Data Extracted from the CoinJar Exchange Could Flag When to Buy

We take a big long look at market behaviour, seasonal trends, and investor demographics, and give you the skinny on what we discovered.

In this article...

- When is the right time to buy crypto?

- No one knows for sure, but certain data can give us clues.

- Here's what we know from info extracted from the CoinJar exchange.

The market has long been known for its cyclical nature, but what drives these patterns? At CoinJar, we've analysed years of customer data to try to work out market behaviour, seasonal trends, and investor demographics.

Even the most experienced investors are just guessing the future, no one knows for sure what will happen. Even we, at one of the oldest crypto exchanges in the world, can be winging it sometimes when guessing what will happen in the future.

So you know the drill. This isn’t financial advice, and if you end up following this and losing everything you can’t sleep in our office. We will already be sleeping there.

Only invest what you can afford to lose. Okay, lecture over. Now to the good stuff. This is our best guess at what will happen to crypto prices using data pulled from our exchange in November of 2024.

The CoinJar customer landscape

Just for some background info, this is who our customers are.

The most active segments on our exchange are older Millennials (35-44) and Gen X (45-54). This challenges the common perception of crypto as a young person's game.

Why are these age groups so dominant? Several factors come into play:

-They're in their peak earning years with substantial disposable income as they become the leaders of their work organisations.

-They combine technological literacy (this generation invented the blockchain) with financial experience.

-They often have lower debt burdens compared to younger generations. Mortgages start to be paid off, kids leave school, expenses are less.

-They typically have higher risk tolerance due to established financial foundations.

Interestingly, our data shows that tradies are among the top crypto investors. This could be attributed to their strong earning potential and desire for investment alternatives as they plan for future career transitions. That is, they don’t want to be doing hard physical labour in their later years and are looking to invest in their future.

Market cycles and major events

Two crucial events historically impact the cryptocurrency market more than any other events.

Bitcoin Halving (occurs every four years)

-Reduces mining rewards

-Leads to a perception of increased scarcity

-Historically comes before major bull runs (but not always).

US election cycles

-Standing governments often undertake economic stimulus activities during election years to make citizens feel like times are good. And they hope this means that they will be re-elected. This extra money in the system often means that people invest in risk assets.

-This creates a potentially favourable environment for cryptocurrency growth.

-Combined with halving cycles, this can create unique market conditions.

Seasonal patterns: The Calendar Effect

Our analysis has identified several seasonal patterns that could influence cryptocurrency prices:

Celebration dynamics

According to our own data from our exchange, there are a few times a year where our customers can all act in the same way at the same time (but this isn’t a certainty every year, of course).

