Coming soon to the USA! While our services may not be available yet, sign up now to stay in the loop as we bring our innovative crypto solutions to America.

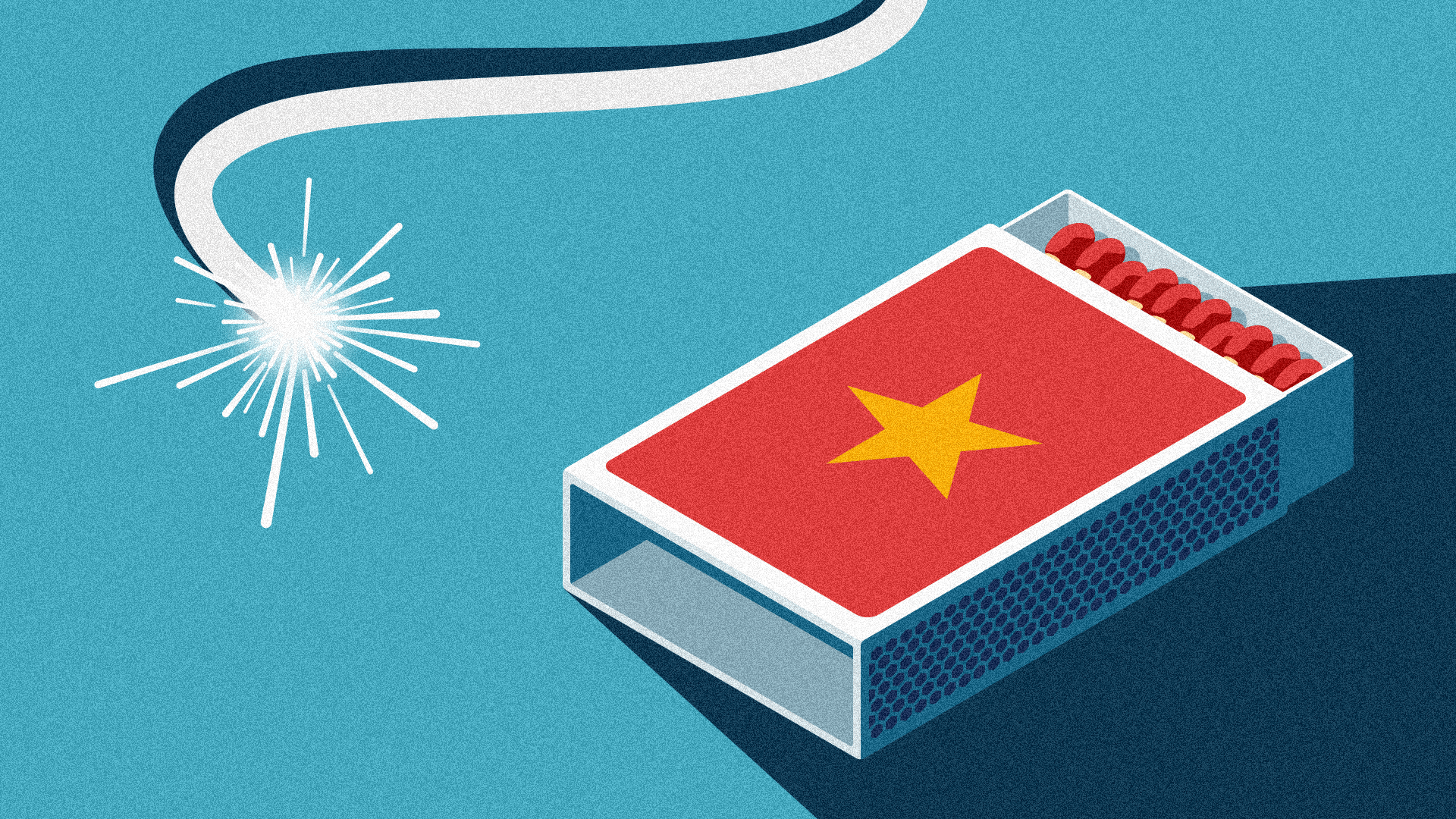

BlockCha̶ina: China Says "Get in the Car"

October 31, 2019

After months of brutal downtrend, bitcoin just had its best day since 2011 – and you can thank Xi Jinping.

So, let’s recap. In the three months to June, bitcoin, seemingly without warning, quadrupled in price. Euphoria reigned, naysayers were roundly booed, down-payments were made on many lambos. And then, for the next three months, the price was slowly, mercilessly ground back down. Despair reigned, boosters were roundly booed, alts were left bloody in the street. When the price dumped to US$7300 with barely a hint of resistance, the writing was on the wall: get ready for new lows because your internet magic money is dead in the water.

