is an Ethereum-based utility token that powers the Curve.fi decentralised exchange (DEX) protocol.

It facilitates the exchange of ERC-20 tokens, particularly stablecoins, with minimal slippage and competitive fees.

Who created CRV?

CRV was developed by Michael Egorov, a Russian scientist and co-founder of NuCypher.

His expertise in blockchain and cryptocurrency contributed to the creation of Curve DAO Token.

Is Curve DAO decentralised?

Yes, Curve is a decentralised exchange that operates without a central authority. Users maintain control over their tokens.

Why Is CRV called a billion token?

CRV is sometimes referred to as a “billion token” due to its large supply and distribution.

Is the Curve DAO token a good investment?

The Curve DAO Token (CRV) is the governance token for Curve Finance, a decentralised exchange (DEX) protocol. Its value depends on various factors, including market sentiment, adoption, and the overall performance of the Curve platform.

While CRV has seen price fluctuations, it’s essential to do thorough research and consider your risk tolerance before investing. Some investors find CRV attractive due to its governance features and liquidity mining rewards.

What are some of the established cryptocurrency DAOs?

Some notable DAOs include:

: Known for its stablecoin , MakerDAO is a decentralised lending platform.

DAO: Uniswap is a popular decentralised exchange with a governance token (UNI).

: A lending and borrowing protocol with its governance token ().

Is Curve CRV cryptocurrency a good investment?

CRV’s value depends on various factors. Research its use cases, governance features, and community support before considering it as an investment.

What are DAOs in crypto?

Decentralised Autonomous Organizations (DAOs) are entities governed by smart contracts and token holders. They allow decentralised decision-making and management without a central authority.

What is the most established blockchain to form a DAO?

Ethereum remains a popular choice for DAOs due to its maturity, tools, and ecosystem. However, other chains like Solana and Cardano are also being explored for their scalability and cost-effectiveness.

Are DAO tokens a scam?

Not all DAO tokens are scams. However, like any investment, there are risks. Be cautious, do due diligence, and avoid suspicious projects.

Will Swerve overtake Curve Finance?

It’s uncertain. Both Swerve and Curve Finance are DEX protocols, but their success depends on adoption, liquidity, and community support.

Which crypto community is bigger, DeFi or DAO?

The DeFi (Decentralised Finance) community is more extensive and established. DAOs are a subset of DeFi, focusing on governance and decision-making.

Are DAO tokens considered a security?

The regulatory status of DAO tokens varies by jurisdiction. Some may be considered securities, while others are utility tokens. Seek legal advice if needed.

What is the most popular cryptocurrency for DeFi platforms?

Ethereum (ETH) is the most popular blockchain for DeFi platforms due to its smart contract capabilities and extensive ecosystem.

Which DeFi project is the most valuable one?

MakerDAO (with its stablecoin DAI) and (a lending platform) are among the most valuable DeFi projects.

What’s a use case for a DAO?

DAOs can be used for decentralised governance, managing funds, decision-making, and community-driven projects.

What is the role of wrapped tokens in the DeFi ecosystem?

Wrapped tokens represent other assets (e.g., BTC, ETH) on a different blockchain (e.g., Ethereum). They enable cross-chain interoperability within DeFi.

What is DeFi, and how do you buy and sell DeFi tokens?

DeFi refers to decentralized financial services. You can buy and sell DeFi tokens on decentralized exchanges (DEXs) like Uniswap or centralized exchanges that list them.

What are some examples of a DeFi token?

Examples include UNI (Uniswap), AAVE, COMP (Compound), and MKR (Maker).

What are the top 5 popular DeFi projects?

The top DeFi projects often include Uniswap, Aave, Compound, MakerDAO, and Synthetix.

What is yield farming?

Yield farming involves staking crypto assets in DeFi protocols to earn rewards, often in the form of additional tokens.

Curve incentivises yield farming by rewarding liquidity providers with CRV tokens.

What is impermanent loss?

Impermanent loss occurs when the value of assets in a liquidity pool fluctuates, causing LPs to lose potential gains compared to simply holding the tokens.

How can I buy Curve DAO tokens?

To buy CRV, use a cryptocurrency exchange like CoinJar.

Deposit funds, search for CRV, and make your purchase.

What is trading volume?

Trading volume refers to the total value of assets traded on a platform within a specific time frame. High trading volume indicates liquidity and active participation.

What is an automated market maker (AMM)?

An AMM is a type of DEX that uses smart contracts to facilitate token swaps automatically. Curve.fi is an example of an AMM.

How many CRV tokens are in circulation?

The circulating supply of CRV tokens represents the total number available for trading. Check the latest data to find the exact number.

What is voting power in Curve DAO?

CRV holders can use their tokens to participate in network governance.

Voting power allows you to influence decisions related to the protocol.

What determines CRV token value?

CRV’s value is influenced by factors such as market cap, demand, and utility within the Curve ecosystem.

How do liquidity pools work?

Liquidity pools are pools of tokens provided by users to facilitate trading on AMMs.

CRV incentivizes liquidity providers to deposit tokens into these pools.

Can I vote on proposals in Curve DAO?

Yes! CRV holders can vote on proposals related to protocol changes, fee structures, and new features.

CoinJar Europe Limited (CRO 720832) is registered and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.