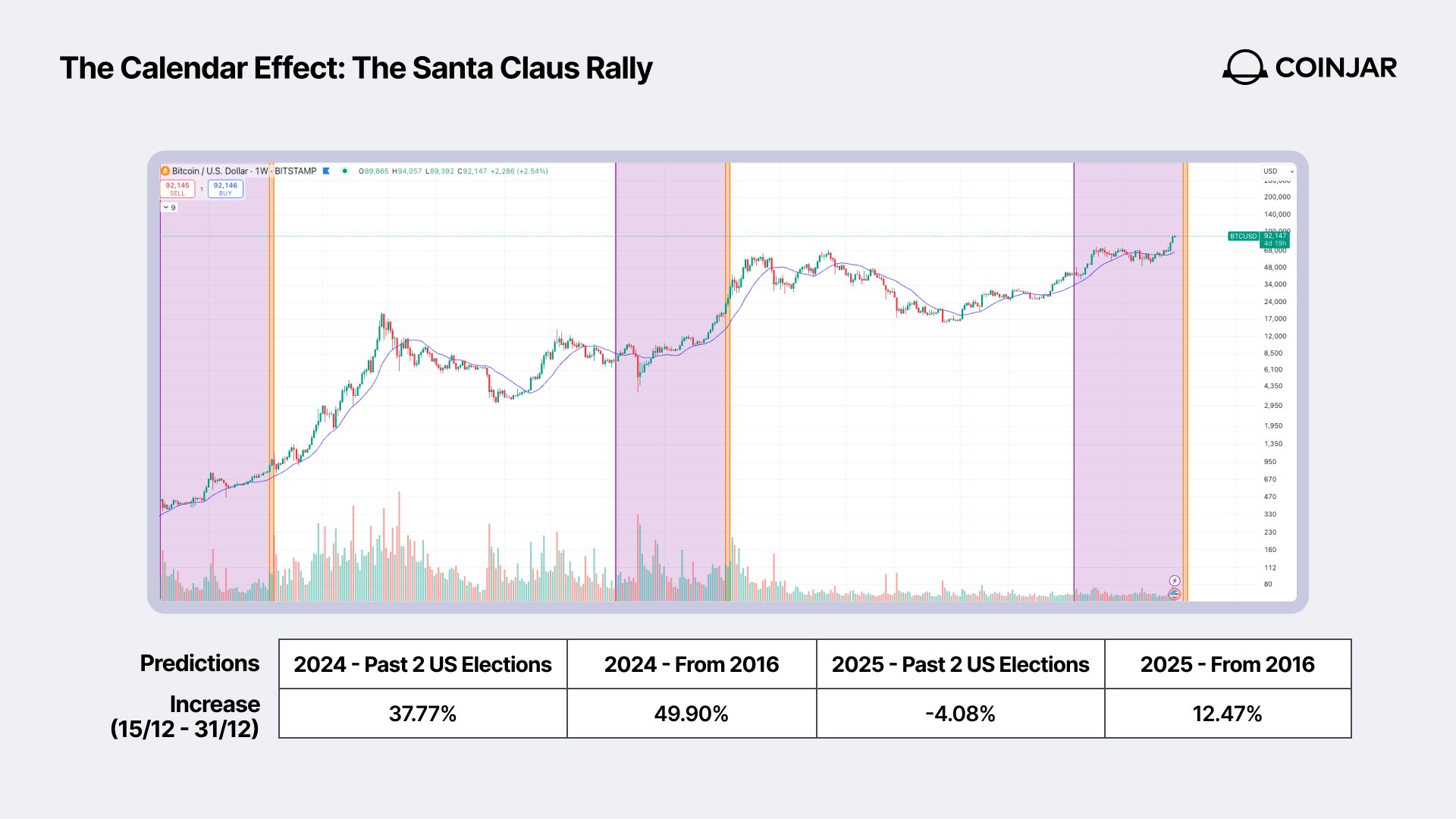

The Santa Rally (late December)

-This is a historically significant time. There is a 49.90% average price increase in Bitcoin since 2016 during the Santa Claus rally. Bitcoin is used as the example as altcoins the Bitcoin price.

-This effect is even stronger during election years with 37.77% average gains.

-This is likely driven by increased leisure time. Our customers are full of food, having meat sweats, get days off work, are getting bored, are opening the CoinJar app and starting to buy… this is the way we reason it out.

