Offchain: ZK-this, ZK-that, ZK-everything

February 22, 2023

Share this:

Zero-knowledge, zero problem: all you need to know about this crypto narrative.

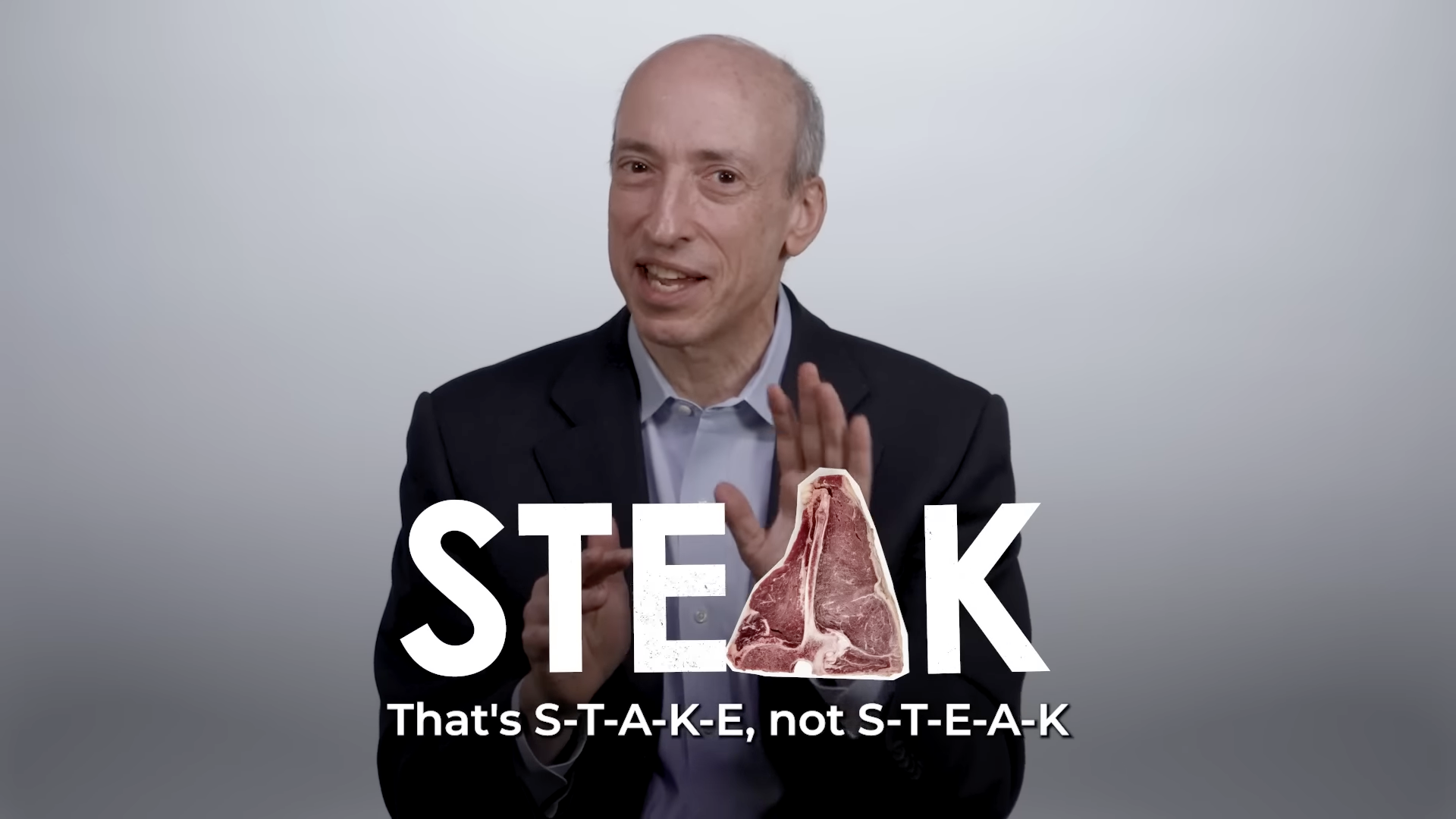

It's been a tough week for anyone following crypto regulations closely. But instead of focusing on the attempts of the SEC's Gary Gensler trying to explain to us that staking has nothing to do with steak (watch at your own discretion), this post focuses on the ZK-narrative.

You might have encountered the ZK acronym when scrolling through Twitter and wondered what it's about. It's everywhere, with companies dropping announcements left and right of adding ZK to their products. Some even suggest it could be a genius fundraising hack - just like adding AI to your pitch deck 10 times.

