CoinJar Instant Buy

Got card? Buy crypto.

Say goodbye to slow moving bank deposits with CoinJar Instant Buy. Simply add your Visa or Mastercard to your CoinJar account and when you buy crypto you’ll be able to use your credit or debit card to make the purchase. You can even use Apple Pay or Google Pay straight from your device.

It’s fast, convenient and with a 2% transaction fee, CoinJar Instant Buys are some of the cheapest crypto credit card purchases in the world.*

How Instant Buy works

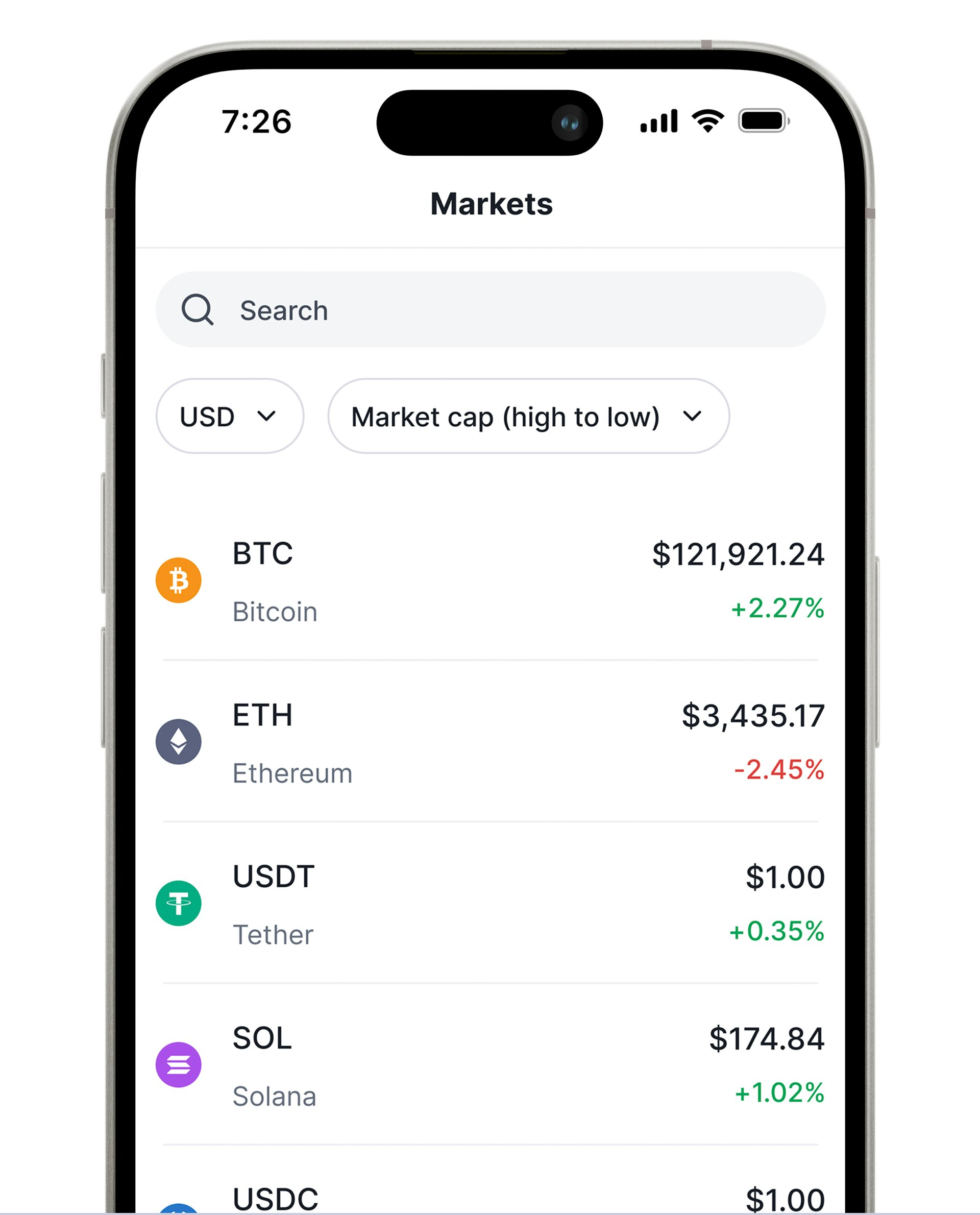