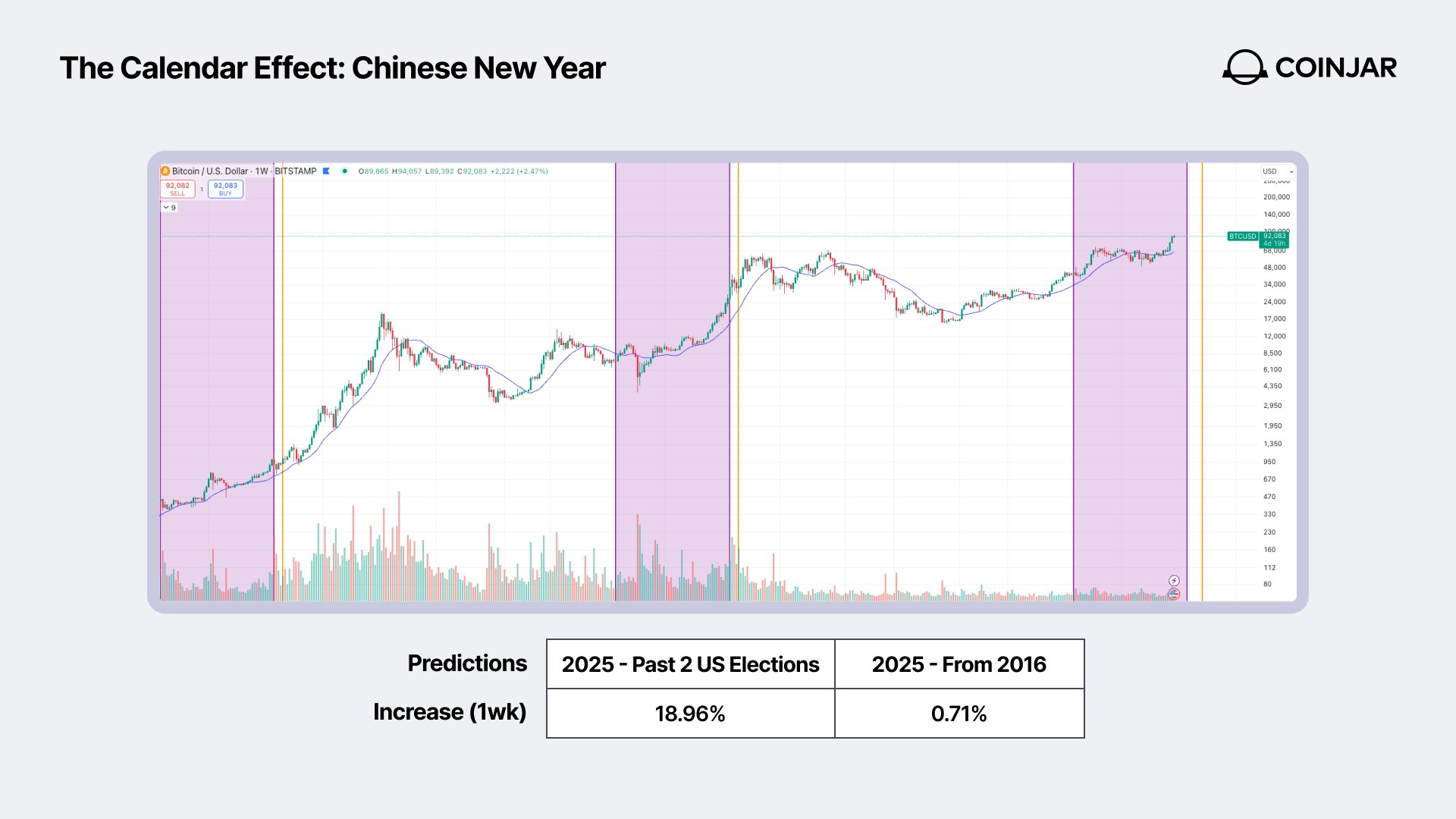

Lunar New Year impact

The urban legend is that in the weeks leading up to the Lunar New Year, the prices of Bitcoin and other major cryptocurrencies often decline then recover. In 2025, Lunar New Year hits January 29th to February 2nd.

Why do prices drop a little before Lunar New Year? One theory is that many people sell some of their cryptocurrency to spray out “red packets” filled with cash as gifts, which can contain substantial amounts of money.

And, people travel back to their hometowns to celebrate with family, leading to a slowdown in trading activity.

But then, afterwards, they get right back to crypto trading with new gifted money. For 2025, it's anticipated that cryptocurrency prices, including Bitcoin, will rise, as it is a post-election year. We guess that an 18.96% increase in BTC price might be about right.

However we think that in 2026, it will be a bit of a nothingburger. Unless Lunar New Year falls in a US election year, it’s not worth thinking about.

Annual Cycles

January-April window

-This is historically a strong performance period

-Post-election and halving years show average returns of 65% according to our exchange stats

-Represents prime opportunity for investors, a “golden hour”.

-Again this is just a guess. Past performance isn’t necessarily a predictor of future performance.

Northern hemisphere summer (June-August)

-This might be the strongest three-month period in post-election/halving years. But this is where things get risky.

-The price of Bitcoin may go up, but this will often follow a May/June correction. If there has not been a correction, this may be risky territory.

-There may be market weakness in late August through October. It’s a spicy time, only for those who aren’t faint of heart.

