Claim your free €20 Bitcoin bonus now! Just verify your ID. Weekly payouts every Friday! Don't invest unless you're prepared to lose all the money you invest.

Onchain: It's giving Bull

February 28, 2024

This week, it's all about number go up, which hints at a bigger trend: the bull market making a comeback.

Story One

MetaMask nears record users

While Bitcoin has already passed it's all-time high in countless countries with weak national currencies, such as Japan, MetaMask is still on its way to the promised land. Recently, the team behind the most-used wallet extension shared that their active user count was on track to reach its highest since January 2022, when 31.7 million users relied on the wallet to get drained their trades done.

MetaMask's monthly active users have steadily grown over the past four months, marking a 55% increase. Note, however, that they count everyone who has the app and the extension installed, which means I am already 2 of those users. You do the math.

The increase in users came alongside an announcement of making MetaMask safer to use, as countless BAYC holders demonstrated that they cannot be trusted with making sensible decisions. Blockaid to the rescue. The security tool alerts users of malicious transactions and phishing attempts. Over 30k malicious transactions have already been prevented this way - but we all know there is little joy in prevention.

Takeaway: The security tool is a solid move to make MetaMask less insecure. Nevertheless, I don't get why you'd use MetaMask when Rainbow has icons for native networks, and... POINTS!

Story Two

Eigenlayer raising 100 million

Never let a lack of production-ready products stop you from raising millions in funds. So the lesson goes from the crypto crowd as soon as they sense the first precursors of an uptrend. First investors and degens aped $2 billion into the Blast multi-sig, identifying as an L2. Now, we have a16z leading a Series B for Eigenlayer Labs, closing at 100 million. One must wonder what they're going to do with the 100 million. Maybe buy up the chip industry in a developing country? But no, this isn't about AI.

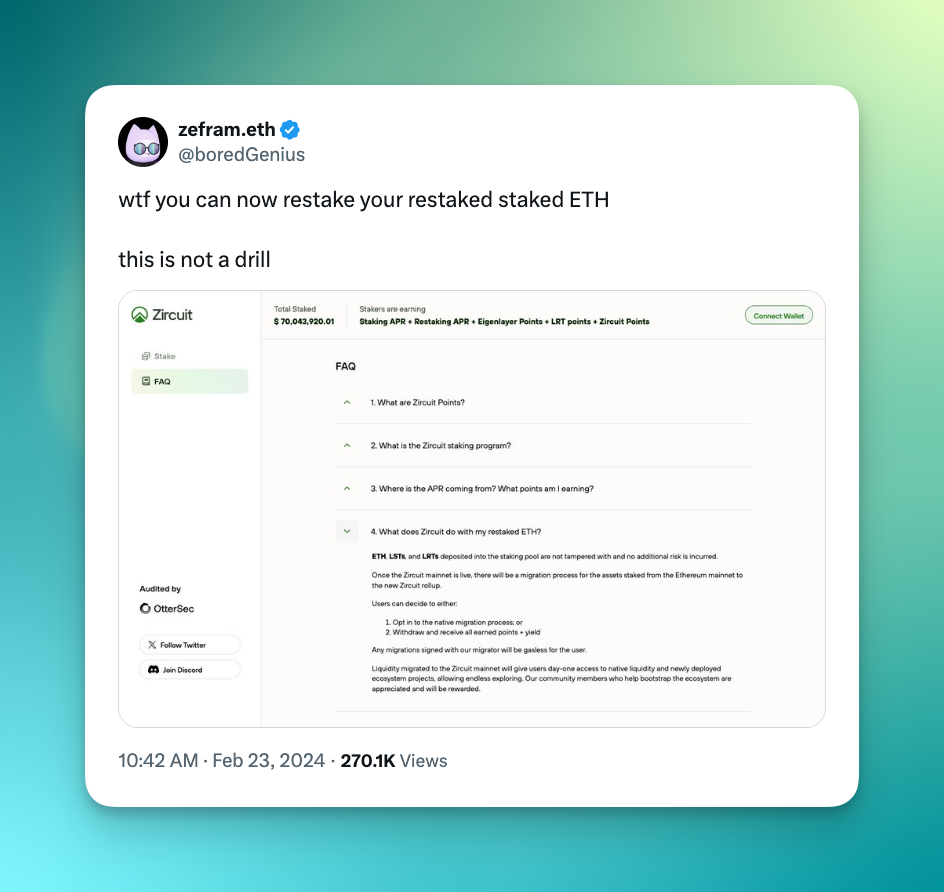

It's about a middleware protocol on top of Ethereum that allows the rehypothecation of Ether. In short, stake once, secure a variety of apps. The idea is simple: allowing other protocols to rely on the security of Ethereum stakers instead of bootstrapping their own. For stakers, it means getting more bang for their buck. For builders, Eigenlayer offers a way to bootstrap a network without having to build up your own validator network.

Needless to say, re-staking like this is the new hot thing, and Eigenlayer has already secured $8 billion in deposits without any of their services being live yet.

Takeaway: It isn't just me who feels a little uneasy about this re-staking and re-re-staking business. Even Vitalik agrees that it introduces "high systemic risks to the ecosystem." I, for one, remember what happened when TradFi pulled this off with mortgages.

Story Three

Governance getting utility

Uniswap has seen a huge increase from $7.22 to over $10 in its token price after the foundation floated the idea of distributing fees to stakers.

So far, UNI's native tokens' utility has allowed holders the ability to vote. Voting is cool; making money is better - at least in crypto. And so, the hope has always been that, eventually, some of that value captured by Uniswap would be redistributed back to token holders.

Dreams might become reality as we enter a new paradigm: vote-to-earn. Jokes aside, in this on-chain version of representative democracy, UNI stakers delegating their tokens to trustworthy individuals will be eligible for a portion of the trading fees earned through the DEX.

Even though the idea of the fee switch has floated around ever since Uniswaps' inception, this time, the market seems confident it'll actually happen. As long as

Takeaway: Voter fatigue is real. During bear markets, people stop engaging altogether as there are more important things in life than voting on how your magic internet money trading venue runs its business. Is paying people for it a good idea, though? I don't know. We probably need a Greek Philosopher AI to get an answer for that.

Fact of the week: Speaking of chips and all that tech... A single smartphone nowadays has 100,000 the processing power of the computers NASA used to land a person on the moon in 1969. And yet, crypto hasn't gone to the moon.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: .

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

EU residents: CoinJar Europe Limited (CRO 720832) is registered as a VASP and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s .

More from CoinJar Blog

CoinJar Europe Limited (CRO 720832) is registered and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

Apple Pay and Apple Watch are trademarks of Apple Inc. Google Pay is a trademark of Google LLC.

This site is protected by reCAPTCHA and the and apply.