If you're raising Venture capital, just spray your pitch deck w a few dozen subliminal "ZK" watermarks and watch your valuation triple. ZK-defi, ZK-gaming, ZK-NFTs... it's all happening in ZK-VC

— 💜☀️🌿🧪🖨️ (@chainyoda) January 31, 2023

This leads to the question...

What is ZK, and why does it matter?

While the myth persists - especially among regulators who should know better (hey gary 👋) -- decentralization does not provide anonymity. Everything you do on a blockchain is stored publicly and traceable to your wallet address. That doesn't directly reveal your real identity, but companies like Chainalysis are really good at tracking people behind wallets down. Not very private.

If crypto wants to gain mass adoption in times of countries exploring CBDCs, we'll need solutions that enable privacy. Zero-Knowledge proofs promise to be that. It's an encryption technology that lets users prove something is true without revealing the actual information.

A popular example to explain how that works is a Where is Wally's puzzle. To prove you found him without revealing his location, you could just take a big piece of paper, cut a hole into where the head is, and then put it over the puzzle. Proving something is true without revealing the information turns out to be very useful for scaling blockchains.

ZK Rollups

A big driver of the entire ZK narrative are ZK rollups built to help Ethereum scale. If you imagine Ethereum as a factory, it has one line to produce blocks with a fixed number of workers. It gets crowded easily when people want to produce more, leading to congestion.

Rollups take the workload off the main factory line and establish parallel lines validating transactions. Optimistic rollups assume that all workers on parallel lines do proper work and only verify it when a supervisor flags a problem.

ZK Rollups, in contrast, use ZK technology to generate validity proofs representing receipts confirming transactions are authentic without requiring supervisory surveillance. They are faster and reduce storage requirements. The only problem is that the Ethereum Operating System (called Ethereum Virtual Machine) isn't compatible with ZK-proofs.

It's like this kid's toy, which taught us all that you cannot squeeze the rectangular form (ZK proof) into the triangle-shaped hole (EVM).

That's where ZKEVM comes in.

ZK EVM

ZK Rollups are great for scaling transactions and simple payments, but not much more. Could we have a rollup that supports smart contracts? The answer is yes. It's called zkEVM and is the latest race rollup companies are engaged in.

ZK EVMs are a type of rollup that emulate the EVM so developers can build as they would on Ethereum. This means dApps could easily migrate to rollups offering users secure scalability and cheaper transactions. Some estimate that rollups could process up to 2,000 transactions per second.

Current contenders in the ZK EVM race are Polygon, who just announced the launch of their ZK-EVM on March 27th, and zkSync. While these two companies might fight over who the first zkEVM is, for Ethereum, it doesn't matter. Both contribute to, as Vitalik put it, the future of Ethereum scalability.

Overall, ZK technology promises to bring improvements to privacy and scalability, which we might all long for whenever the next big airdrop is around. It better not be a CBDC 🎈

Naomi from CoinJar

The above article is not to be read as investment, legal or tax advice and takes no account of particular personal or market circumstances; all readers should seek independent investment, legal and tax advice before investing in cryptocurrencies. This article is provided for general information and educational purposes only. No responsibility or liability is accepted for any errors of fact or omission expressed therein. CoinJar, Inc. makes no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability, or completeness of any such information. Past performance is not a reliable indicator of future results.

Share this:

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s Privacy Policy.

More from CoinJar Blog

Onchain: In bad taste

February 25, 2026ICYMI, the tech bros have once again discovered taste, so get ready to be lectured by dudes who think it's acceptable to live with one ceiling light on what to wear and consume....Read more

Onchain: The selling continues

February 11, 2026Until morale improves, or so I hope. Story One L2s are pointless Tweets the guy who advocated for them as part of the Ethereum scaling roadmap. Perhaps to deflect from his...Read more

Onchain: Lots of things on sale

January 28, 2026Story One Crypto Social for Sale Been an interesting time to observe what happens to the still-standing crypto social networks. Aave, a leading DeFi protocol and creator of...Read moreYour information is handled in accordance with CoinJar’s Privacy Policy.

Copyright © 2025 CoinJar, Inc. All rights reserved.

CoinJar, Inc. is a registered Money Services Business with FinCEN and licensed as a money transmitter, NMLS #2492913. For a list of states in which CoinJar, Inc. is licensed or authorized to operate, please visit here. In certain other states, money transmission services are provided by Cross River Bank, Member FDIC.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.