What is Blockchain? What is it Used For?

Discover what blockchain is and how it revolutionises digital transactions. Explore the fundamentals in this easy-to-understand guide.

In this article...

- The first blockchain in common use was the Bitcoin blockchain

- The idea was so good, that blockchain technology has now spread to other industries

- Many technologies are now incorporating blockchain into their systems.

Are you asking yourself, what is blockchain? Here is the in depth explainer in simple terms.

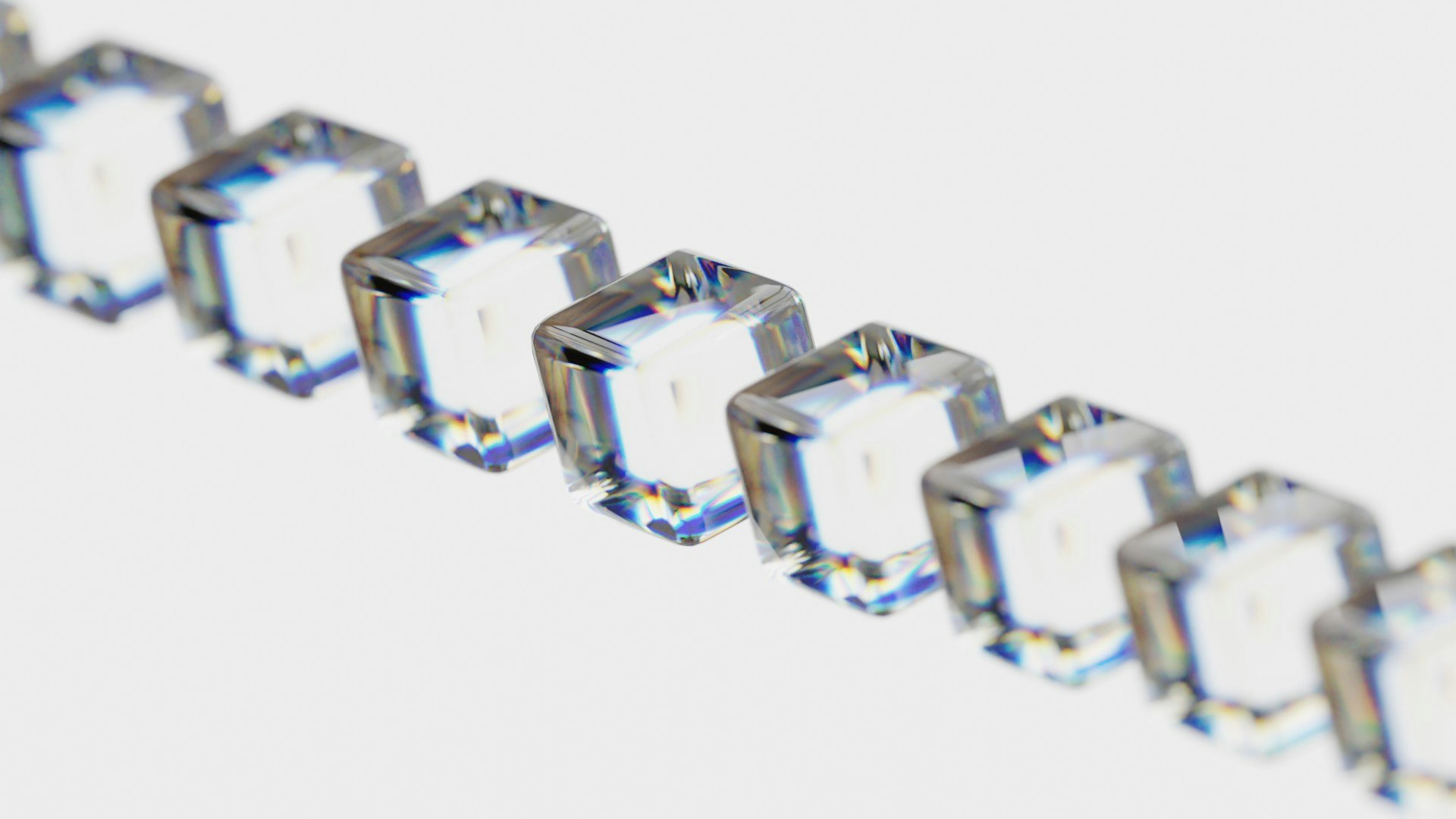

Imagine a chain of blocks, like a necklace made of interconnected beads. Each block in this chain contains information that needs to be kept secure. Now, instead of a physical necklace, think of this chain as a digital ledger (like an organised spreadsheet).

There’s no central server controlling it. Instead, the data is stored across many computers all at once.

How does it work?

When someone wants to make a transaction, like sending money or recording something important, it gets added to the blockchain. Another way to say blockchain is Distributed Ledger Technology (DLT).

But here’s the magic: Once it’s in there, it’s pretty much impossible to change. Why? Because all those computers (called nodes) work together to validate and secure the information.

More or less, all the computers have to agree that the change is legit. So anyone up to no good would have to break into every single computer to change the digital ledger. It’s hard to imagine how that could even happen.

In this way, it makes the DLT a very secure place to store information. This is why people call it “immutable”.

When we say that a blockchain is immutable, it means that once data (such as transactions) is recorded on the blockchain, it becomes permanent and tamper-proof.

The history of transactions stored in a DLT cannot be altered or changed after its creation. Immutability is one of the defining properties of a blockchain system.

Real-life examples

uses blockchain to keep track of who owns what.

Medical records can be stored safely on a DLT, accessible only when needed. Identity documents like passports, driver’s licenses – can all be securely stored.

Food supply records can be kept that trace every step from farm to table. Voting using the blockchain is transparent and tamper-proof.

Art and can be recorded on the DLT, which means that there is proof of ownership of that particular piece.

The birth of blockchain