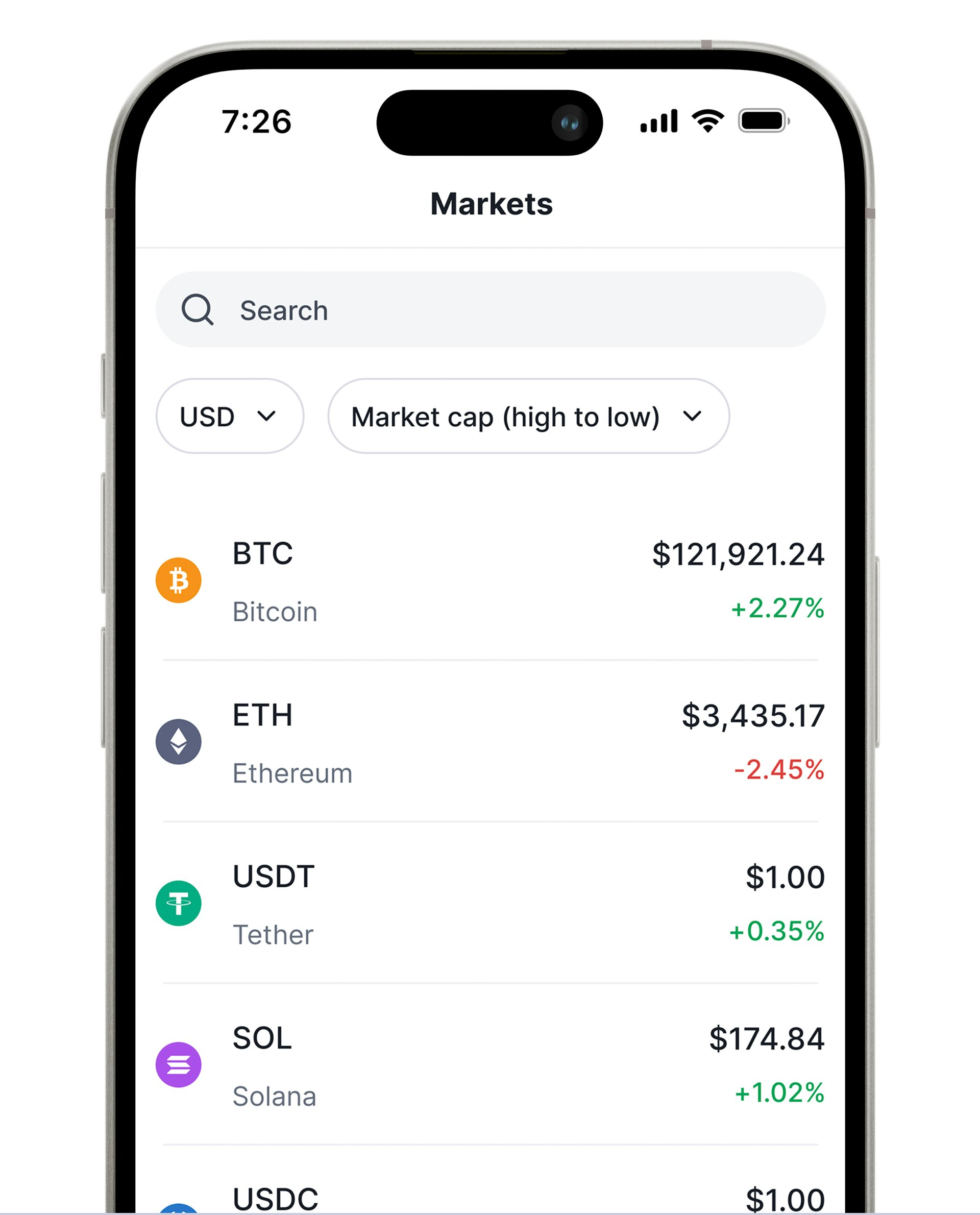

Pick your crypto

Choose from more than 60 leading cryptocurrencies.Choose a card

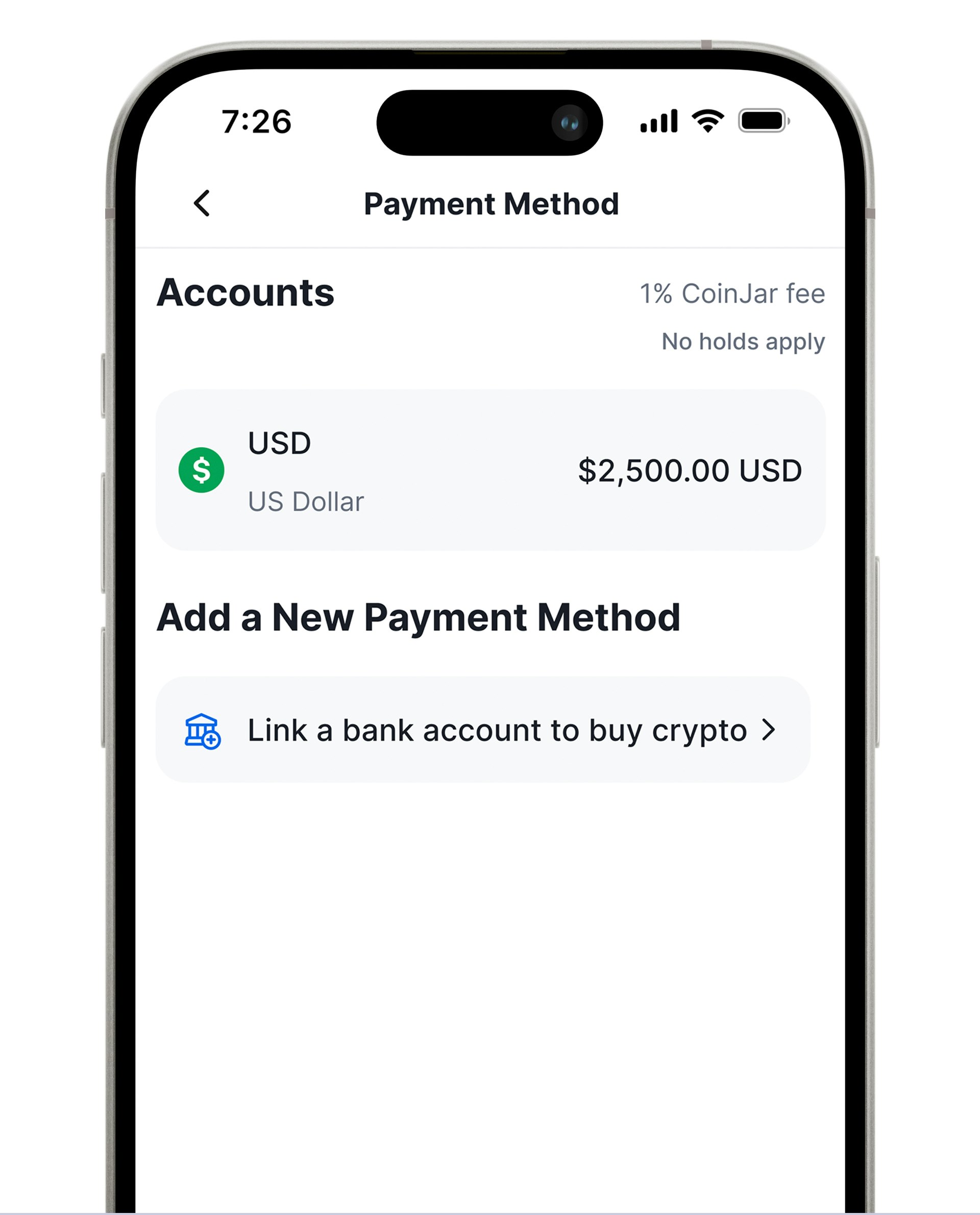

Add your Australian Visa or Mastercard to your account or choose Apple Pay or Google Pay.Make a purchase