Then on Friday night, Xi Jinping, the President of China, appeared on national TV and said that his country of 1.38 billion people needed to dedicate itself to the .

Fasten your seatbelts

The result of this announcement was less explosive than it was thermonuclear. The price of bitcoin surged 45% in 12 hours, a feat that hasn’t been achieved since 2011, back when bitcoin was trading at a little over US$5. So, what the hell just happened?

The long and the short of it

I’m always suspicious of the convenient narratives that media outlets deploy to explain the latest shift in the bitcoin price. When the price dropped last week, half the sites were calling it a response to the Congressional hearings on Libra, the rest were saying it was somehow tied to Google’s announcement that it had achieved .

In all likelihood, the drop was purely technical, a response to a lack of bullish momentum that allowed short-sellers to get on top of the price. While these moves seem dramatic in the moment, they’re driven primarily by cryptocurrency’s hypercharged derivatives market, which account for somewhere between the volume of the traditional buy-and-sell exchanges. It’s sentiment-driven trading on steroids: traders scrying charts for clues as to the market direction and then shorting or longing accordingly.

100x or bust

Yet this also explains why the resultant correction upwards has been so savage. Every time bitcoin dropped over the last few months, traders opened new shorts. As they became more confident, the shorts become larger and more leveraged. When President Xi did his thing on Friday, the price started rising organically, which liquidated a bunch of shorts, which pushed the price up, which liquidated more shorts and on and on until half the downtrend had been eliminated in one fell swoop.

While there’s still plenty to come out in the wash, here’s what we do know:

- Like it was in 2016 and 2017, China remains the most important story in crypto, but this time they’re embracing blockchain rather than rejecting it.

- , not just bitcoin – China-facing coins could be well-placed for a surge.

- and the conditions for a new bullish market have been set. Fingers crossed for a strong finish to the year.

- The old adage has never been truer: time in the market beats timing the market. So buy, HODL and treat yourself to a margarita.

Ask CoinJar

Margin trading sounds fun! How does it work? Should I do it?

To quote Reverend Lovejoy: short answer yes with an “if”, long answer no with a “but”.

Margin trading works by allowing you to bet on whether the price of bitcoin (or any other asset) is going to go up or down. At a basic level, this isn’t so different from regular trading, but there are two key differences: you’re never trading actual, physical bitcoin, only using it as collateral; and you can leverage that bitcoin by a factor of 5, 10 or even 100, meaning that if you bet right your gains are multiplied five-, ten- or even one hundred-fold.

When you “long” bitcoin – that is, you bet that the price is going to go up – you decide how much to wager on the bet and how much leverage you want to use. Based on this, you’re assigned a liquidation price: the price at which your entire position will be automatically sold on market to cover your losses. The higher your leverage, the closer to the starting price that liquidation level will be. Choose 100x and your margin for error is almost zero.

If this all sounds a lot like gambling, that’s because it is. Margin trading is not for the faint-hearted and requires a tremendous amount of education, diligence and attention to avoid being pulverised. And while the rewards can be great, always keep this at the back of your mind: research has shown around . Are you good enough to be in that 1%?

Like what you see? and never miss out!

We are not affiliated, associated, endorsed by, or in any way officially connected with any business or person mentioned in articles published by CoinJar. All writers’ opinions are their own and do not constitute financial or legal advice in any way whatsoever. Nothing published by CoinJar constitutes an investment or legal recommendation, nor should any data or content published by CoinJar be relied upon for any investment activities. CoinJar strongly recommends that you perform your own independent research and/or seek professional advice before making any financial decisions.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: .

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

EU residents: CoinJar Europe Limited (CRO 720832) is registered as a VASP and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.

On/Offchain

Your weekly dose of crypto news & opinion.

Join more than 150,000 subscribers to CoinJar's crypto newsletter.

Your information is handled in accordance with CoinJar’s .

More from CoinJar Blog

Copyright © 2023 CoinJar, Inc. All rights reserved. The products and features displayed on this website are representative of our Australian and UK services and certain features may not be offered to customers residing in the United States, depending on applicable state and federal regulations.

Google Pay is a trademark of Google LLC. Apple Pay and Apple Watch are trademarks of Apple Inc.

This site is protected by reCAPTCHA and the and apply.