How did it all begin? Back in 2008, an anonymous person (or group) named Satoshi Nakamoto introduced the concept of DLT when they created Bitcoin, the first-ever cryptocurrency.

Bitcoin is often referred to as digital gold — except you can’t hold it in your hand. Instead, it lives on the internet.

Unlike traditional banks, where a central authority controls everything, DLT is decentralised. No one single boss calls the shots.

In an ideal world, DLT is a bridge that connects people, businesses, and even robots.

The future of blockchain

Global trust network

Here is where most people in the blockchain industry think it is going.

Imagine a world where trust isn’t just a handshake — it’s encoded in digital blocks. Blockchain will create a global trust network where you can verify anything… from the organic origins of your avocado to the authenticity of a rare .

No more shady deals or fake stuff!

Financial revolution

Banks? Who needs them! Blockchain is already revolutionising finance. Users can send money instantly, without middlemen gobbling up fees. This is expected to increase in adoption. In fact it is already .

Health records

Doctors and hospitals will securely access your health data. No more lost files!

Decentralised everything

Governments, voting, social media — everything will be decentralised. No more Big Brother watching. You’ll have a say in how things run. It’s like a digital utopia where power belongs to the people.

Remember, this isn’t sci-fi — it’s the future that is already being built.

What are smart contracts?

Not all DLTs can run smart contracts, which are like a digital agreement. Ethereum, for example, is the rockstar of smart contracts.

, on the other hand, does not have smart contracts, but it is like a reliable old library — it’s great for storing transaction records.

Here’s how smart contracts work. Imagine you’re ordering pizza online. You want the pizza delivered, and the delivery person wants payment. Now, what if we had a magical digital helper — a smart contract — to handle this?

A smart contract is like a digital agreement. It lives on a blockchain. Just like a regular contract, a smart contract sets rules. But here’s the cool part: it automatically follows those rules without any human intervention.

So, you order pizza. The smart contract kicks in: “When pizza arrives, pay the delivery person.”

It happens automatically without the delivery person or the pizza eater doing anything.