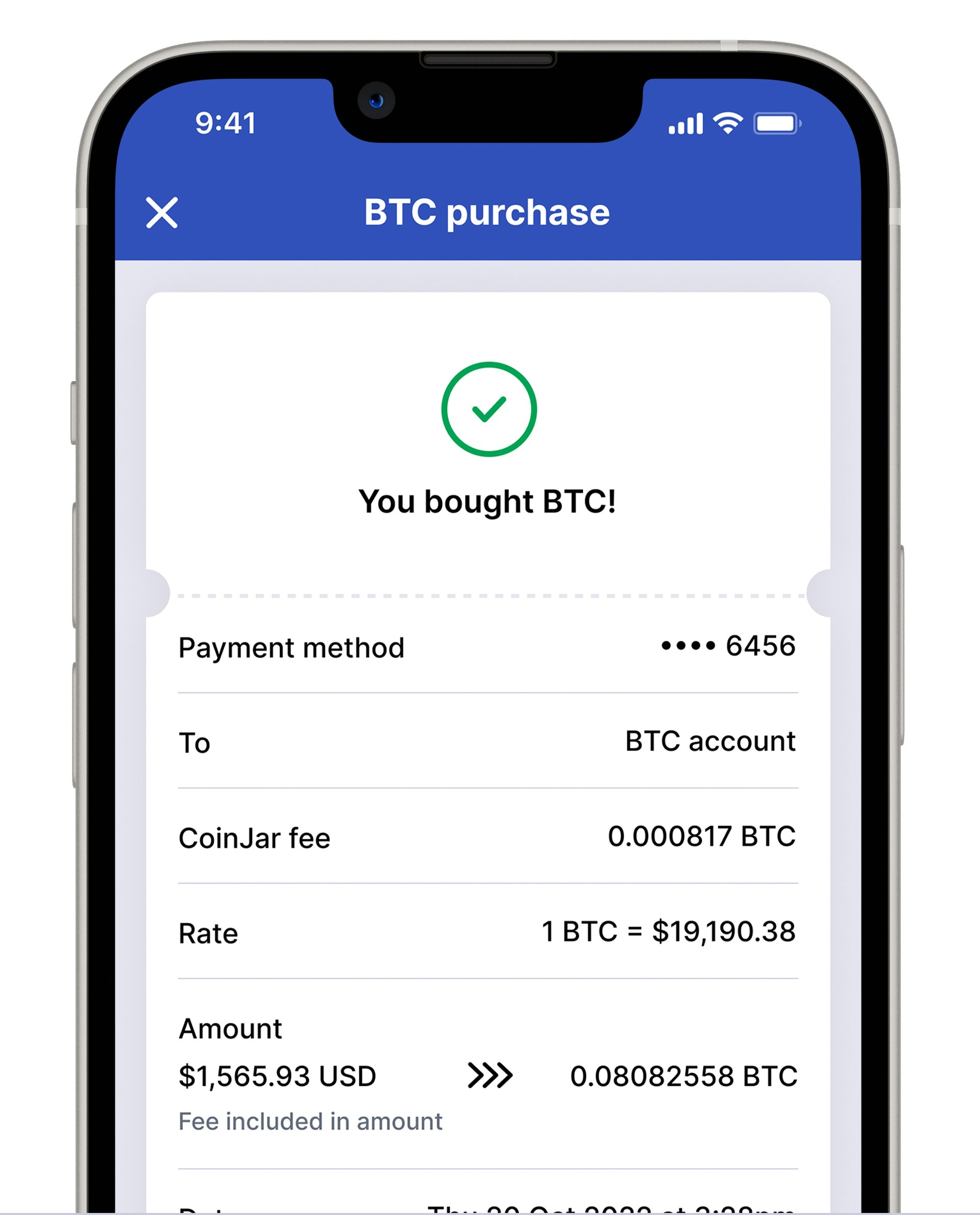

Enter your amount, click confirm and boom: crypto in your wallet.^

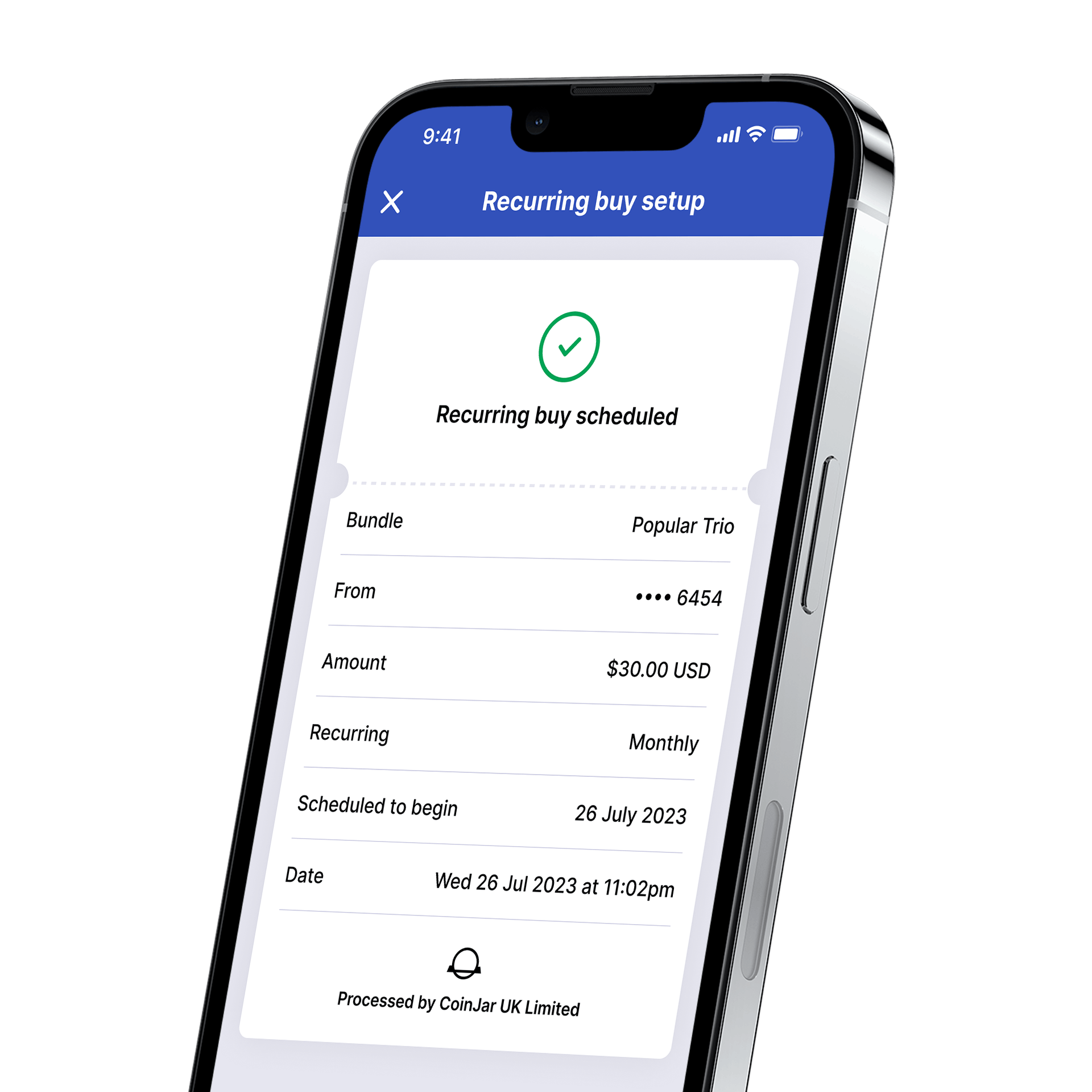

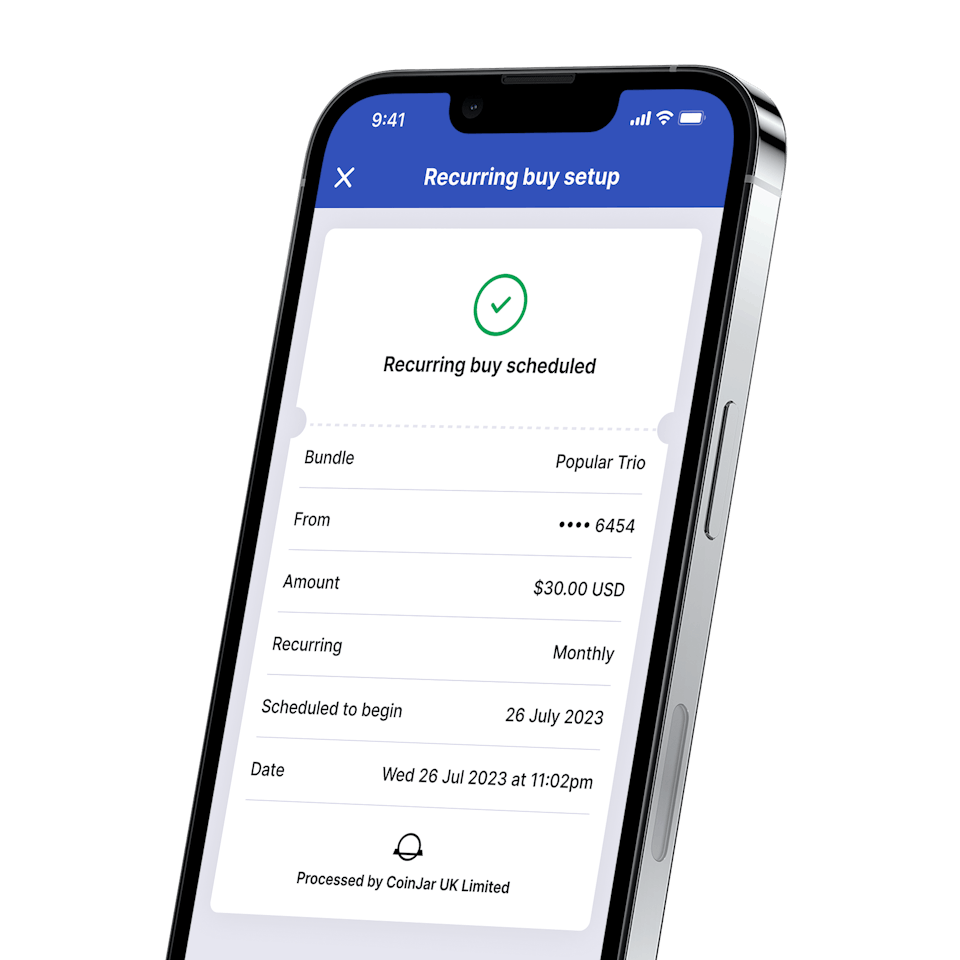

CoinJar Bundles & DCA

Automate & diversify your portfolioCoinJar Bundles & DCA

Automate & diversify your portfolio

*As of 26 April 2021. This excludes any additional fees that you may be charged by your bank or credit card provider.

^All purchases made with credit or debit card will be subject to a 7-day reserved balance. For more information, see our dedicated Knowledge Base article.

Frequently asked questions

Can I earn reward points when buying cryptocurrency with my credit card on CoinJar?

It depends on your credit card offerings. Some card issuers may treat cryptocurrency purchases as cash advances, which often don’t earn rewards and may have higher interest rates.

How do I link my bank account to CoinJar for cryptocurrency purchases?

You’ll need to use your bank account to fund your CoinJar account after the setup process. This allows for seamless transfers when buying and selling cryptocurrency.