Current market analysis

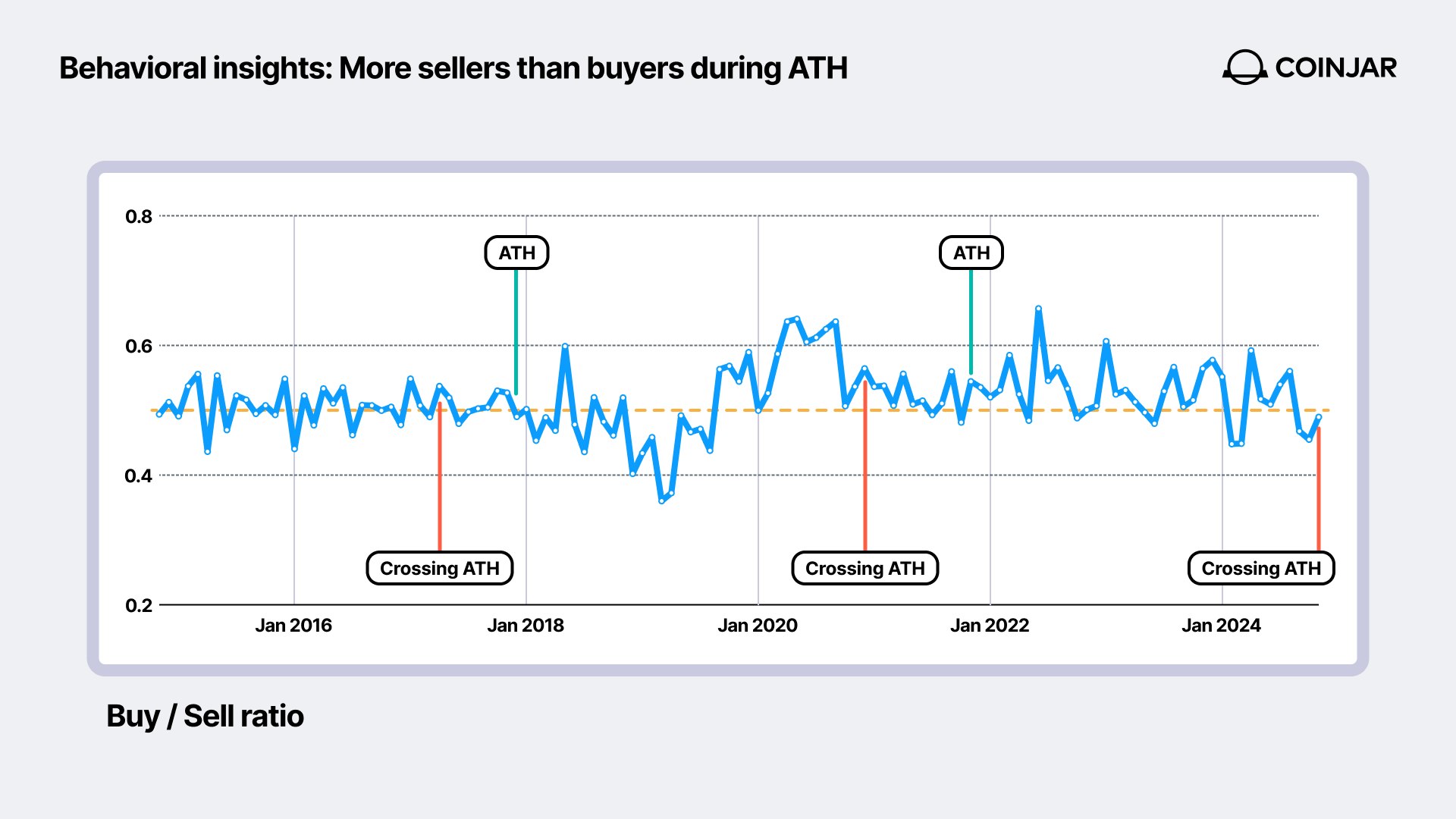

Recent data suggests we're at a crucial juncture:

-New all-time highs are attracting fresh retail investors

-Account reactivations at CoinJar trending upward but not yet at peak levels. This could be a sign that the bull market is not over.

-Institutional buyers (particularly in the US) showing strong interest. This is sending the price upwards. However unless the retail buyers come into the market in large numbers, this will not be sustained.

-Retail participation is currently increasing but needs to keep happening to sustain continued price growth.

Market indicators to watch

For those looking to guess market conditions, there are a few things you can keep an eye on.

One of these is app store rankings. If crypto apps in the most-downloaded positions this suggests strong market interest.

Looking ahead

Based on our analysis, we anticipate continued market strength through the first half of 2024, with particular attention to the January-April window. However, investors should remain vigilant, especially as we approach the traditionally volatile May-June period.

While we can make educated guesses, this is based on current conditions. And, anything can happen. All markets, whether that be traditional stock markets, precious metals or crypto are sensitive to world events.

Governments can rise and fall unexpectedly, war can break out, interest rates can get hiked, inflation can go bananas, earthquakes can hit, pandemics can break out, and regulations can change. The only certainty in life is uncertainty. We live in a world of probabilities, not a world of sure things, so keep that in mind.

And may the crypto markets forever be in your favour.

_ Disclaimer: This analysis is based on historical data and patterns. While we strive to provide accurate insights, cryptocurrency markets are inherently unpredictable. This information is not financial advice._

Suggested Articles

What is Bitcoin (BTC)? What is "Digital Gold" Used For?

What is Bitcoin? It is a digital currency that can be traded, exchanged, and used as a form of payment independent of central banks and governments.What is Ethereum? What is ETH Used For?

Ethereum is a decentralised blockchain-based open-source software platform that allows for the development of decentralised applications (dApps).What Is Crypto? How do Cryptocurrencies Work?

Crypto has become incredibly popular. But how does this digital currency work? And are there cryptos other than Bitcoin?Browse by topic

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the and before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the and apply.