Features of smart contracts

Distributed

Imagine all your friends having a copy of the same contract. No one can secretly change it. Everyone’s on the same page!

Deterministic

This means the smart contract always behaves the same way. No surprises! If the pizza arrives, payment happens — every time.

Immutable

Once a smart contract is set — it can’t be altered. No sneaky edits!

Autonomous

No middlemen! The smart contract runs itself. Pizza referee not required.

Customisable

Before launching, you can tweak the rules. Want extra cheese? Customise away.

Transparent

Everyone can see the contract on the blockchain. It’s like a public pizza menu!

NFTs

NFTs are digital assets representing unique items — like digital art. Smart contracts handle NFT ownership and verify authenticity.

If you are a creator of NFTs, when someone buys your , the smart contract can be written so that when your art changes hands, the contract triggers a payment to you automatically, like a royalty every time it sells.

Conclusion: The future

Although DLT technology is still in its adolescence, it has enormous potential for innovation and disruption. DLT technology can change how people interact with one another and the environment around them as it develops and scales.

And as cryptocurrency and other digital assets are more widely adopted, Blockchain will become part of the infrastructure of life.

Frequently Asked Questions

Are Bitcoin and Ethereum blockchains?

Both Bitcoin and Ethereum use DLT technology. Whereas Ethereum is a public blockchain used to support transactions in the Ethereum network, Bitcoin is a public blockchain used to support transactions in the Bitcoin network.

Proof-of-work consensus procedures are used by both blockchains to approve transactions and tack on new blocks to the chain.

How can I use the blockchain and buy things with It?

You must first obtain certain digital assets, such as Bitcoin or Ethereum, before using the DLT. These assets may be bought on cryptocurrency exchanges with fiat money or other digital assets.

These assets can then be traded on exchanges for other digital assets or fiat money, or used to make purchases on websites that accept cryptocurrencies.

How is the blockchain secure?

DLT's decentralized structure and use of encryption to secure data on the ledger make it secure. Each block has a hash that connects it to the preceding block, forming an almost impenetrable chain of blocks.

Furthermore, it is challenging for malicious parties to modify the ledger since the blockchain employs consensus methods to confirm transactions and add new blocks to the chain. The blockchain is a potential technology for applications like online voting because of its security features since security and transparency are crucial.

What are the advantages of the blockchain?

The transparency of the blockchain is one of its key benefits. All transactions are accessible to everyone with network access, and the ledger is open to the public.

This renders it incredibly safe and almost tamper-proof. Because the blockchain is decentralised, there is no single entity in charge of the network.

This means that it is extremely resistant to hacking and other types of online assaults. Also, compared to traditional banking systems, which can take days to execute transactions, the blockchain is incredibly efficient, processing transactions in a matter of seconds.

How Does the Blockchain Work?

The blockchain functions by adding new blocks to the chain and validating transactions via a consensus method.

Participants in a proof-of-work consensus mechanism figure out challenging mathematical puzzles to approve transactions and add new blocks to the chain.

Participants in a proof-of-stake consensus method stake their digital assets to verify transactions and add new blocks to the chain.

What are different types of blockchains?

Private Blockchains: Contrarily, only a small number of users may access private blockchains, and a central authority manages the consensus mechanism.

Due to this, private DLT are less decentralised than public ones, but they can still be very efficient and safe. Private blockchains are frequently utilised for business applications where data security and privacy are top priorities.

Compared to public DLTs, private DLTs provide several benefits. The confidentiality and privacy of your data are key benefits. The information on the network can be kept private and safe since only a small number of users have access to private blockchains. Due to this, private blockchains are perfect for business applications where data confidentiality and privacy are crucial.

In contrast to typical banking systems, which might take days to execute transactions, private blockchains can be extremely efficient, processing transactions in real time.

What are hybrid Blockchains?