Will I be charged interest when buying cryptocurrency with a credit card?

Yes, interest rates apply to any outstanding balance on your credit card, including crypto purchases.

What are the advantages of using a credit card to buy crypto on CoinJar?

Credit cards offer convenience and the potential to earn rewards. They can also be handy for larger crypto purchases if you don’t have enough funds readily available in your bank account.

Is there an annual fee for using a credit card?

Your credit card issuer might charge an annual fee. Check your card agreement for any applicable fees. Your credit card issuer sets the due date.

Are there any credit limits for buying crypto on CoinJar?

Yes, your credit card issuer sets a credit limit, which may be lower for crypto purchases than for regular transactions.

Is CoinJar a financial institution?

No, CoinJar is a cryptocurrency exchange, not a financial institution. It facilitates buying and selling crypto but doesn't offer traditional banking services.

Can I use balance transfers to buy crypto on CoinJar?

This depends on your credit card issuer. Some allow balance transfers for crypto purchases, while others don’t. Check with your financial institution for their specific policy.

What are the advantages of using a credit card to buy cryptocurrency?

Credit card purchases are processed almost instantly, allowing you to buy cryptocurrency quickly and take advantage of market opportunities. This is especially beneficial in volatile markets where prices can change rapidly.

Many credit cards offer rewards programs where you can earn points or cashback on your purchases, including cryptocurrency. These rewards can offset some of the costs associated with buying crypto.

Using your credit card responsibly and paying off your balance on time can help improve your credit score.

Credit cards are widely accepted, making it easy to buy cryptocurrency even if you don't have readily available funds in your bank account.

However, it's crucial to weigh these advantages against potential drawbacks such as high interest rates, fees, and the risk of accumulating debt.

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.