Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

Onchain: Stranger

December 4, 2024

That's the path crypto seems to be going down. It's also the name of a novel by Camus, published in 1942. In it, he wrote, “After a while, you could get used to anything.”

I am approaching that point, but that won't stop me from reporting in from the frontlines of the absurd. Or the trenches, as we've coined gambling in crypto now.

Story One

Smart contracts are not property

Not that any of us would ever have considered smart contracts to be property, to begin with. Nevertheless, it took the Fifth Circuit Court of the US to rule that in reaction to the Treasury sanctioning Tornado Cash two years ago.

Tornado Cash is a mixer; it takes coins and obfuscates their origin, which allows users to maintain their privacy when sending transactions. Unfortunately, it has also been discovered as a useful tool by North Korea's GDP Growth Working Group (others call them Lazarus), who used it to launder $7 billion in proceeds from crypto exploits.

As a reaction, the US Treasury sanctioned Tornado Cash, making it somewhat illegal. Two Tornado Cash developers were arrested for money laundering and put in jail.

It was the first case of a smart contract being sanctioned, and it might be the last, as the court ruled that the treasury was overstepping its boundaries. According to their ruling, the smart contract as automation software isn't owned or controlled by humans.

A win for privacy and anyone building truly decentralized protocols.

Takeaway: Even the court will acknowledge a smart contract without anyone able to control it as sufficiently decentralized not to be sanctioned as they did.

Story Two

Fair launch is the new fair launch

If you've been around long enough, you might remember when Pepe and Shiba launched. It was a time when memecoins would write Fair Launch on their website and then allocate large portions of their supply to their team under the guise of special community allocation.

Fair launch is back. And this time, it's different. Take Clanker, an AI agent on Farcaster that launches memecoins based on casts. Here's the kicker: everyone has to buy in, including the person who told it to launch the coin.

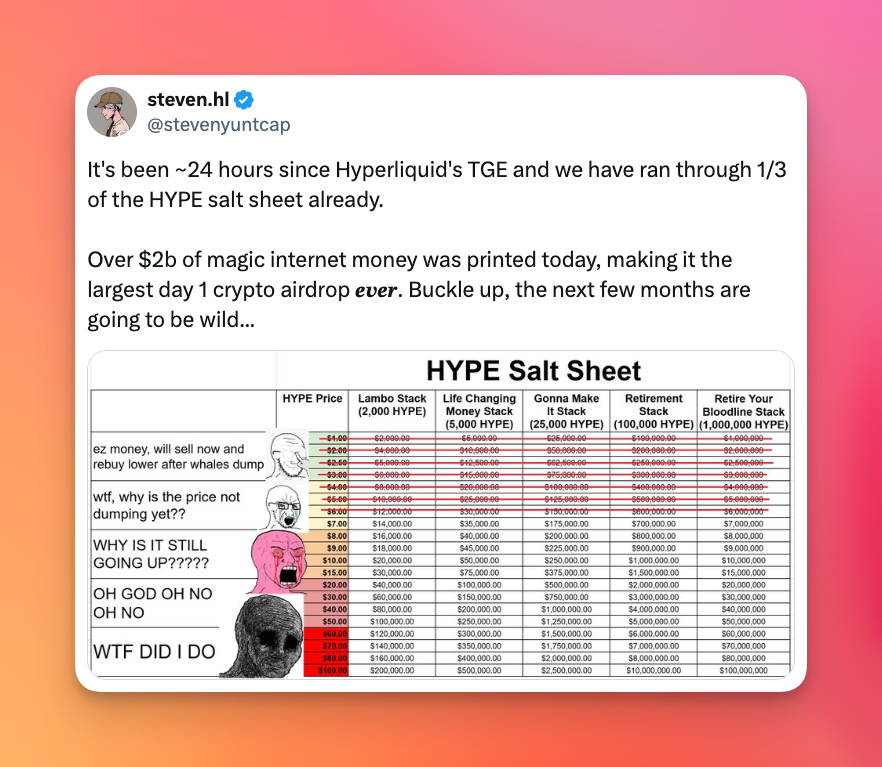

But FC isn't the only place for a fair launch. On November 29th, Hyperliquid, a perpetual trading platform and L1, executed the biggest airdrop worth 1.2 billion.

While most launches this year have been cynically viewed as yet another opportunity for VCs to dump on retail, Hyperliquid gave 30% of its supply to users of its product - without any lockup. No money was given to private investors, exchanges, or market makers.

And it paid off. Within one hour since its launch, trading volume had reached $157 million. At the time of writing, the token price hovers around $9, a solid 3x.

Takeaway: The new meta is the old meta. With all the excitement about fairness, though, don't forget to ask yourself whether any project you invest in has a point.

Story Three

Bananas

Never has a banana had more spotlight than the one featured in the artwork by Maurizio Cattelan. He decided that taping a Banana against the wall with duct tape was High Art. And the art world agreed - just as they did when

If you don't get it, it's avant-garde. If you don't understand why this Banana is in a crypto newsletter, it's because an obnoxious, attention-seeking crypto-rich entrepreneur bought it for $6.2 million.

He wouldn't be Justin Sun if he had left it at that. No, the founder of Tron also organized a

He wasn't the first to eat the Banana, yet the first to spend $6.2 million plus the money it took to purchase bananas and duct tape for all the event attendees - so they could recreate the experience at home.

Takeaway: This, too, must be avant-garde because I don't get it.

Fact of the week: On the topic of Bananas, it's always a good idea to eat them for the potassium. But you probably know that. What you didn't know is that technically, they are classified as berries while growing on plants that are considered herbs.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: .

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

EU residents: CoinJar Europe Limited (CRO 720832) is registered as a VASP and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s .

More from CoinJar Blog

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.