By enabling both public and private network membership, hybrid DLTs incorporate the greatest features of both types of networks. Because of this, hybrid DLTs are quite flexible and may be used for a variety of purposes.

For instance, a hybrid DLT might be utilised to build an open, safe, and accessible supply chain network while also protecting participant privacy and security.

What are advantages of hybrid DLTs?

The benefits of both public and private blockchains are offered by hybrid DLTs.

They are quite versatile and may be adapted to a broad range of applications since they allow for both public and private involvement in the network. Decentralised banking applications, safe and transparent supply chain networks, and other things can all be made with hybrid DLTs.

How are blockchains created?

Mining is a procedure used to generate blockchains that entails resolving challenging mathematical puzzles to validate and record transactions on the ledger.

Because of the high computational and energy requirements, there have been questions raised regarding how mining for blockchains would affect the environment. As an alternative, some blockchains employ the proof of stake consensus process, which requires that users stake their digital assets to confirm network transactions.

What are some examples of popular blockchains?

Among the most well-known blockchains are Bitcoin and Ethereum, but there are many more with a variety of applications and use cases.

Solana, Polkadot, Binance Smart Chain, and Cardano are a few examples. Although the consensus algorithms, governance models, and applications of these blockchains vary, they all share the fundamental characteristics of blockchain technology.

How are institutions using blockchain?

Several organisations are looking to use the blockchain for a range of purposes, such as automatic sales tax payment, tax collection, ID verification, international payments to get around sluggish and costly SWIFT, and more.

What is Blockchain Technology?

Blockchain is a shared, immutable ledger used for recording transactions, tracking assets, and building trust in a business network.

It can handle both tangible assets (like houses, cars, and cash) and intangible assets (such as intellectual property, patents, copyrights, and branding).

Essentially, anything of value can be tracked and traded on a blockchain network, reducing risk and cutting costs for all involved.

Why is Blockchain Important for Financial Services?

Business relies on information, and blockchain provides immediate, shared, and transparent information stored on an immutable ledger.

In financial services, blockchain can track orders, payments, accounts, and more, giving participants a single view of the truth.

It enhances confidence, efficiency, and opportunities by eliminating duplication of effort and ensuring data integrity.

What Is Computational Power?

Computational power refers to the processing capacity required to validate and secure transactions on a blockchain network.

Miners or validators use computational power to solve complex mathematical puzzles, ensuring the accuracy and security of the blockchain.

What Is the Blockchain?

The term blockchain (including distributed ledger as a term) encompasses a wide array of implementations, from public and permissioned blockchains to consortium blockchains and beyond.

Each type of blockchain (like the Bitcoin blockchain for example) offers unique benefits of blockchain technology, including enhanced security, transparency, and efficiency. Whether employed for transactional data management or other complex operations, blockchain solutions rely on the fundamental principle of blocks linked together, each referencing the previous block.

This intricate structure ensures the immutability and trustworthiness of the blockchain, with every participant possessing a copy of the blockchain for verification. As blockchain technology continues to evolve, its transformative potential across industries remains undeniable.

Suggested Articles

What is Bitcoin (BTC)? What is "Digital Gold" Used For?

What is Bitcoin? It is a digital currency that can be traded, exchanged, and used as a form of payment independent of central banks and governments.What is Ethereum? What is ETH Used For?

Ethereum is a decentralised blockchain-based open-source software platform that allows for the development of decentralised applications (dApps).What Is Crypto? How do Cryptocurrencies Work?

Crypto has become incredibly popular. But how does this digital currency work? And are there cryptos other than Bitcoin?Browse by topic

CoinJar’s digital currency exchange services are operated by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC.

CoinJar Card is a prepaid Mastercard issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard. CoinJar Australia Pty Ltd is an authorised representative of EML Payment Solutions Limited (AR No 1290193). We recommend you consider the and before making any decision to acquire the product. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Google Pay is a trademark of Google LLC. Apple Pay is a trademark of Apple Inc.

This site is protected by reCAPTCHA and the and apply.